- Canada

- /

- Metals and Mining

- /

- TSX:CS

Capstone Copper's Surging Profits Despite Lower Output Guidance Could Be a Game Changer for TSX:CS

Reviewed by Sasha Jovanovic

- Capstone Copper Corp. recently reported third-quarter and nine-month 2025 earnings, showing significant increases in sales to US$598.44 million and net income of US$248.09 million compared to the previous year, while also confirming that annual copper production is trending toward the lower end of its 220,000 to 255,000 tonne guidance range.

- Despite the lower production outlook, the company's substantial year-over-year improvement in profitability reflects strong operational performance and increased copper prices.

- We'll examine how Capstone Copper's robust earnings growth shapes its investment narrative amid guidance for lower production in 2025.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Capstone Copper Investment Narrative Recap

To be a shareholder in Capstone Copper today, you need to believe that sustained demand for copper, scale expansion at key projects, and disciplined cost management will offset short-term variability in production. The company's latest confirmation that 2025 output will be near the lower end of guidance does not appear to materially affect the biggest catalyst, commissioning and ramp-up at major assets, nor does it significantly increase operational risks in the immediate term.

Among recent developments, the October announcement of higher copper grades from the Mantoverde Phase 1 drill program stands out. These results may underpin confidence in future throughput and margin uplift, which supports the company's expansion-focused investment case even as near-term guidance is revised lower.

However, investors should also keep in mind that if concentrated reliance on a few core mines were ever disrupted...

Read the full narrative on Capstone Copper (it's free!)

Capstone Copper's outlook anticipates $3.0 billion in revenue and $413.5 million in earnings by 2028. This assumes a 15.2% annual revenue growth rate and a $337.9 million earnings increase from the current earnings of $75.6 million.

Uncover how Capstone Copper's forecasts yield a CA$15.01 fair value, a 23% upside to its current price.

Exploring Other Perspectives

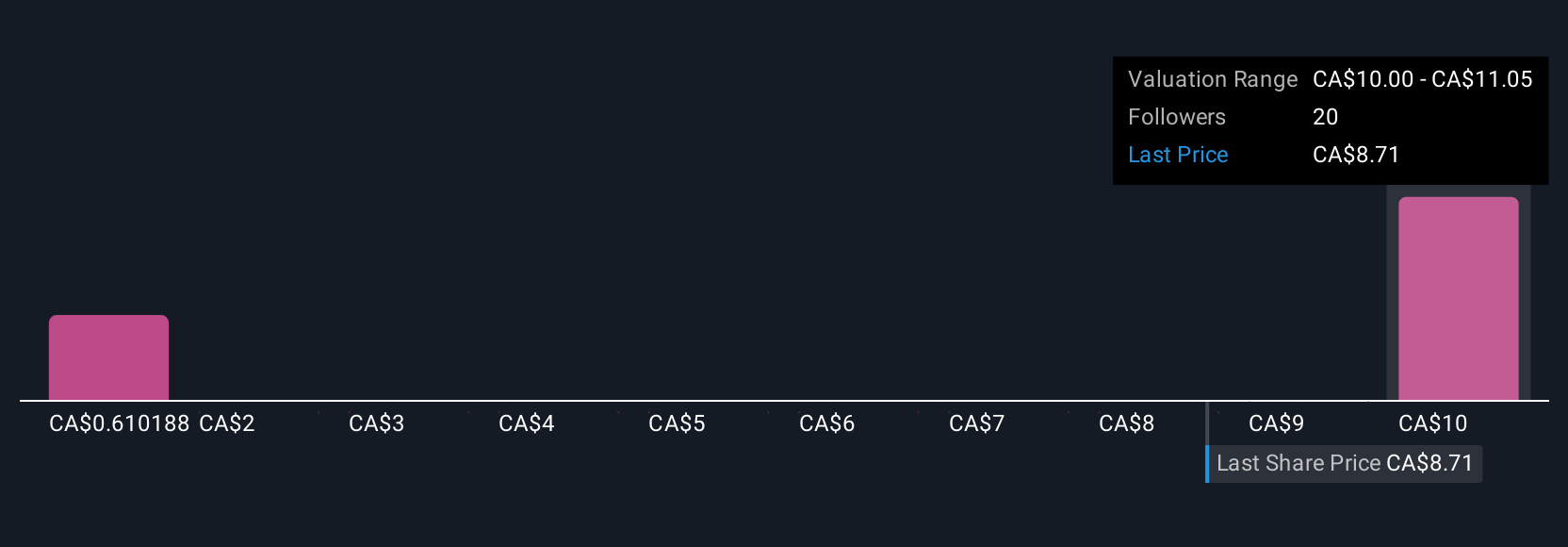

Simply Wall St Community members submitted four fair value estimates for Capstone Copper, ranging from as low as US$1 to US$15.01 per share. With operational concentration risk still relevant, consider how production challenges at major mines can shape future sentiment among diverse market participants.

Explore 4 other fair value estimates on Capstone Copper - why the stock might be worth less than half the current price!

Build Your Own Capstone Copper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capstone Copper research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Capstone Copper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capstone Copper's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CS

Capstone Copper

A copper mining company, mines, explores for, and develops mineral properties in the United States, Chile, and Mexico.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives