- Canada

- /

- Metals and Mining

- /

- TSX:DPM

Dundee Precious Metals (TSX:DPM) Valuation in Focus Following Earnings-Driven Net Income Growth

Reviewed by Kshitija Bhandaru

DPM Metals (TSX:DPM) shares are catching attention after their latest earnings report highlighted a surge in annual net income growth and steady top-line momentum. Investors are parsing through results to see whether gains are likely to continue.

See our latest analysis for DPM Metals.

This earnings-driven momentum follows a period of modest but consistent gains for DPM Metals, with the latest share price at $31.35 and a one-year total shareholder return of 1.3%. While the pace has not been rapid, recent events appear to be changing perceptions about the company’s growth potential.

If steady performance and earnings momentum have you rethinking your exposure, now is an ideal moment to broaden your scope and discover fast growing stocks with high insider ownership

With solid fundamentals fueling interest, the key question now is whether DPM Metals is an undervalued opportunity or if the market has already factored in the company’s robust outlook and future growth prospects.

Most Popular Narrative: Fairly Valued

DPM Metals’ most popular narrative forecasts a fair value in line with its recent close of CA$31.35, highlighting the tension between optimism for future production and near-term profit headwinds. As analysts weigh the company’s robust acquisitions against declining earnings, the fair value calculation comes down to specifics that are not yet obvious from recent price action.

The successful advancement of the Coka Rakita project, including additional discoveries and the ongoing feasibility study, is expected to significantly increase high-margin gold production by 2028, positively impacting future revenue and earnings. Dundee Precious Metals' strong cash position of over $800 million provides financial capacity to fund growth opportunities, which could support revenue and earnings growth through strategic investments and developments.

Want to know what’s driving this valuation? The narrative hinges on breakthrough project expansions, bold assumptions on profit growth, and a future earnings multiple that is contrary to industry trends. Take a closer look to see which big numbers underpin these projections and why analysts are divided.

Result: Fair Value of $30.79 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent project delays or a sharp rise in mining costs could quickly shift forecasts and undermine confidence in DPM Metals’ upbeat growth outlook.

Find out about the key risks to this DPM Metals narrative.

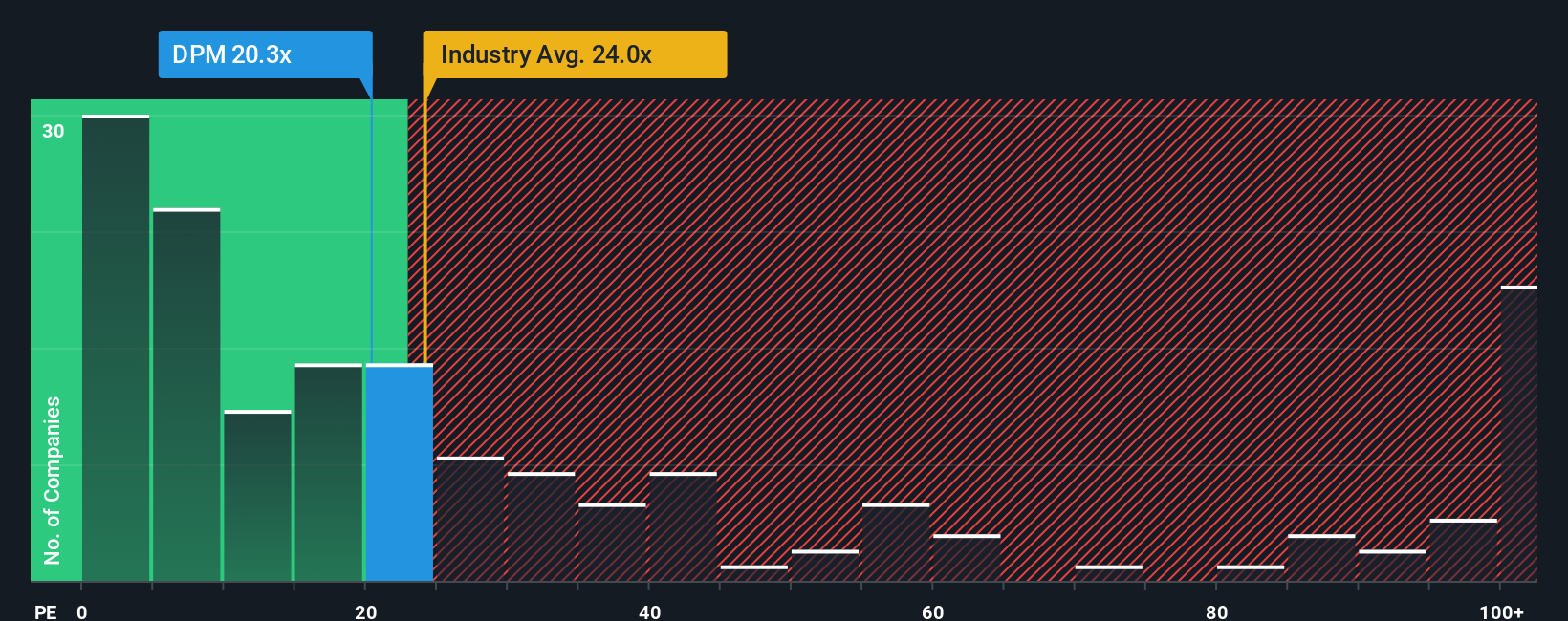

Another View: Market Ratios Tell a Different Story

While the fair value narrative suggests DPM Metals is about right, the market’s preferred price-to-earnings ratio paints a nuanced picture. DPM trades at 20x earnings, which is below the Canadian Metals and Mining industry average of 23.9x, but above the market’s fair ratio for the stock at 13.4x. This gap hints at both potential opportunity and downside risk. Could investor sentiment shift the multiple closer to fair value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DPM Metals Narrative

If you have a different perspective or prefer taking a hands-on approach, you can craft your own data-driven view of DPM Metals in just a few minutes. Do it your way

A great starting point for your DPM Metals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take your portfolio to the next level by targeting innovative companies and hidden opportunities. You could uncover the next big winner by searching where others aren’t.

- Expand your watchlist with these 908 undervalued stocks based on cash flows that are poised for future growth, backed by strong cash flow potential and sensible valuations.

- Get ahead of market trends by following these 24 AI penny stocks that are transforming industries through artificial intelligence breakthroughs and disruptive digital solutions.

- Boost your income with these 19 dividend stocks with yields > 3% which are known for robust yields, solid fundamentals, and consistent shareholder rewards.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DPM

DPM Metals

A gold mining company, engages in the acquisition, exploration, development, mining, and processing of precious metals.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives