EcoSynthetix Inc.'s (TSE:ECO) P/S Is Still On The Mark Following 28% Share Price Bounce

Despite an already strong run, EcoSynthetix Inc. (TSE:ECO) shares have been powering on, with a gain of 28% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 43% in the last year.

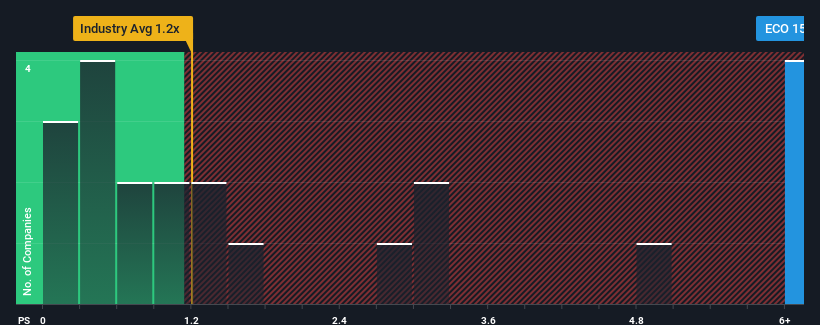

After such a large jump in price, you could be forgiven for thinking EcoSynthetix is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 15.3x, considering almost half the companies in Canada's Chemicals industry have P/S ratios below 1.2x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for EcoSynthetix

What Does EcoSynthetix's Recent Performance Look Like?

For example, consider that EcoSynthetix's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for EcoSynthetix, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like EcoSynthetix's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to decline by 3.8% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this in mind, it's clear to us why EcoSynthetix's P/S exceeds that of its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the industry. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Bottom Line On EcoSynthetix's P/S

Shares in EcoSynthetix have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As detailed previously, the strength of EcoSynthetix's recent revenue trends over the medium-term relative to a declining industry is part of the reason why it trades at a higher P/S than its industry counterparts. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. However, it'd be fair to raise concerns over whether this level of revenue performance will continue given the harsh conditions facing the industry. If things remain consistent though, shareholders shouldn't expect any major share price shocks in the near term.

Plus, you should also learn about this 1 warning sign we've spotted with EcoSynthetix.

If these risks are making you reconsider your opinion on EcoSynthetix, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if EcoSynthetix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ECO

EcoSynthetix

A renewable chemicals company, develops and commercializes bio-based technologies that are used as replacement solutions for synthetic, petrochemical-based chemicals, and other related products in the Americas, Europe, the Middle East, Africa, and Asia Pacific.

Flawless balance sheet with weak fundamentals.

Similar Companies

Market Insights

Community Narratives