- Canada

- /

- Metals and Mining

- /

- TSX:EDV

Is Endeavour Mining Still Attractive After a 126% Rally in 2025?

Reviewed by Bailey Pemberton

If you’ve been following Endeavour Mining, you might be wondering if now is the moment to jump in, trim your holdings, or simply watch from the sidelines. The stock has been on a wild ride, climbing an impressive 15.4% in the past month and a staggering 126.6% year-to-date. Over the past year, Endeavour Mining has more than doubled, catching the attention of both risk-tolerant investors and those looking for solid long-term growth stories.

These numbers are hard to ignore and reflect more than just sector momentum. Recent shifts in global gold prices and increased attention on mining equities have undoubtedly played a part in boosting confidence among investors. There is also a broader reassessment of mining risk, as global market developments have put resource companies like Endeavour in a more favorable light.

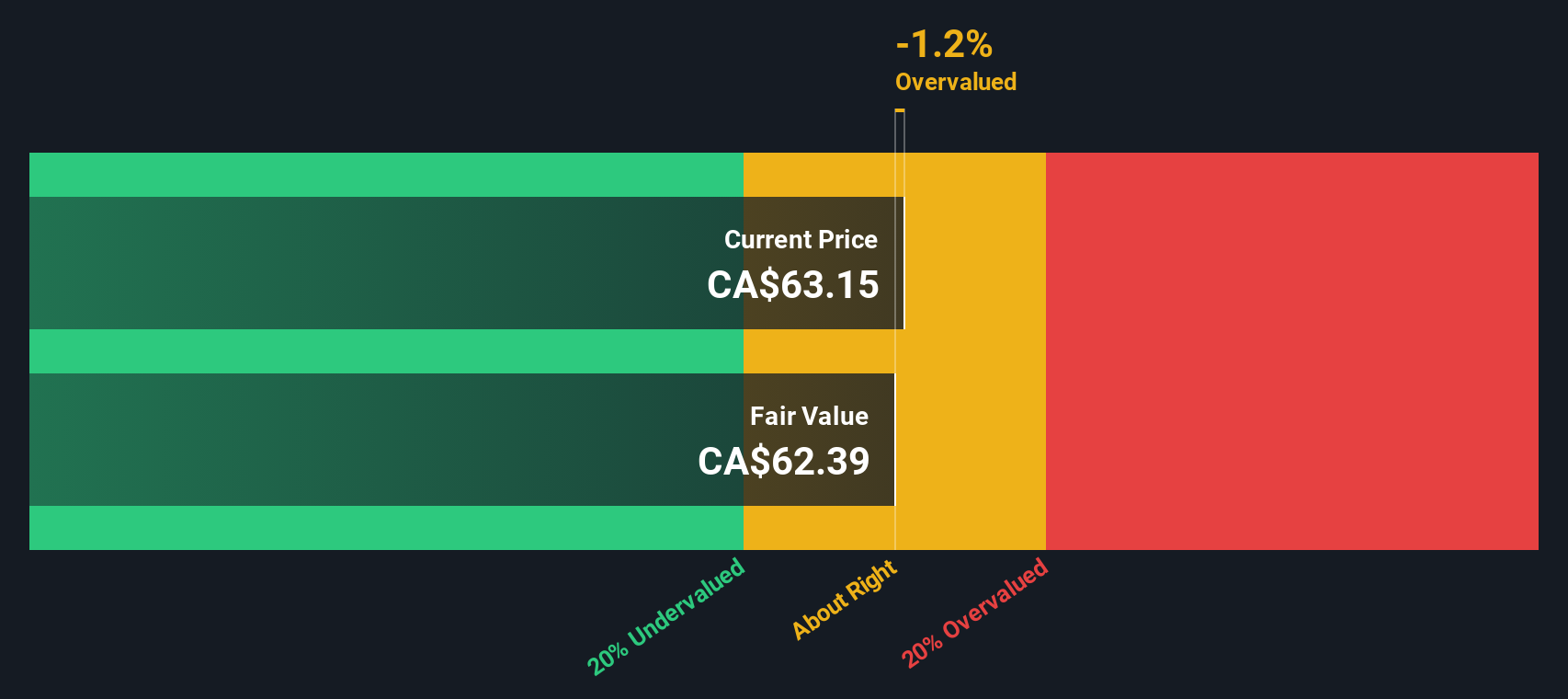

Of course, stellar performance often leads to an important question: is the stock still undervalued, or is it running ahead of itself? That is where valuation analysis steps in. Based on six different valuation checks, Endeavour Mining scores a 3, meaning it is considered undervalued by half of the measures typically used by analysts.

Let us break down those valuation approaches one by one to see what they reveal. Stay tuned, because I will also share a more nuanced angle that could change how you view Endeavour Mining’s true worth.

Approach 1: Endeavour Mining Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and discounting them back to today's value. This approach helps investors understand what Endeavour Mining might really be worth, based on its ability to generate cash over the coming years.

Currently, Endeavour Mining reports trailing twelve-month Free Cash Flow (FCF) of $478.3 Million. According to analyst projections and Simply Wall St extrapolations, FCF is expected to climb as high as $1.52 Billion by 2026, before tapering to an estimated $756 Million in 2035. These forecasts, drawn from a blend of analyst estimates and model assumptions, give a detailed picture of how the company’s cash machine could evolve over the decade.

Based on this method, Endeavour Mining’s estimated intrinsic value lands at $78.56 per share. With the DCF model implying the stock is trading at a 22.7% discount to its fair value, Endeavour Mining is considered undervalued by this metric.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Endeavour Mining is undervalued by 22.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Endeavour Mining Price vs Earnings (PE Ratio Analysis)

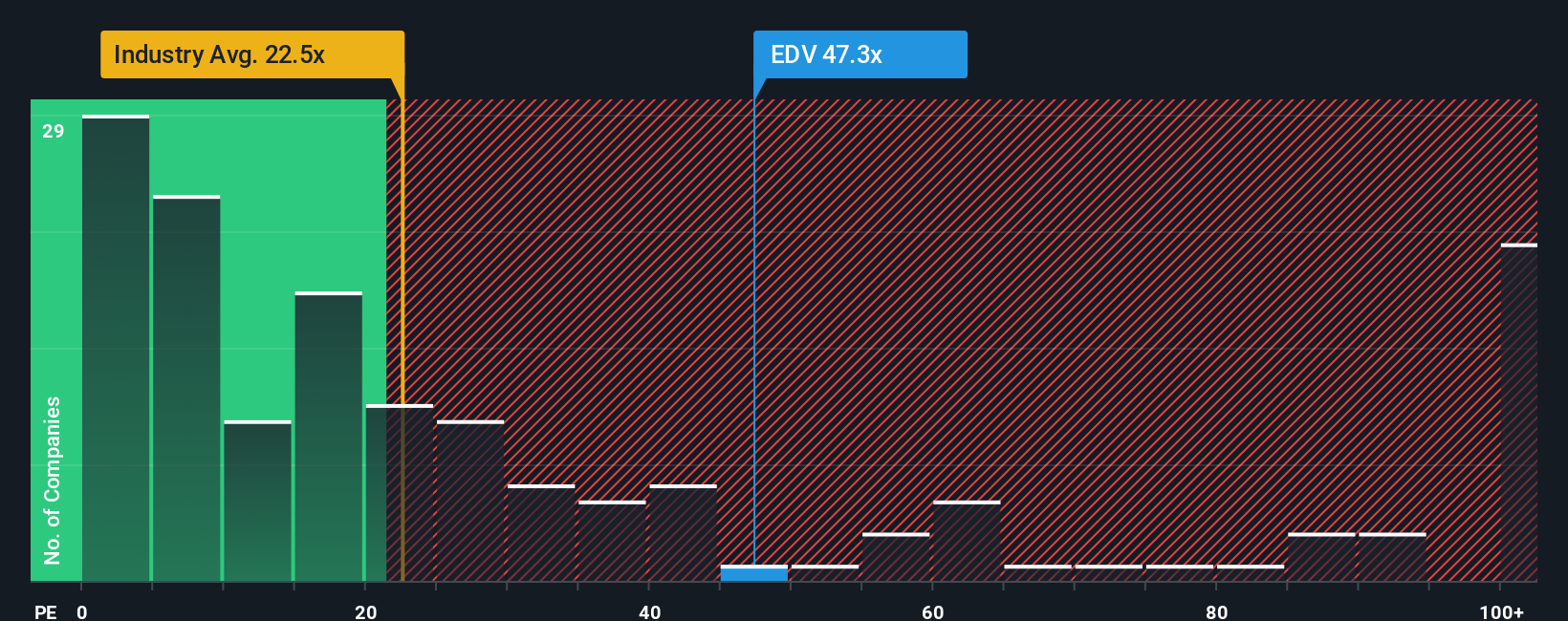

When it comes to valuing profitable companies like Endeavour Mining, the Price-to-Earnings (PE) ratio is a time-tested metric. It tells investors how much they are paying for each dollar of the company’s earnings, making it easy to compare across similar businesses.

Interpreting what counts as a “normal” or “fair” PE ratio depends on more than just the company’s bottom line. Factors such as future earnings growth, market risks, industry trends, and overall investor sentiment all play a role in determining whether a high or low PE ratio makes sense for a given stock.

Endeavour Mining is currently trading at a PE ratio of 45.7x. To put this in perspective, the average PE for the Metals and Mining industry sits at 23.6x, while a group of similar peers average 51.5x. However, these measures only tell part of the story. They overlook how the company’s own unique combination of growth prospects, margins, risks, and market size should factor into valuation.

That is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio, calculated as 27.0x for Endeavour Mining, is tailored to the company’s specific attributes: its expected earnings growth, profit margins, industry context, and even its market capitalization. This proprietary measure is more precise than generic peer or industry comparisons, offering a valuation context that really fits the individual business.

Comparing Endeavour Mining’s actual PE of 45.7x to its Fair Ratio of 27.0x suggests the market is pricing in a significant premium. In this case, the stock appears to be trading above the level warranted by its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Endeavour Mining Narrative

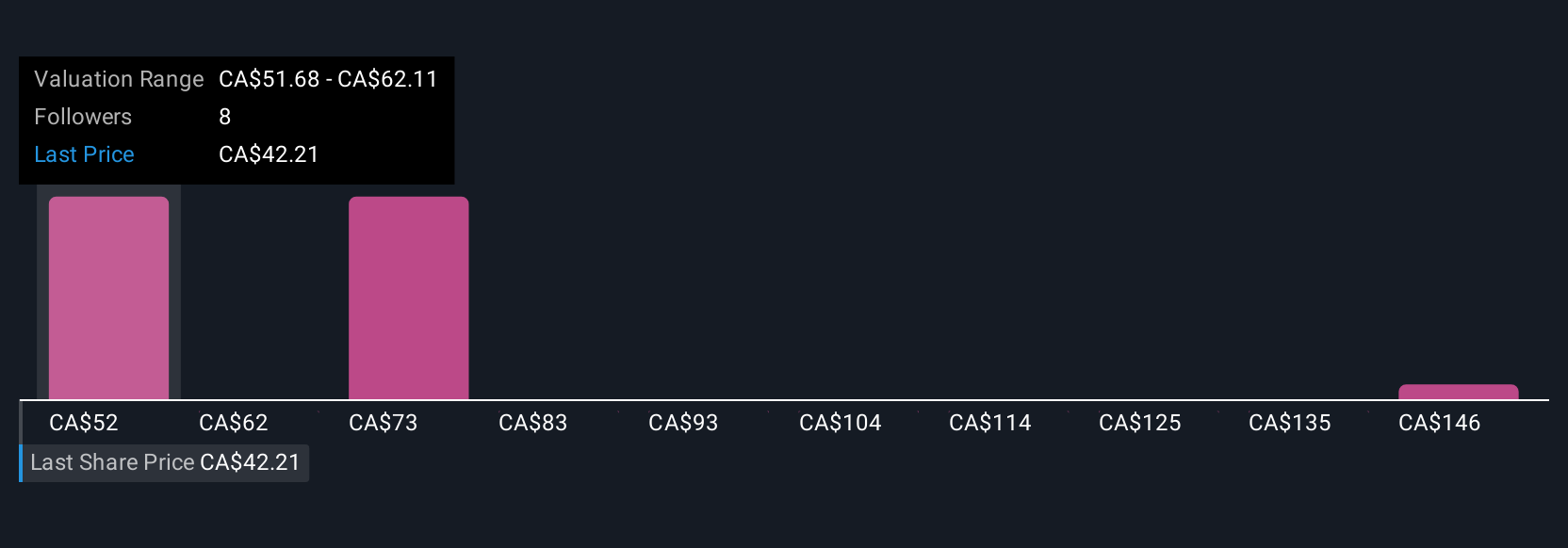

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a simple, dynamic way to capture your perspective on a company by combining your story about Endeavour Mining’s prospects with your own estimates of future revenue, earnings, and margins, then translating those into a personal fair value.

More than just crunching numbers, a Narrative connects what you believe about Endeavour’s business and industry with a financial forecast and an up-to-date fair value that adapts as new information arrives. Narratives are built directly into the Simply Wall St platform’s Community page, making it easy for anyone, including millions of global investors, to set, adjust, and share their investment view.

This approach helps you decide when to buy or sell by simply comparing your fair value to the current share price, and since Narratives update automatically if there is important news or fresh earnings data, your decision-making always stays relevant.

For example, with Endeavour Mining, some investors see upside and set their Narrative’s fair value as high as CA$63.00, expecting robust cash flow and gold price leverage, while others are more cautious with a fair value as low as CA$37.50, focused on regional risks and cost pressures. This proves that understanding a stock is as much about your perspective as it is about the numbers.

Do you think there's more to the story for Endeavour Mining? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Endeavour Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EDV

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.