- Canada

- /

- Metals and Mining

- /

- TSX:CS

Capstone Copper (TSX:CS) Valuation in Focus After Mantoverde Production Disruption

Reviewed by Simply Wall St

Most Popular Narrative: 10.7% Undervalued

According to the most widely followed narrative on Capstone Copper, the stock is trading at a notable discount compared to its estimated fair value. Strong project execution, upcoming capacity expansions, and financial discipline form the basis for this view of future outperformance.

The imminent execution of the Mantoverde Optimized project, following recent permit approval, is expected to materially increase throughput and sustain higher copper production at lower incremental cost. This could positively impact both revenue and net margins as expanded volumes are realized.

Curious what forces are driving this double-digit discount to fair value? Behind the headline is a bold set of growth forecasts, margin expansion ambitions, and a future profit multiple that could shift the valuation narrative for this Canadian miner. What are the exact numbers and projections steering this target? Take a closer look inside the most popular fair value call to uncover what's really behind the 10% upside.

Result: Fair Value of $11.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent water shortages or unexpected setbacks at key mines could quickly derail these growth forecasts and pose challenges for Capstone Copper’s optimistic outlook.

Find out about the key risks to this Capstone Copper narrative.Another View: Looking at Price Tags

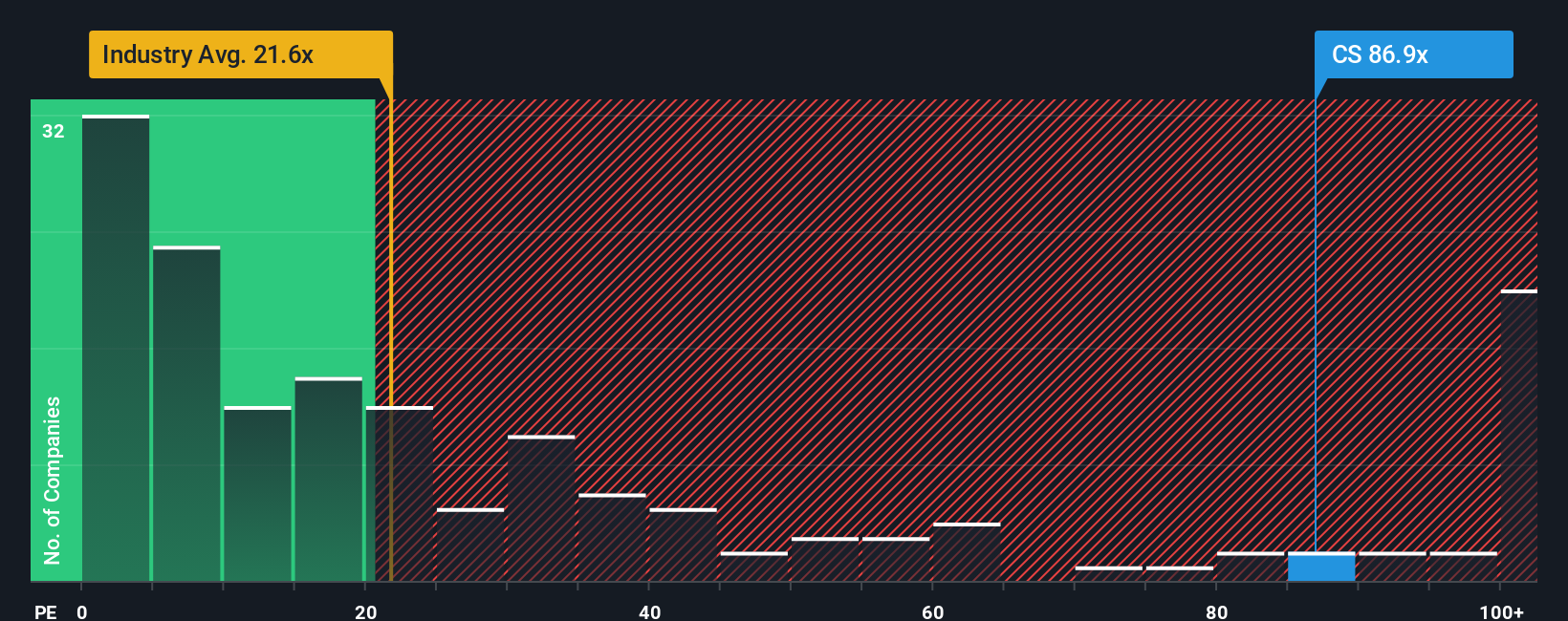

While fair value models point to Capstone Copper being undervalued, another valuation method based on current share price compared to industry standards offers a less optimistic outlook. Could the market be pricing in more risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capstone Copper Narrative

If you have a different perspective or want to dig into the numbers firsthand, you can quickly build your own narrative in just a few minutes with our tools. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Capstone Copper.

Ready for More Investment Opportunities?

You could miss out on standout opportunities if you only focus on one stock. The Simply Wall Street Screener uncovers high-potential ideas that smart investors are following right now.

- Tap into steady income by scanning for established companies offering reliable returns through dividend stocks with yields > 3%.

- Get ahead of financial trends and see which firms are using AI to revolutionize healthcare with healthcare AI stocks.

- Find overlooked value plays that could soon be market favorites when you check out undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:CS

Capstone Copper

A copper mining company, mines, explores for, and develops mineral properties in the United States, Chile, and Mexico.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives