- Canada

- /

- Metals and Mining

- /

- TSX:EDR

Insider Buying Highlights 3 Undervalued Small Caps In Global

Reviewed by Simply Wall St

Amid heightened global trade tensions and a significant market downturn triggered by unexpected U.S. tariffs, small-cap stocks have faced considerable pressure, with the Russell 2000 Index experiencing a notable decline. In this challenging environment, identifying small-cap companies that demonstrate resilience through strategic insider buying can provide valuable insights into potential opportunities for investors seeking to navigate the current volatility.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Atturra | 27.9x | 1.2x | 38.04% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 28.32% | ★★★★★☆ |

| Robert Walters | NA | 0.2x | 49.56% | ★★★★★☆ |

| Viva Energy Group | NA | 0.1x | 39.61% | ★★★★★☆ |

| Sing Investments & Finance | 7.2x | 3.7x | 42.37% | ★★★★☆☆ |

| PWR Holdings | 32.3x | 4.5x | 29.57% | ★★★☆☆☆ |

| Dicker Data | 18.9x | 0.7x | -35.10% | ★★★☆☆☆ |

| Hansen Technologies | 297.4x | 2.9x | 22.40% | ★★★☆☆☆ |

| Integral Diagnostics | 149.0x | 1.7x | 43.82% | ★★★☆☆☆ |

| Manawa Energy | NA | 2.6x | 42.78% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

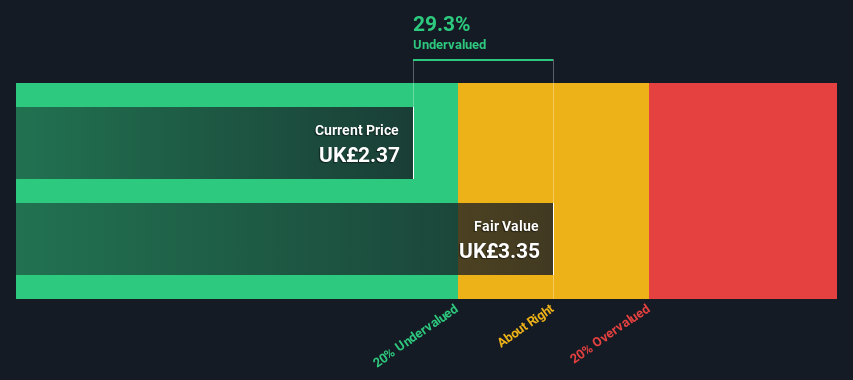

Norcros (LSE:NXR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Norcros is a company that specializes in building products, with operations focused on providing a range of solutions within this sector, and has a market capitalization of approximately £0.25 billion.

Operations: The company primarily generates revenue from building products, with a recent quarterly revenue of £378.9 million. Operating expenses have consistently been a significant cost factor, impacting net income margins which have shown variability, peaking at 6.83% and dipping to as low as 1.08%.

PE: 21.8x

Norcros, a smaller company in the market, is navigating challenging conditions with strategic moves like reviewing its South African tile operations. Despite a dip in reported revenue to £368 million for the year ending March 2025, earnings are projected to grow significantly at 45.79% annually. Insider confidence is evident with recent share purchases. The company's strong brand presence and supply chain resilience position it well against macro uncertainties, though it faces funding risks due to reliance on external borrowing.

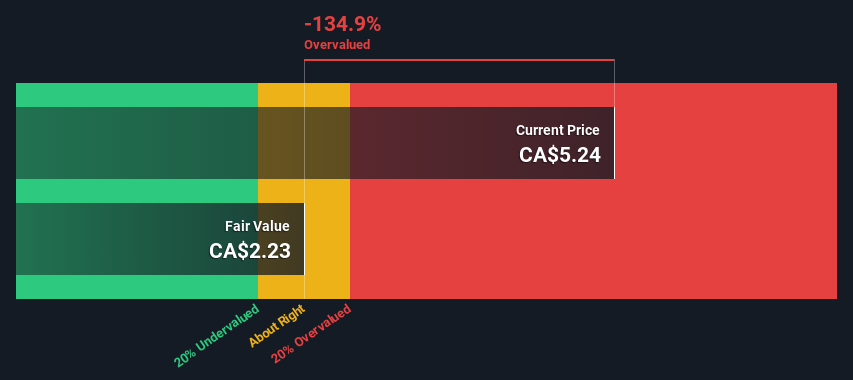

Altus Group (TSX:AIF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Altus Group is a company that provides analytics and advisory services primarily in the real estate sector, with a market cap of CA$2.57 billion.

Operations: The company generates revenue primarily from Analytics and Appraisals and Development Advisory services, totaling CA$520.49 million. The gross profit margin has experienced fluctuations, reaching a recent high of 38.45% in September 2024. Operating expenses are significant, with general and administrative expenses consistently being the largest component within this category.

PE: -2766.3x

Altus Group, a company with a focus on real estate and property services, recently reported an increase in annual sales to C$519.73 million and net income rising to C$13.42 million for 2024. Despite a basic loss per share of C$0.02, insider confidence is evident with William Brennan purchasing 53,651 shares valued at approximately C$2.88 million, reflecting potential optimism about future prospects. The company anticipates modest revenue growth between 3% and 5% in 2025 while maintaining shareholder returns through dividends and strategic share repurchases totaling C$17.33 million over recent months.

- Get an in-depth perspective on Altus Group's performance by reading our valuation report here.

Examine Altus Group's past performance report to understand how it has performed in the past.

Endeavour Silver (TSX:EDR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Endeavour Silver is a mining company focused on the exploration, development, and production of silver and gold assets in Mexico with a market cap of approximately C$1.07 billion.

Operations: Bolanitos and Guanaceví contribute significantly to revenue, with the latter generating $147.28 million. The gross profit margin has fluctuated over time, reaching 36.66% in June 2023 before decreasing to 33.07% by December 2024. Operating expenses and non-operating expenses have been notable cost components impacting net income margins, which have varied from positive figures in recent years to negative values as of late 2024.

PE: -32.4x

Endeavour Silver, a small company in the mining sector, recently reported a 17% drop in silver production for Q1 2025 compared to the previous year, mainly due to reduced output at Guanaceví mine. However, increased production at Bolañitos partially offset this decline. The company raised US$45 million through a follow-on equity offering and is advancing its Terronera Project towards completion with wet commissioning expected soon. Insider confidence was demonstrated by recent stock purchases within the past quarter, indicating potential optimism about future prospects despite current challenges.

- Click here to discover the nuances of Endeavour Silver with our detailed analytical valuation report.

Understand Endeavour Silver's track record by examining our Past report.

Where To Now?

- Dive into all 140 of the Undervalued Global Small Caps With Insider Buying we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Endeavour Silver might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EDR

Endeavour Silver

A silver mining company, engages in the acquisition, exploration, development, extraction, processing, refining, and reclamation of mineral properties in Mexico, Chile, Peru, and the United States.

High growth potential with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)