- Canada

- /

- Metals and Mining

- /

- TSX:ELD

Does Eldorado Gold’s TSX30 Recognition Reflect Sustainable Progress in Its Transformation Strategy (TSX:ELD)?

Reviewed by Simply Wall St

- Eldorado Gold was recently included in the 2025 TSX30 by the Toronto Stock Exchange, an acknowledgment reserved for the top 30 performing listed companies over the past three years.

- This recognition highlights the company's consistent operational achievements and focused expansion efforts, underscoring its role as a leading performer within the metals and mining sector.

- To better understand the impact of Eldorado’s TSX30 recognition, we’ll explore how this acknowledgment could influence its ongoing transformation through the Skouries project.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Eldorado Gold Investment Narrative Recap

For investors to back Eldorado Gold, they must believe in the company's disciplined operational track record, its ability to control costs, and the transformative potential of the Skouries project. While the TSX30 recognition underlines Eldorado’s past performance and growth, it does not materially alter near-term catalysts or ease the dominant short-term risk: the complexity of commissioning and ramping up Skouries remains a crucial hurdle for future earnings and margin expansion.

One recent announcement particularly relevant here is Eldorado’s update on Skouries’ capital costs, specifying a revised estimate of approximately US$1.06 billion due to ongoing workforce and planning challenges. This update reinforces that, despite accolades and share price appreciation, investors will remain focused on timely, cost-effective project delivery at Skouries as the key lever for value creation in the near term.

However, investors should also keep in mind the ongoing risk of higher-than-expected costs at Skouries, which could …

Read the full narrative on Eldorado Gold (it's free!)

Eldorado Gold's narrative projects $3.2 billion revenue and $1.0 billion earnings by 2028. This requires 26.5% yearly revenue growth and a $579.7 million increase in earnings from $420.3 million today.

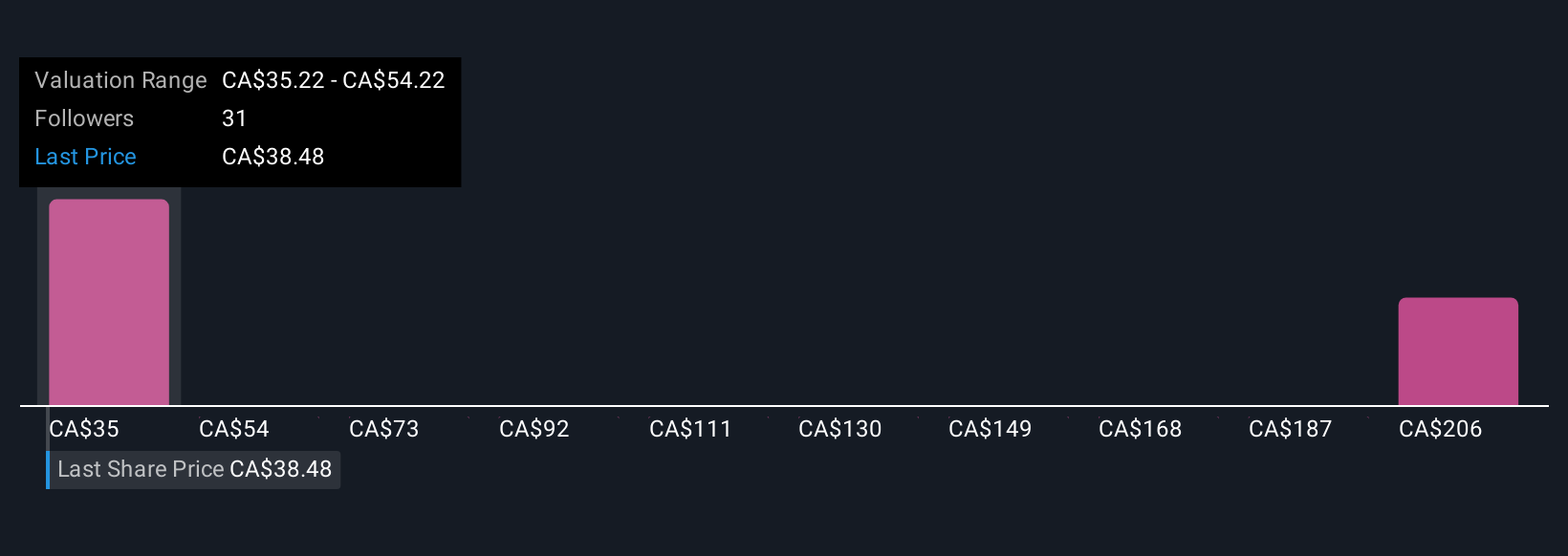

Uncover how Eldorado Gold's forecasts yield a CA$35.24 fair value, a 9% downside to its current price.

Exploring Other Perspectives

Five individual fair value estimates from the Simply Wall St Community range from CA$35.24 to CA$253.64 per share. With commissioning challenges still ahead at Skouries, you may wish to weigh these diverse opinions before forming your view on potential outcomes.

Explore 5 other fair value estimates on Eldorado Gold - why the stock might be worth over 6x more than the current price!

Build Your Own Eldorado Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eldorado Gold research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Eldorado Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eldorado Gold's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eldorado Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ELD

Eldorado Gold

Engages in the mining, exploration, development, and sale of mineral products primarily in Turkey, Canada, and Greece.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives