- Canada

- /

- Metals and Mining

- /

- TSX:DSV

Discovery Silver (TSX:DSV) Valuation After TSX Smallcap Rally and Growing Focus on Cordero Project

Reviewed by Simply Wall St

Discovery Silver (TSX:DSV) has pushed its rally further as the TSX Smallcap Index gains ground, drawing fresh attention to how the Cordero project in Chihuahua might reshape the company’s long term production profile.

See our latest analysis for Discovery Silver.

That momentum has not come out of nowhere, with the stock logging a roughly 55 percent 1 month share price return and a huge year to date share price gain. The 1 year total shareholder return above 800 percent shows how dramatically sentiment has shifted toward the Cordero story.

If the run in Discovery Silver has you thinking more broadly about growth stories in resources and beyond, it could be a good time to explore fast growing stocks with high insider ownership.

Yet with the share price now hovering near and even above some analyst targets, investors are left to weigh whether Discovery Silver still trades below its long term potential or whether the market is already pricing in the Cordero growth story.

Price-to-Earnings of 128.1x: Is it justified?

Discovery Silver last closed at CA$7.98, and on a price-to-earnings ratio of 128.1x it screens as richly valued against both its peers and its own fundamentals.

The price-to-earnings multiple compares the current share price with the company’s earnings per share, giving a snapshot of how much investors pay today for each dollar of current profits. For an early stage miner that has only recently become profitable, such an elevated multiple often signals that the market is looking far beyond near term earnings and is instead baking in aggressive expectations for future cash flows from key assets like Cordero.

In Discovery Silver’s case, the market multiple looks stretched when set against both the estimated fair price to earnings ratio of 42.8x and the wider Canadian Metals and Mining sector average of 21.2x. That gap suggests investors are assigning a premium far above what sector norms and fair ratio modelling would imply, leaving limited room for disappointment if the anticipated growth or project execution falters.

Explore the SWS fair ratio for Discovery Silver

Result: Price-to-Earnings of 128.1x (OVERVALUED)

However, rising expectations heighten risk, as potential project delays at Cordero or commodity price weakness could quickly undermine the lofty valuation underpinning recent gains.

Find out about the key risks to this Discovery Silver narrative.

Another View on Value

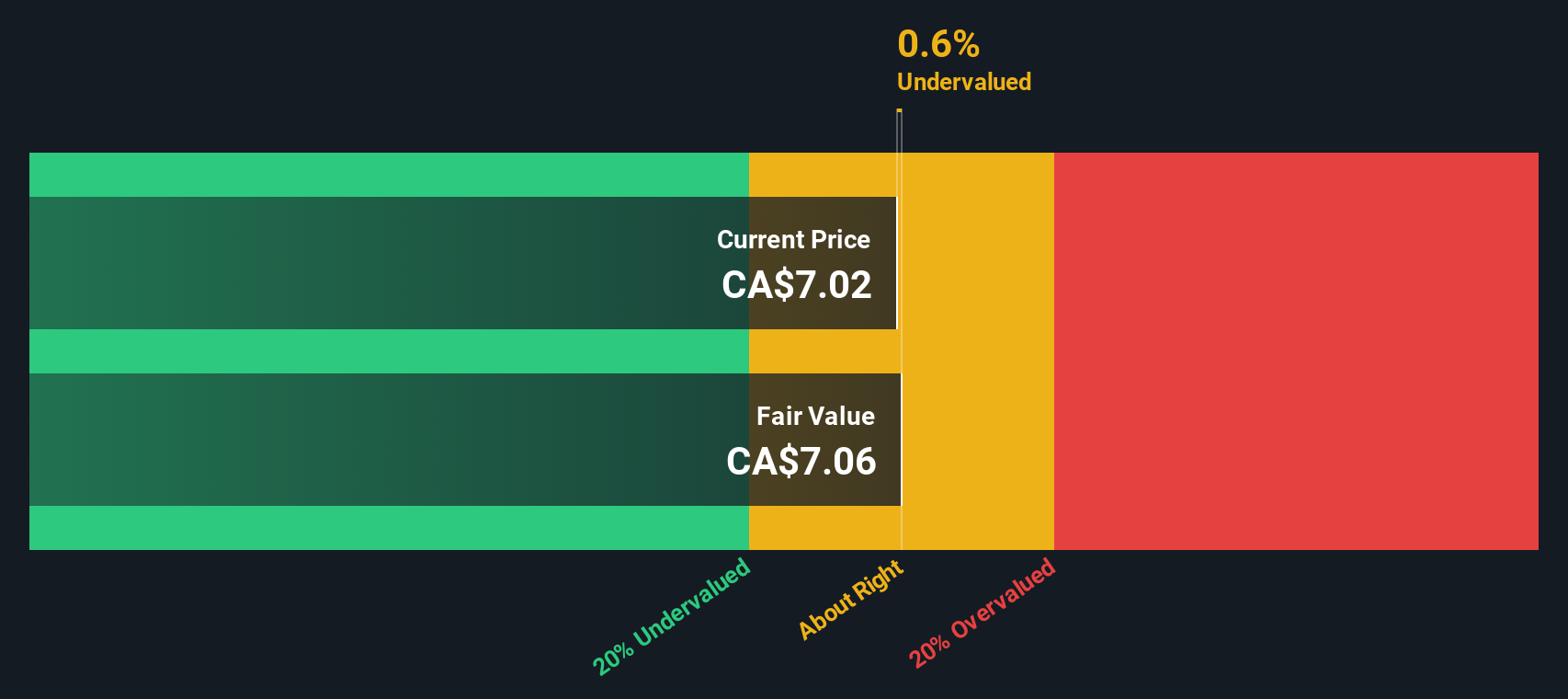

Our DCF model paints a much tighter picture, with Discovery Silver trading only slightly above its estimated fair value of CA$7.76. That suggests less obvious upside than the lofty 128.1x earnings multiple implies, raising the question: is the market already pricing in the best case for Cordero?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Discovery Silver for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Discovery Silver Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes, Do it your way.

A great starting point for your Discovery Silver research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one success story, use the Simply Wall St Screener to uncover fresh, data backed opportunities that could sharpen and strengthen your entire portfolio.

- Secure steadier portfolio income by focusing on proven payers through these 15 dividend stocks with yields > 3% that aim to reward shareholders year after year.

- Capture early stage innovation by scanning these 26 AI penny stocks for companies using artificial intelligence to reshape industries and unlock new growth.

- Position yourself for asymmetric upside by targeting mispriced opportunities within these 909 undervalued stocks based on cash flows that look cheap against their underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DSV

Discovery Silver

A mineral exploration company, engages in the acquisition, exploration, and development of mineral properties in Canada.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026