- Canada

- /

- Metals and Mining

- /

- TSX:EDV

Did Business Growth Power Endeavour Mining's (TSE:EDV) Share Price Gain of 169%?

Endeavour Mining Corporation (TSE:EDV) shareholders might be concerned after seeing the share price drop 19% in the last quarter. But that doesn't change the fact that shareholders have received really good returns over the last five years. In fact, the share price is 169% higher today. Generally speaking the long term returns will give you a better idea of business quality than short periods can. The more important question is whether the stock is too cheap or too expensive today.

Check out our latest analysis for Endeavour Mining

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

We know that Endeavour Mining has been profitable in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. So we might find other metrics can better explain the share price movements.

On the other hand, Endeavour Mining's revenue is growing nicely, at a compound rate of 18% over the last five years. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

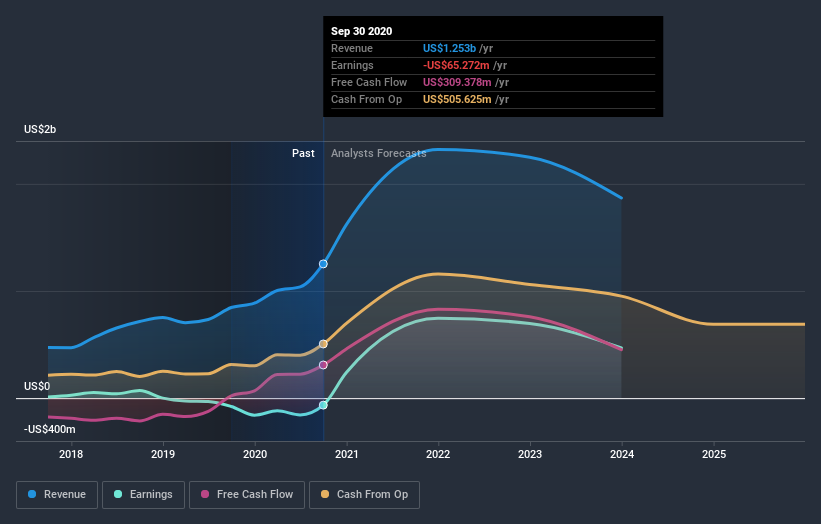

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling Endeavour Mining stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Endeavour Mining, it has a TSR of 174% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Endeavour Mining shareholders have received a total shareholder return of 16% over one year. And that does include the dividend. Having said that, the five-year TSR of 22% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. It's always interesting to track share price performance over the longer term. But to understand Endeavour Mining better, we need to consider many other factors. For instance, we've identified 3 warning signs for Endeavour Mining that you should be aware of.

Endeavour Mining is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you decide to trade Endeavour Mining, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Endeavour Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:EDV

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives