- Canada

- /

- Metals and Mining

- /

- TSX:DPM

What Recent M&A Rumors Mean for DPM Metals Share Price in 2025

Reviewed by Bailey Pemberton

Thinking about your next move with DPM Metals? You’re not alone. This stock has been catching more eyes lately, and for good reason. If you’ve followed DPM Metals at all over the past several years, you’ll know it’s delivered the kind of performance that turns heads—up 143.8% in the last year and an even more impressive 478.4% over three years. That’s the kind of growth that has investors asking: is there more upside ahead, or is the story already told?

Recent momentum has only sharpened the debate. DPM Metals notched a 3.3% gain this past week and is up more than 10% in just the last month, all while global metals markets signal growing demand and shifting risk appetites. It's hard to ignore the positive long-term trajectory, too—a 261.4% return over five years shows just how much sustained value there’s been for those who got in early.

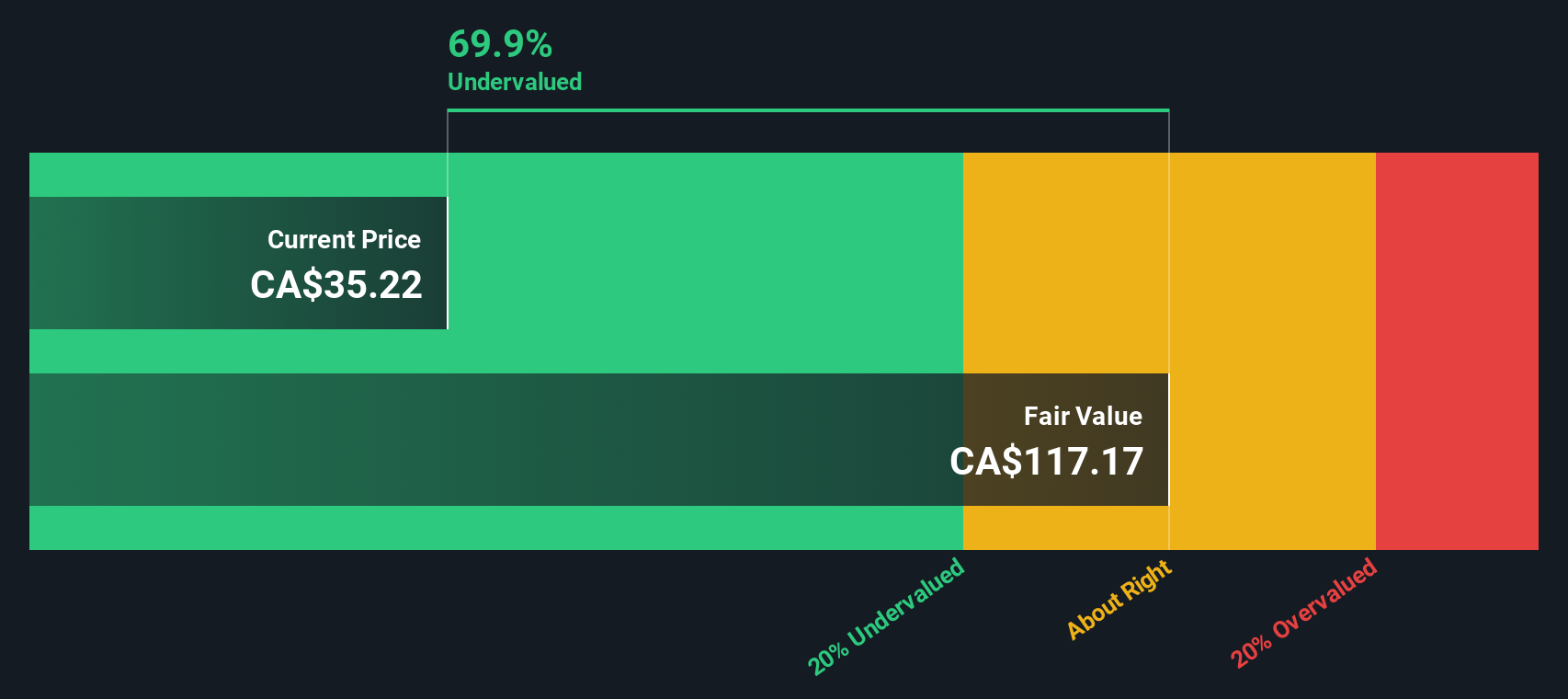

But let’s get to what you’re really wondering: is DPM Metals undervalued or already priced for perfection? By our valuation score, which checks six different measures for signs of undervaluation, DPM Metals scores a 4. That means it ticks the box on four out of six key checks, a solid case that there might be more value left on the table.

Of course, valuation is never just a single number game. In the next section, we’ll walk through the main methods that analysts (and savvy investors) are using right now to judge what DPM Metals is actually worth, before revealing a perspective that often gets overlooked but can make all the difference.

Approach 1: DPM Metals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a tried-and-true method for valuing a company by projecting its future cash flows and then discounting them back to present value. For DPM Metals, this means evaluating expected Free Cash Flow (FCF) over the next decade and using those estimates to determine what the business is really worth today.

Currently, DPM Metals generates $230.68 Million in Free Cash Flow. Analyst estimates provide detailed projections through 2028, after which Simply Wall St extrapolates figures to 2035. By 2028, annual FCF is expected to reach $574 Million, and the model suggests a continuation of growth tending towards just over $1 Billion by the end of the ten-year window. All these figures are reported in dollars and reflect a notable upward trend in DPM’s cash generation.

Based on these projections, the DCF model calculates an intrinsic value of $117.29 per share. Compared to the current share price, this suggests DPM Metals is trading at a 72.0% discount, making it one of the most significant under-valuations identified using this methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DPM Metals is undervalued by 72.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: DPM Metals Price vs Earnings

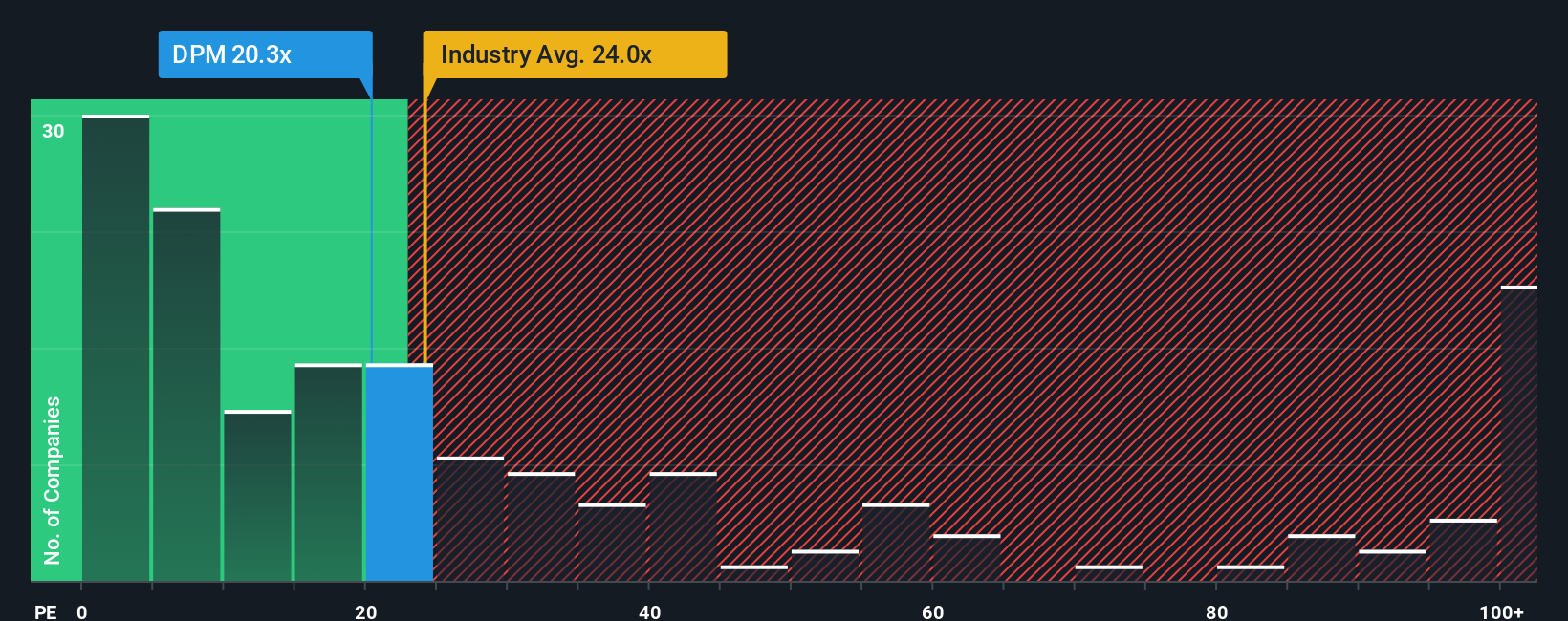

The Price-to-Earnings (PE) ratio is a go-to metric for valuing profitable companies like DPM Metals, as it connects a company’s share price directly to its earnings. This makes it especially effective for judging whether investors are paying a fair price for each dollar of profit, an important consideration for companies with consistent earnings history.

In general, higher growth prospects and lower perceived risk justify a higher PE ratio, while lower growth or greater uncertainty call for a more modest valuation. The industry average PE ratio for Metals and Mining currently sits at 24.04x, while DPM Metals’ own PE ratio is 20.94x. Compared to its peers, which average around 33.50x, DPM Metals trades at a noticeable discount. This suggests the market may not be fully pricing in its operational strengths or potential.

Simply Wall St’s “Fair Ratio” adds an extra layer to the analysis. It is a proprietary figure that judges what PE ratio is justified for DPM Metals, factoring in specific elements like the company’s earnings growth, industry position, profit margins, market cap, and business risks. This approach aims to deliver a more nuanced and accurate benchmark by taking into account crucial company-specific drivers that traditional peer or industry comparisons can overlook.

With a Fair Ratio of 28.32x against DPM Metals’ actual 20.94x, the stock appears undervalued based on this measure. This implies investors might be getting more value for their money at current levels.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DPM Metals Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives, an approach that connects your view of DPM Metals’ story directly to financial forecasts and, in turn, to a fair value estimate.

In simple terms, a Narrative is your own perspective about the company. It reflects why you believe DPM Metals will succeed, what risks you see on the horizon, and how you expect its revenue, profit margins, and earnings to evolve. Through Narratives, you turn these beliefs into a set of numbers, like an assumed fair value and reasoned forecasts, which you can then compare to what the market is currently pricing in.

This makes Narratives a dynamic tool used by millions on Simply Wall St’s Community page. It empowers investors to easily build, share, and adjust their own valuations, rather than just relying on published consensus. Narratives help you identify opportunities when your fair value estimate diverges from the current market price, and they update automatically as new news or earnings are released, ensuring your decisions remain relevant.

For example, some DPM Metals Narratives are built around bullish expectations of CA$33.44 per share, focusing on increased production and higher margins. Others take a more cautious view and align with a lower CA$17.72 price target, emphasizing margin pressure and revenue risks.

Do you think there's more to the story for DPM Metals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DPM

DPM Metals

A gold mining company, engages in the acquisition, exploration, development, mining, and processing of precious metals.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success