As 2025 draws to a close, the Canadian market is navigating a period of uncertainty with optimism as inflation shows signs of easing and wage pressures moderate. For investors looking beyond the major players, penny stocks—often representing smaller or newer companies—remain an intriguing segment of the market. Despite being considered somewhat outdated, these stocks continue to offer potential growth opportunities for those who focus on companies with strong financial health and clear growth prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.10 | CA$53.09M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$21.61M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.26 | CA$246.67M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.16 | CA$116.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.465 | CA$3.88M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.345 | CA$51.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.30 | CA$864.89M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.18 | CA$23.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.03 | CA$153.69M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.96 | CA$185.47M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 395 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Dundee (TSX:DC.A)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dundee Corporation, with a market cap of CA$357.27 million, operates through its subsidiaries in diverse sectors including investment advisory, corporate finance, energy, resources, agriculture, real estate and infrastructure.

Operations: Dundee's revenue is primarily derived from its Mining Services segment, which generated CA$1.56 million, and its Mining Investments segment, which contributed CA$1.00 million.

Market Cap: CA$357.27M

Dundee Corporation, with a market cap of CA$357.27 million, operates in diverse sectors but lacks meaningful revenue streams, generating only CA$4 million. The company's short-term assets significantly exceed its liabilities, and it has more cash than debt. Despite negative operating cash flow, Dundee's earnings have grown impressively by 95.2% over the past year and it boasts a high return on equity at 30.2%. Recent legal victories in tax disputes may positively impact financials as they await reassessment refunds from the CRA. Additionally, Dundee’s stock is attractively valued with a low price-to-earnings ratio of 2.8x compared to the broader Canadian market.

- Take a closer look at Dundee's potential here in our financial health report.

- Assess Dundee's previous results with our detailed historical performance reports.

Imaflex (TSXV:IFX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Imaflex Inc. is engaged in the development, manufacturing, and sale of flexible packaging materials for agriculture and packaging industries across Canada, the United States, and internationally, with a market cap of CA$119.28 million.

Operations: The company generates CA$108.00 million in revenue from its operations focused on the development, manufacturing, and sale of flexible packaging materials.

Market Cap: CA$119.28M

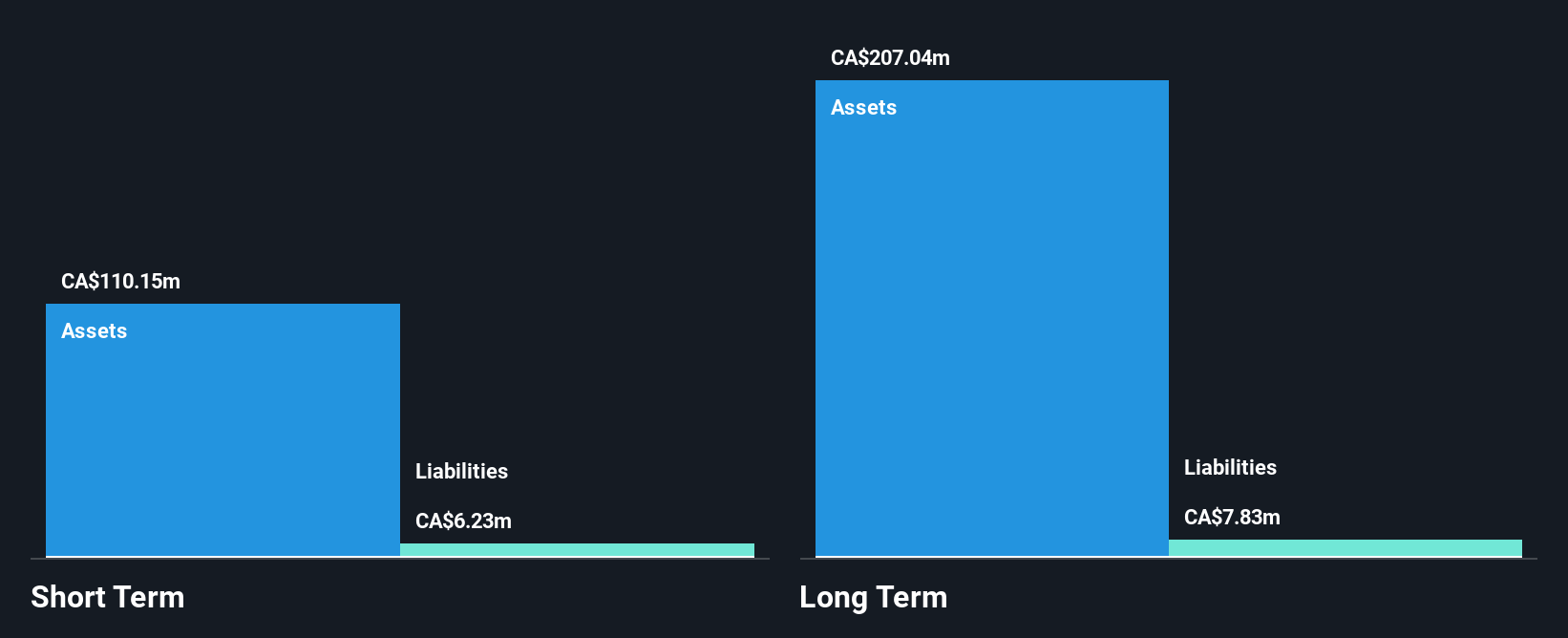

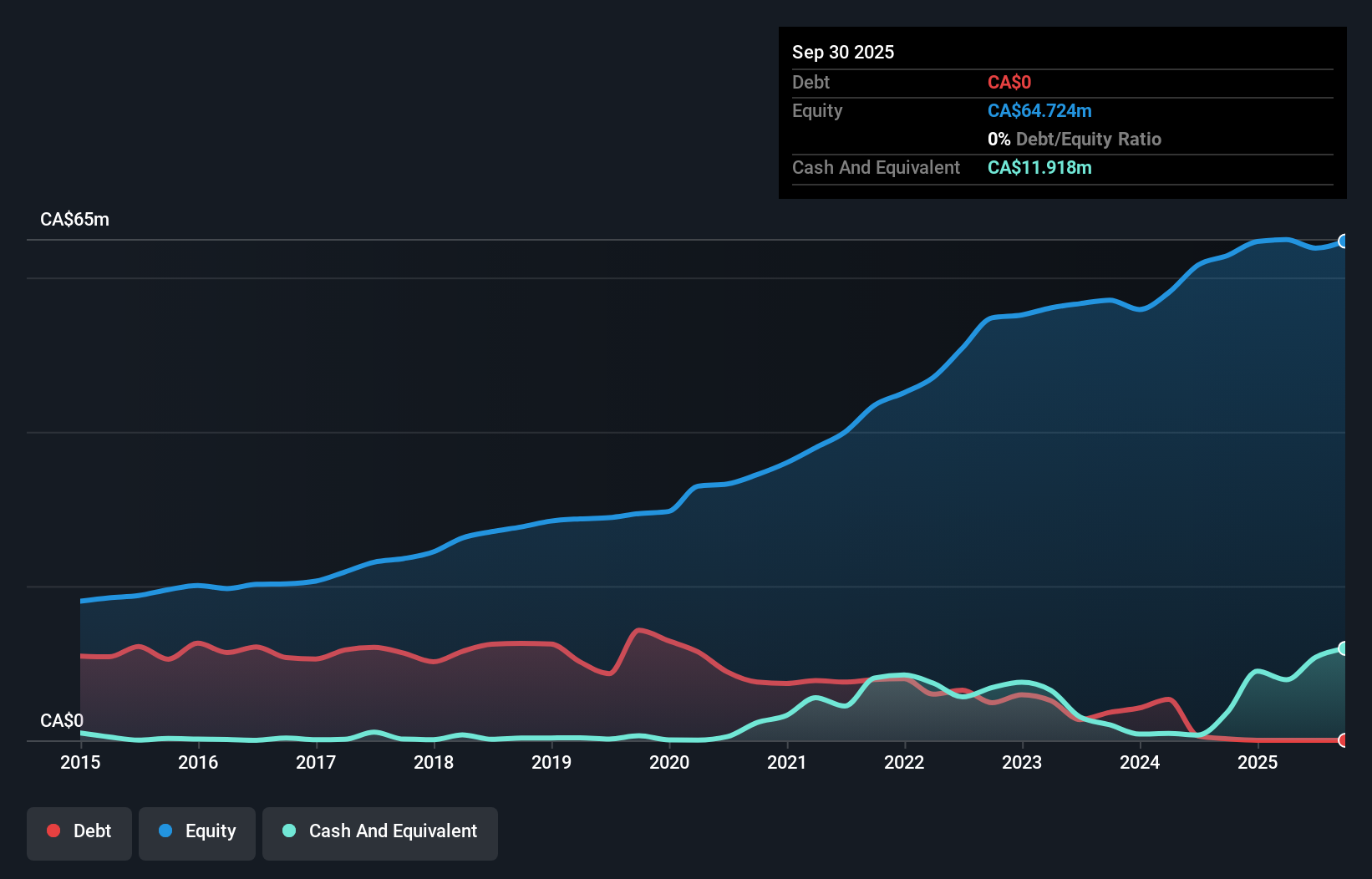

Imaflex Inc., with a market cap of CA$119.28 million, is currently experiencing financial challenges despite its debt-free status. The company reported declining earnings and profit margins over the past year, with net income dropping significantly compared to the previous year. Its return on equity remains low at 2.1%, impacted by a large one-off loss of CA$2.5 million in recent financial results. Despite these setbacks, Imaflex's short-term assets comfortably cover both short and long-term liabilities, providing some financial stability amid high share price volatility. Recently, Soteria Flexibles Corp announced plans to acquire Imaflex for approximately CA$120 million, which would transition it into a privately held entity upon completion of necessary approvals.

- Unlock comprehensive insights into our analysis of Imaflex stock in this financial health report.

- Gain insights into Imaflex's outlook and expected performance with our report on the company's earnings estimates.

Skyharbour Resources (TSXV:SYH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Skyharbour Resources Ltd. focuses on acquiring, exploring, and evaluating uranium and thorium mineral properties in Canada with a market cap of CA$98.04 million.

Operations: Skyharbour Resources Ltd. does not currently report any revenue segments.

Market Cap: CA$98.04M

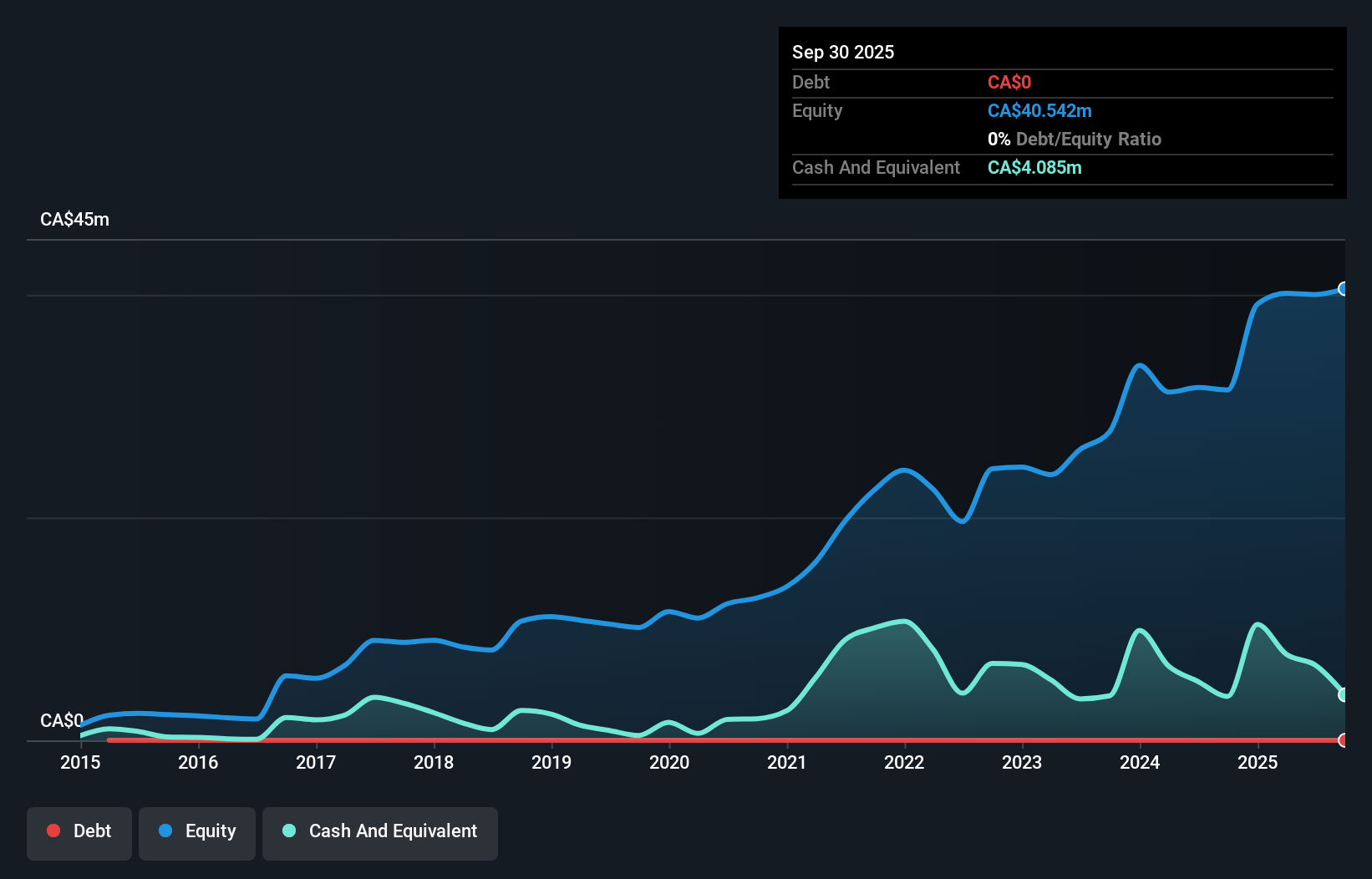

Skyharbour Resources, with a market cap of CA$98.04 million, is pre-revenue and recently became profitable, marking a significant milestone in its financial trajectory. The company has strategically expanded its uranium exploration assets by acquiring full ownership of the Russell Lake Uranium Project for CA$10 million, enhancing its position in the Eastern Athabasca Basin. Skyharbour's management team is experienced with an average tenure of 3.9 years, and the board boasts even greater experience at 11.3 years on average. Despite high share price volatility and low return on equity (2%), the firm remains debt-free with solid short-term asset coverage over liabilities.

- Click here and access our complete financial health analysis report to understand the dynamics of Skyharbour Resources.

- Gain insights into Skyharbour Resources' historical outcomes by reviewing our past performance report.

Seize The Opportunity

- Reveal the 395 hidden gems among our TSX Penny Stocks screener with a single click here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:IFX

Imaflex

Develops, manufactures, and sells flexible packaging materials for agriculture and packaging industries in Canada, the United States, and internationally.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion