- Canada

- /

- Metals and Mining

- /

- TSX:EDR

What Endeavour Silver (TSX:EDR)'s Kolpa Drill Results Could Mean for Resource Growth Potential

Reviewed by Sasha Jovanovic

- Endeavour Silver Corp. has announced positive drill results from ongoing exploration at the Kolpa Mine in Peru’s Huancavelica province, revealing significant mineralization in the Poderosa West vein and mapped extensions spanning 2.5 kilometers.

- These structural patterns, known as "structural pairing," could increase the potential for new mineral discoveries, supporting Kolpa's role as a growth catalyst for the company’s future operations.

- We'll examine how recent exploration success at Kolpa could reshape Endeavour Silver's outlook for expanding production and resource potential.

Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

Endeavour Silver Investment Narrative Recap

To own Endeavour Silver, investors need conviction in the company's ability to turn recent exploration wins, like Kolpa’s positive drill results, into resource growth and eventual profitability, while navigating liquidity and ramp-up risks. The latest Kolpa update is encouraging for the short-term production growth story, but until this translates to commercial output or meaningful improvement in working capital, liquidity remains the most important risk to monitor. The Kolpa news primarily highlights future potential, not a near-term financial turnaround.

The most relevant recent announcement is the positive Kolpa drill results, revealing significant silver and base metal mineralization and mapping a 2.5-kilometer strike that underpins longer-term resource and production expansion. This directly supports the catalyst of integrating and scaling Kolpa, but the extent to which it offsets cash flow strain depends on timing, permitting, and successful development, all of which remain to be seen.

By contrast, liquidity pressure driven by persistent net losses and negative working capital is a key piece of information investors should be aware of if...

Read the full narrative on Endeavour Silver (it's free!)

Endeavour Silver’s outlook anticipates $705.2 million in revenue and $155.6 million in earnings by 2028. This implies a 41.7% annual revenue growth rate and a $225.2 million increase in earnings from the current level of -$69.6 million.

Uncover how Endeavour Silver's forecasts yield a CA$10.17 fair value, a 5% downside to its current price.

Exploring Other Perspectives

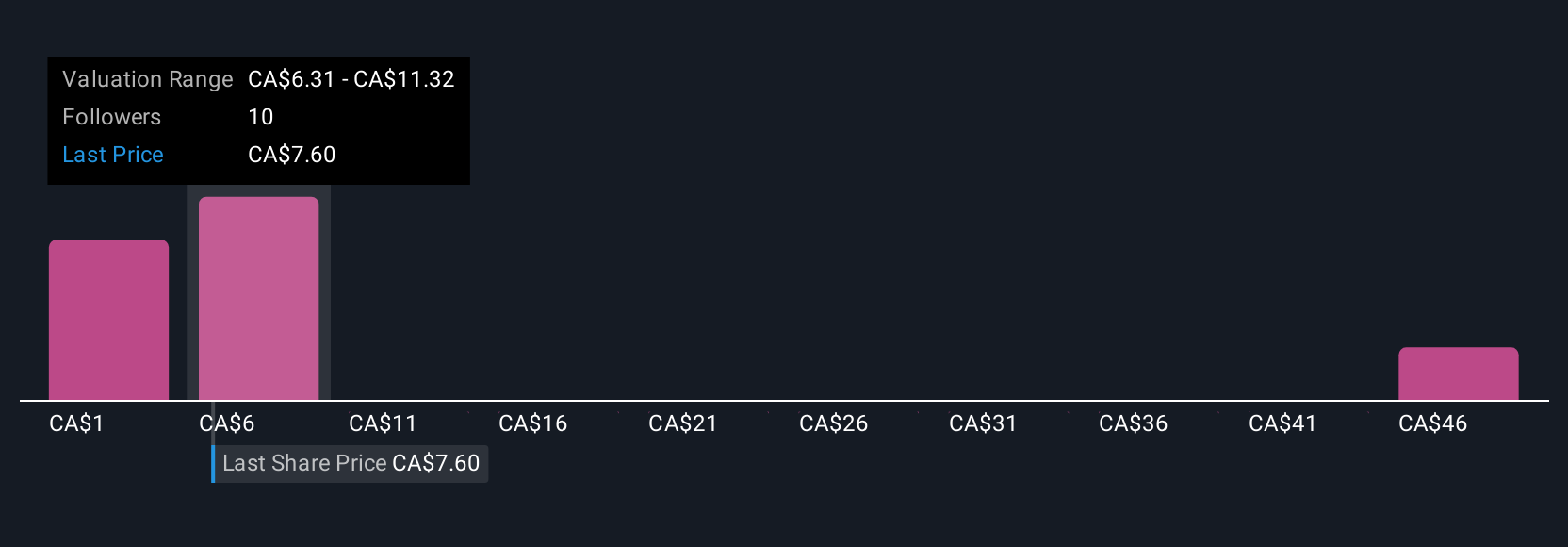

Ten fair value estimates from the Simply Wall St Community range from as low as CA$1.13 to CA$67.50 per share. As you consider potential Kolpa-driven production growth, keep in mind that opinions on the company’s true worth and timing of payoff can vary greatly.

Explore 10 other fair value estimates on Endeavour Silver - why the stock might be worth less than half the current price!

Build Your Own Endeavour Silver Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Endeavour Silver research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Endeavour Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Endeavour Silver's overall financial health at a glance.

No Opportunity In Endeavour Silver?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Endeavour Silver might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EDR

Endeavour Silver

A silver mining company, engages in the acquisition, exploration, development, extraction, processing, refining, and reclamation of mineral properties in Mexico, Chile, Peru, and the United States.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives