- Canada

- /

- Metals and Mining

- /

- TSX:DPM

DPM Metals (TSX:DPM): Evaluating Value After Strong Market Gains

Reviewed by Simply Wall St

See our latest analysis for DPM Metals.

DPM Metals' recent share price surge adds to an already impressive streak, with a 90-day share price return of 36.29% and a massive year-to-date climb of 148.15%. Looking longer term, its total shareholder return stands out even more. The company has delivered 172% over the past year and 476% for investors who stayed the course over three years. This momentum reflects a shift in investor sentiment and suggests that growth potential is now in focus.

If you're keen to see what other names are gaining traction, now is an excellent time to uncover new opportunities with our fast growing stocks with high insider ownership

With the stock already up significantly, the big question now is whether DPM Metals remains undervalued or if current prices reflect all the anticipated growth. This leaves investors to wonder if there is still a real buying opportunity.

Most Popular Narrative: 19.4% Undervalued

With the widely followed narrative setting a fair value at CA$41.54, DPM Metals is trading at a notable discount to this estimate, especially after closing at CA$33.50. The gap points to a bullish outlook among analysts and investors, centered on specific catalysts that could drive further upside.

The successful acquisition of new assets, particularly the addition of productive mining operations in Bosnia and Herzegovina, is seen as a catalyst for higher production volumes and has strengthened the company’s overall outlook. Recent coverage initiations and resumed ratings highlight DPM Metals as being in a strong position to capitalize on operational improvements and expansion, supporting further future valuation growth.

Curious why this valuation is so much higher than the current price? Only a handful of financial projections and a bold production growth roadmap set this target apart. Want to discover the specific earnings trajectory and margin assumptions that power this narrative? Click above and get the whole story now.

Result: Fair Value of $41.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays at the Coka Rakita project or setbacks at Loma Larga could quickly temper the optimistic outlook for DPM Metals’ growth trajectory.

Find out about the key risks to this DPM Metals narrative.

Another View: What Do Multiples Say?

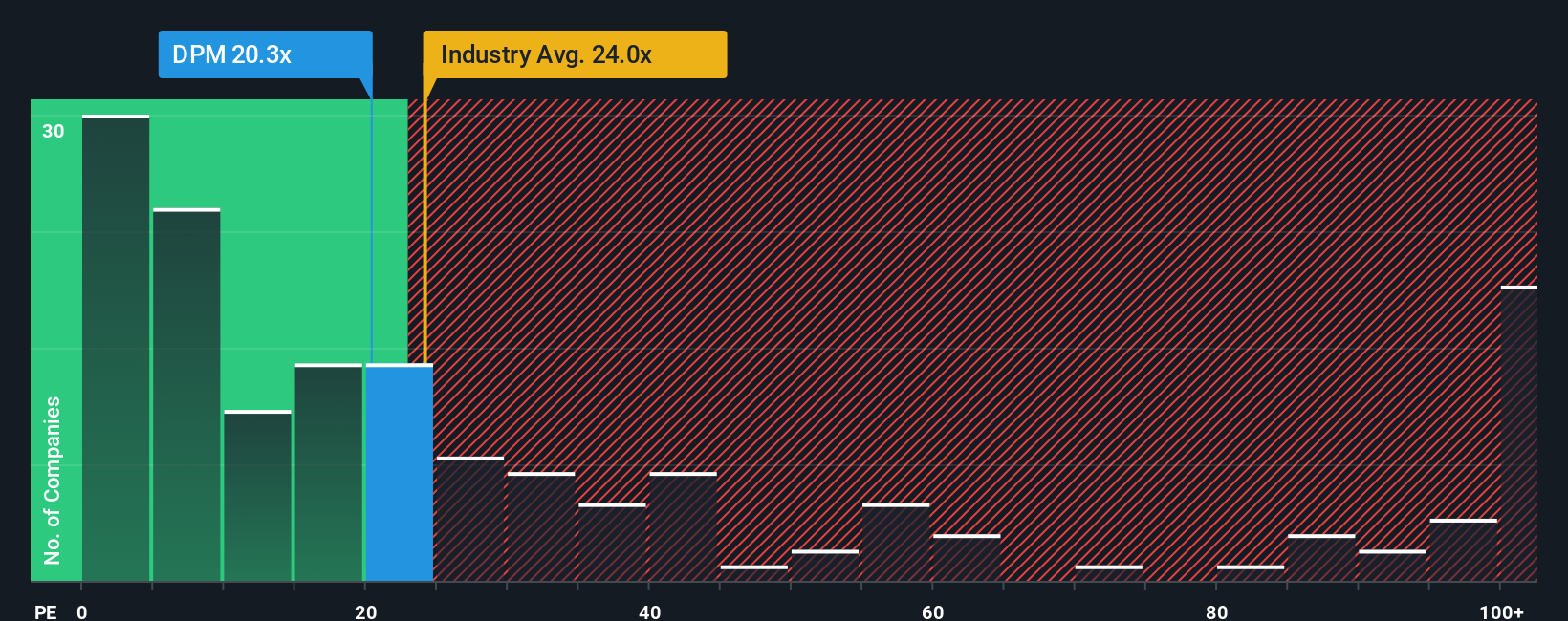

While the narrative-driven fair value suggests DPM Metals is undervalued, taking a look at the price-to-earnings ratio paints a different picture. At 17.7x, DPM trades lower than the Canadian Metals and Mining industry average of 19.5x and well below its fair ratio of 21.5x. This pricing may indicate a margin of safety or could signal the market sees more risk ahead. Does this gap mean investors are being too cautious, or is the market hedging against volatility?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DPM Metals Narrative

Keep in mind, if you have a different perspective or want to dig into the numbers yourself, you can craft your own analysis in just a few minutes. Do it your way

A great starting point for your DPM Metals research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investing Opportunities?

Don’t miss out on sharp market ideas that match your style. The Simply Wall Street Screener makes it easy to uncover trends and find promising stocks with game-changing potential.

- Maximize your yield by tracking these 16 dividend stocks with yields > 3%, which offers attractive payouts above 3% for steady income and growth.

- Spot innovative leaders transforming healthcare by tapping into these 32 healthcare AI stocks, built on advanced AI solutions and next-level patient care.

- Seize early-mover advantages alongside these 3584 penny stocks with strong financials, disrupting markets with fresh growth prospects and untapped potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DPM

DPM Metals

A gold mining company, engages in the acquisition, exploration, development, mining, and processing of precious metals.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives