- Canada

- /

- Metals and Mining

- /

- TSX:EDV

What You Need To Know About The Endeavour Mining plc (TSE:EDV) Analyst Downgrade Today

Today is shaping up negative for Endeavour Mining plc (TSE:EDV) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

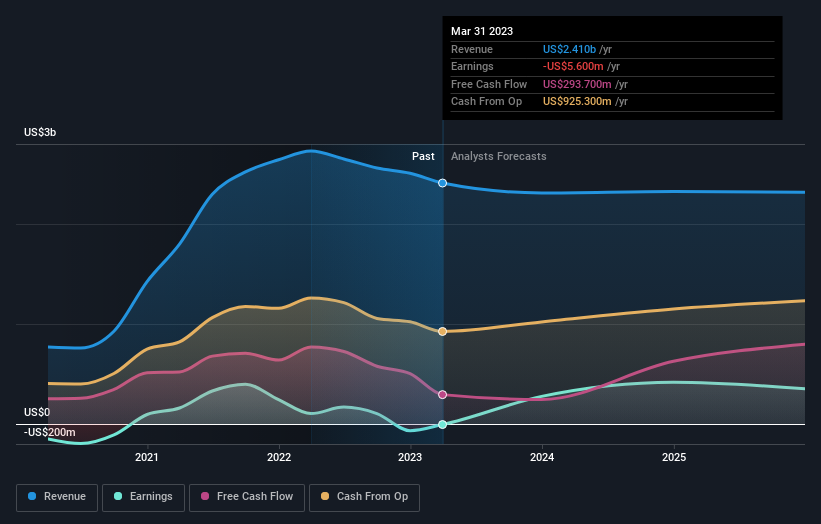

Following the downgrade, the consensus from seven analysts covering Endeavour Mining is for revenues of US$2.3b in 2023, implying a perceptible 4.1% decline in sales compared to the last 12 months. The losses are expected to disappear over the next year or so, with forecasts for a profit of US$1.07 per share this year. Before this latest update, the analysts had been forecasting revenues of US$2.6b and earnings per share (EPS) of US$1.30 in 2023. Indeed, we can see that the analysts are a lot more bearish about Endeavour Mining's prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for Endeavour Mining

Despite the cuts to forecast earnings, there was no real change to the CA$44.46 price target, showing that the analysts don't think the changes have a meaningful impact on its intrinsic value. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Endeavour Mining, with the most bullish analyst valuing it at CA$56.50 and the most bearish at CA$36.00 per share. This shows there is still some diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that sales are expected to reverse, with a forecast 5.5% annualised revenue decline to the end of 2023. That is a notable change from historical growth of 34% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 15% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Endeavour Mining is expected to lag the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Endeavour Mining. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Endeavour Mining's revenues are expected to grow slower than the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on Endeavour Mining after today.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have estimates - from multiple Endeavour Mining analysts - going out to 2025, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Endeavour Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:EDV

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Robinhood Stock: Profitability Arrives, But Can Tokenization and Trading Growth Last?

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion