- Canada

- /

- Metals and Mining

- /

- TSX:CS

The Bull Case For Capstone Copper (TSX:CS) Could Change Following Record Output but Squeezed Margins

Reviewed by Simply Wall St

- Capstone Copper reported record copper production and significant operational milestones in the second quarter of 2025, while revenue rose to US$543.16 million from US$393.05 million a year earlier but net income slipped to US$23.97 million.

- Despite the increase in production and key project progress, higher expenses resulted in lower profit margins, highlighting a tension between operational strength and financial performance.

- We'll take a closer look at how record copper output and increased expenses shape Capstone Copper's updated investment narrative.

These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Capstone Copper Investment Narrative Recap

To be a shareholder in Capstone Copper, you need confidence in the company’s ability to balance ambitious growth projects, such as expanding copper production in the Americas, with cost discipline, especially as recent high production did not fully translate to higher profits. The recent news on record copper output supports optimism around operational progress, but the effect on near-term catalysts, like boosting production at Mantoverde while controlling expenses, appears measured, with the most significant risk continuing to be profit margin pressure from rising costs.

The announcement of receiving the environmental permit for the Mantoverde Optimized project is particularly relevant, as it directly supports ongoing production growth catalysts. This regulatory progress enables a substantial increase in throughput and mine life, forming a key part of Capstone’s growth ambitions while underscoring the importance of delivering on promised efficiencies to support future financial results.

Yet, even as output climbs, investors should remain aware of how cost inflation and operational setbacks may challenge Capstone’s ability to...

Read the full narrative on Capstone Copper (it's free!)

Capstone Copper's narrative projects $2.9 billion in revenue and $534.9 million in earnings by 2028. This requires 18.1% yearly revenue growth and a $453.9 million earnings increase from $81.0 million today.

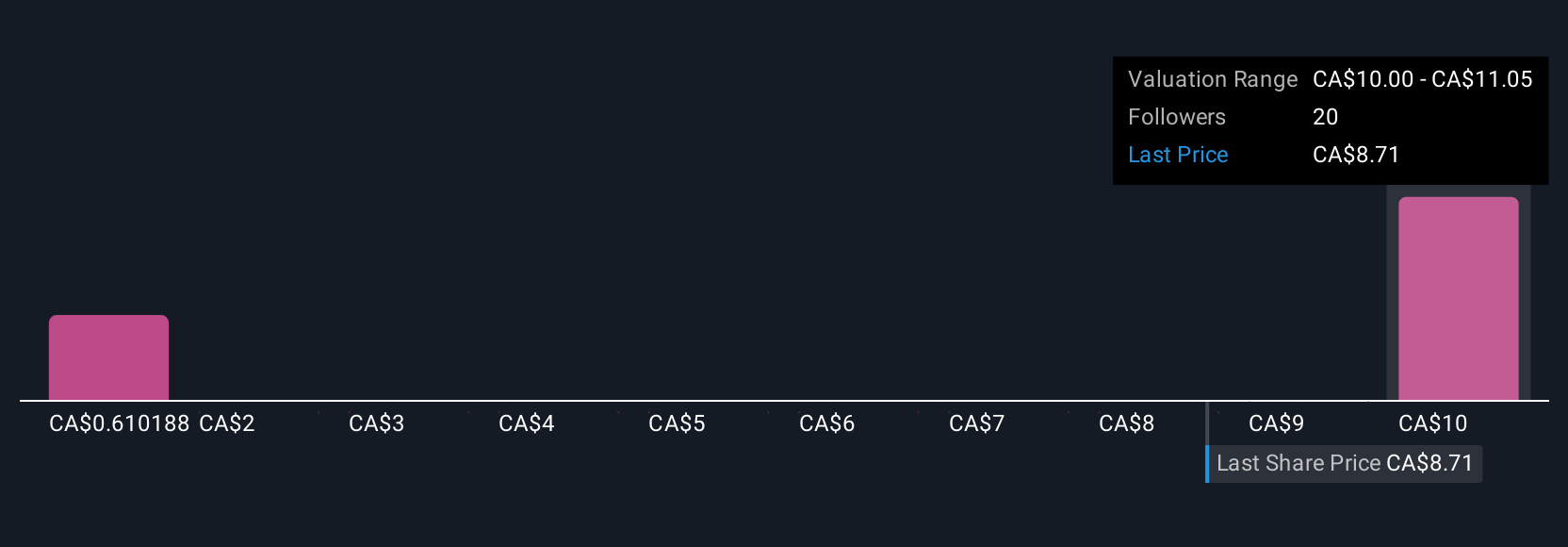

Uncover how Capstone Copper's forecasts yield a CA$11.05 fair value, a 35% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided four fair value estimates for Capstone, ranging broadly from CA$1 to CA$40.78. Despite this spread in expectations, rising operating expenses and their impact on margins remain a central consideration for anyone following the company’s future execution.

Explore 4 other fair value estimates on Capstone Copper - why the stock might be worth over 4x more than the current price!

Build Your Own Capstone Copper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capstone Copper research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Capstone Copper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capstone Copper's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CS

Capstone Copper

A copper mining company, mines, explores for, and develops mineral properties in the United States, Chile, and Mexico.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives