- Canada

- /

- Metals and Mining

- /

- TSX:DPM

July 2024 Insight Into Canada's Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

As the U.S. presidential campaign unfolds, key economic topics such as government debt and trade policies are at the forefront, potentially influencing market conditions and investor sentiment. These broader economic discussions could impact various sectors, including small-cap stocks in Canada, where understanding market fundamentals becomes crucial in identifying undervalued opportunities. In this context, a good stock might be characterized by solid fundamentals and potential resilience or benefit from current economic conditions.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Dundee Precious Metals | 9.1x | 3.1x | 43.40% | ★★★★★★ |

| Calfrac Well Services | 2.3x | 0.2x | 28.42% | ★★★★★☆ |

| Primaris Real Estate Investment Trust | 11.6x | 3.0x | 34.87% | ★★★★★☆ |

| Nexus Industrial REIT | 2.5x | 3.1x | 18.68% | ★★★★☆☆ |

| Guardian Capital Group | 10.4x | 4.0x | 32.19% | ★★★★☆☆ |

| Sagicor Financial | 1.2x | 0.4x | -95.11% | ★★★★☆☆ |

| Trican Well Service | 8.3x | 1.0x | -15.99% | ★★★☆☆☆ |

| Westshore Terminals Investment | 14.3x | 3.9x | 1.03% | ★★★☆☆☆ |

| Russel Metals | 8.9x | 0.5x | -4.53% | ★★★☆☆☆ |

| Freehold Royalties | 15.8x | 6.8x | 47.54% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

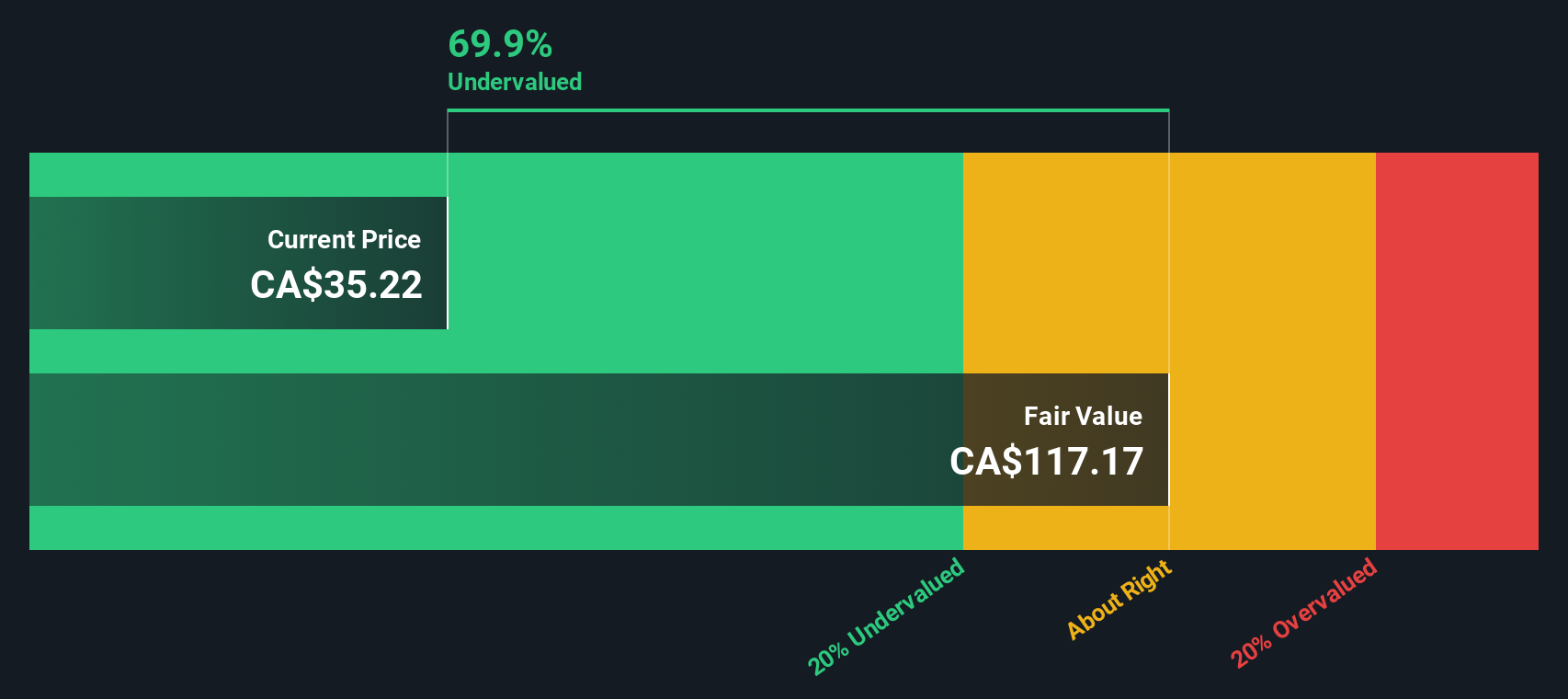

Dundee Precious Metals (TSX:DPM)

Simply Wall St Value Rating: ★★★★★★

Overview: Dundee Precious Metals is a gold mining company operating primarily through its Ada Tepe and Chelopech mines, with a market capitalization of approximately $1.10 billion.

Operations: Ada Tepe and Chelopech generated revenues of $243.33 million and $274.18 million respectively, contributing significantly to the company's financial performance in a recent period. The firm achieved a gross profit margin of 52.79% by the end of 2024, reflecting efficient management of production costs which stood at $244.57 million for the last reported period.

PE: 9.1x

Dundee Precious Metals, a notable player in the mining sector, recently showcased solid production figures with 130.3 K oz of gold and 14.6 Mlbs of copper produced year-to-date as of June 2024. This performance underpins their guidance for robust yearly outputs up to 285 Koz gold and 34 Mlbs copper. Adding confidence, insiders have recently purchased shares, signaling strong belief in the company's prospects. Moreover, the appointment of W. John DeCooman Jr., with extensive experience in corporate development, aligns well with strategic growth objectives, potentially enhancing shareholder value through expert leadership and innovative strategies.

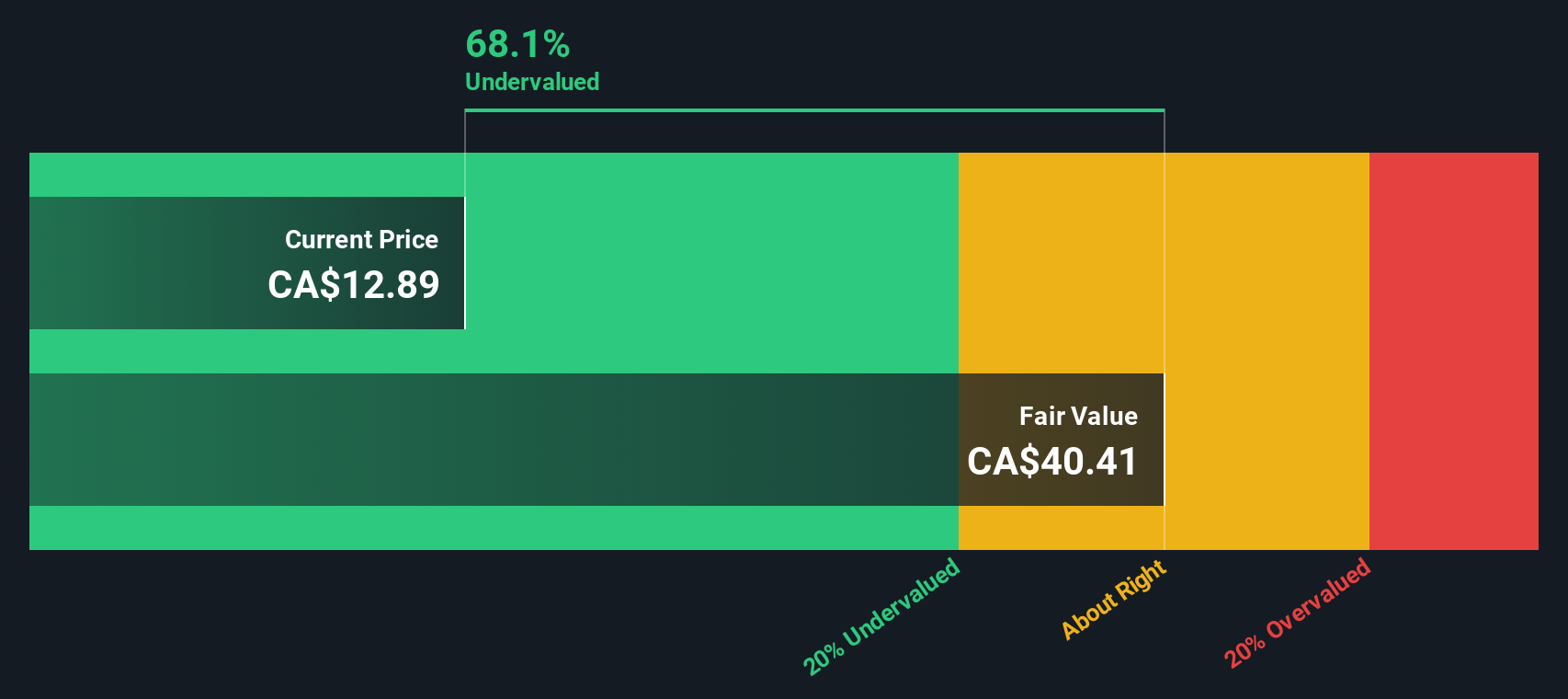

Freehold Royalties (TSX:FRU)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Freehold Royalties is a company engaged in oil and gas exploration and production, with a market capitalization of approximately CA$1.63 billion.

Operations: The entity generates a gross profit margin of approximately 96.74%, derived from its oil and gas exploration and production activities, with recent revenue reported at CA$312.28 million. Operational costs, excluding COGS which stood at CA$10.19 million, include significant depreciation and amortization expenses amounting to CA$95.13 million, impacting the net income which reached CA$134.87 million, reflecting a net income margin of about 43.19%.

PE: 15.8x

Freehold Royalties, demonstrating consistent financial health, recently declared a steady dividend of CAD 0.09 per share, underscoring its reliable cash flow. With an average production slightly down year-over-year in Q1 2024 but within the reiterated full-year guidance range, they show operational stability. Notably, insider confidence is evident as insiders have recently purchased shares, suggesting belief in the company's future prospects despite external borrowing being its sole funding source—a higher risk strategy that demands careful monitoring.

- Click here to discover the nuances of Freehold Royalties with our detailed analytical valuation report.

Gain insights into Freehold Royalties' past trends and performance with our Past report.

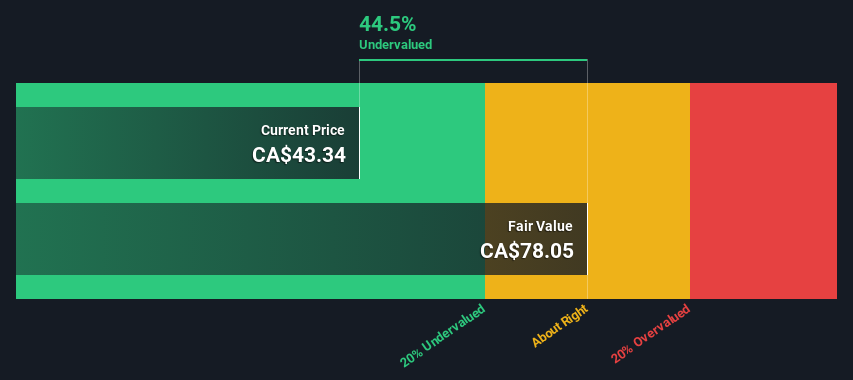

MTY Food Group (TSX:MTY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MTY Food Group operates a diversified business in the food industry, focusing on franchising and corporate operations across Canada and internationally, with a market capitalization of approximately CA$1.41 billion.

Operations: MTY Food Group generates revenue primarily through franchising and corporate operations across Canada and internationally, with significant contributions from the U.S. & International Corporate segment (CA$456.89 million) and the Canada Franchising segment (CA$150.86 million). The company's gross profit margin has shown variability over recent periods, with a notable figure of 0.62% as of the latest reporting date in 2023, reflecting changes in cost of goods sold and operational efficiency.

PE: 11.3x

MTY Food Group, reflecting a cautious yet promising outlook, recently announced a dividend and completed notable share repurchases, signaling potential undervaluation. With sales slightly down to CAD 255.11 million in the first half of 2024 compared to the previous year, and net income at CAD 44.58 million, financial stability seems intact despite a dip in earnings per share from CAD 2 to CAD 1.84. Insider confidence is evident as they bought shares extensively by June 2024 under a new buyback plan initiated last June, enhancing shareholder value amidst market fluctuations.

Seize The Opportunity

- Unlock our comprehensive list of 33 Undervalued TSX Small Caps With Insider Buying by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DPM

Dundee Precious Metals

A gold mining company, engages in the acquisition, exploration, development, mining, and processing of precious metals.

Very undervalued with flawless balance sheet.