- Canada

- /

- Metals and Mining

- /

- TSXV:FISH

Dundee Leads The Way With 2 Other TSX Penny Stocks

Reviewed by Simply Wall St

The Canadian market has recently reached new heights, with large-cap stocks hitting an all-time high, showcasing resilience amid global economic uncertainties and policy shifts. In such a landscape, investors often turn to penny stocks—smaller or newer companies that can offer surprising value despite their vintage name. By focusing on those with strong financial foundations and potential for growth, these stocks may present unique opportunities for investors seeking to tap into promising smaller companies.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.76 | CA$80.92M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.34 | CA$103.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.22 | CA$136.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.67 | CA$445.75M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.08 | CA$567.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.84 | CA$452.49M | ✅ 3 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.65 | CA$3.71M | ✅ 2 ⚠️ 5 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.59 | CA$549.02M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.53 | CA$132.47M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.89M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 904 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Dundee (TSX:DC.A)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dundee Corporation is a publicly owned investment manager with a market cap of CA$195.86 million.

Operations: Dundee Corporation has not reported any specific revenue segments.

Market Cap: CA$195.86M

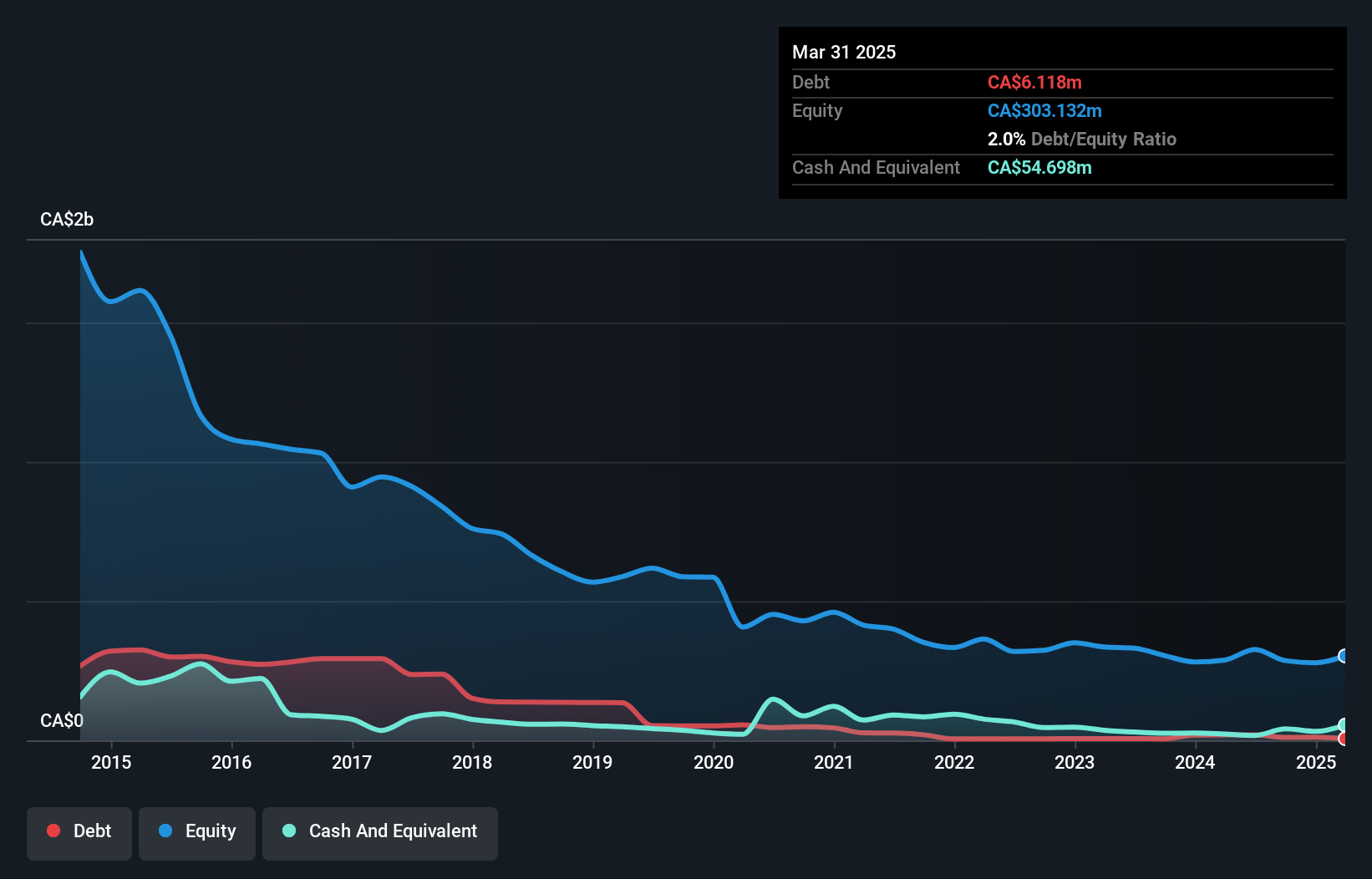

Dundee Corporation, with a market cap of CA$195.86 million, has shown significant financial improvement by becoming profitable over the past year despite limited revenue at CA$4.63 million for 2024. The company's strong return on equity at 24.6% and reduced debt levels from 13.7% to 2% over five years highlight its financial resilience. Dundee's recent share buyback program reflects a strategic focus on enhancing shareholder value, while its experienced board and management team bolster governance stability. However, with negative operating cash flow, debt coverage remains an area of concern despite having more cash than total debt obligations.

- Dive into the specifics of Dundee here with our thorough balance sheet health report.

- Learn about Dundee's historical performance here.

Mandalay Resources (TSX:MND)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mandalay Resources Corporation, along with its subsidiaries, focuses on acquiring, exploring, extracting, processing, and reclaiming mineral properties in Australia, Sweden, Chile, and Canada with a market cap of CA$452.49 million.

Operations: The company generates revenue of $263.21 million from its metals and mining segment, specifically focusing on gold and other precious metals.

Market Cap: CA$452.49M

Mandalay Resources, with a market cap of CA$452.49 million, has demonstrated robust financial growth, reporting earnings of US$14.82 million for Q1 2025, up from US$5.89 million the previous year. The company's net profit margins improved to 21.5%, and its return on equity is high at 22.1%. Mandalay's debt is well covered by operating cash flow and short-term assets exceed both short- and long-term liabilities, indicating strong financial health. A merger with Alkane Resources Ltd., valued at approximately CA$500 million, aims to enhance operational synergies and expand market presence in precious metals mining globally.

- Unlock comprehensive insights into our analysis of Mandalay Resources stock in this financial health report.

- Explore Mandalay Resources' analyst forecasts in our growth report.

Sailfish Royalty (TSXV:FISH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sailfish Royalty Corp. focuses on acquiring precious metals royalty and streaming agreements, with a market cap of CA$143.20 million.

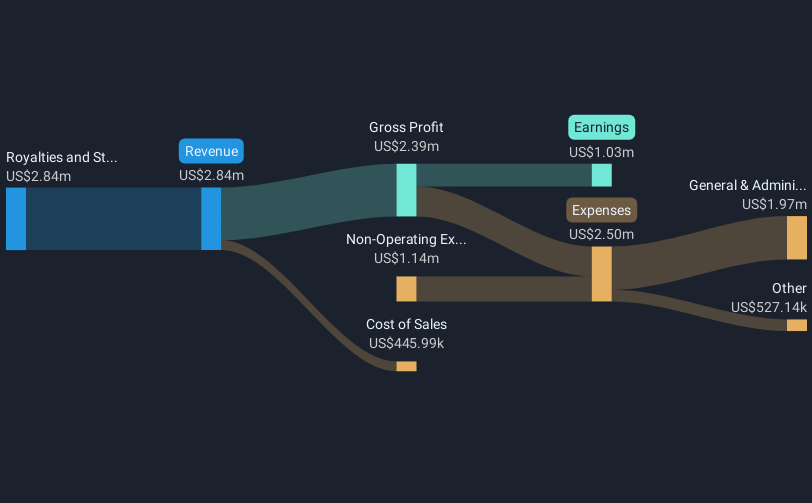

Operations: The company's revenue is primarily derived from royalties and stream interests, totaling $2.84 million.

Market Cap: CA$143.2M

Sailfish Royalty Corp., with a market cap of CA$143.20 million, has recently become profitable, reporting net income of US$0.55 million for 2024 compared to a loss the previous year. Despite its earnings growth, the company's revenue remains modest at US$2.84 million and is not well covered by cash flow due to negative operating cash flow. Sailfish's debt management shows improvement with a reduced debt-to-equity ratio now at 11.8%. Recent strategic moves include acquiring remaining silver production from Mako Mining Corp., potentially enhancing future revenue streams despite forecasted earnings decline over the next three years.

- Take a closer look at Sailfish Royalty's potential here in our financial health report.

- Review our growth performance report to gain insights into Sailfish Royalty's future.

Seize The Opportunity

- Click this link to deep-dive into the 904 companies within our TSX Penny Stocks screener.

- Curious About Other Options? Rare earth metals are the new gold rush. Find out which 23 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:FISH

Sailfish Royalty

Engages in the acquisition of precious metals royalty and streaming agreements.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives