- Canada

- /

- Metals and Mining

- /

- TSX:CMMC

Did You Manage To Avoid Copper Mountain Mining's (TSE:CMMC) 24% Share Price Drop?

It is a pleasure to report that the Copper Mountain Mining Corporation (TSE:CMMC) is up 37% in the last quarter. But that doesn't help the fact that the three year return is less impressive. In fact, the share price is down 24% in the last three years, falling well short of the market return.

Check out our latest analysis for Copper Mountain Mining

Copper Mountain Mining wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Copper Mountain Mining grew revenue at 2.8% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. The stock dropped 8.8% during that time. If revenue growth accelerates, we might see the share price bounce. But ultimately the key will be whether the company can become profitability.

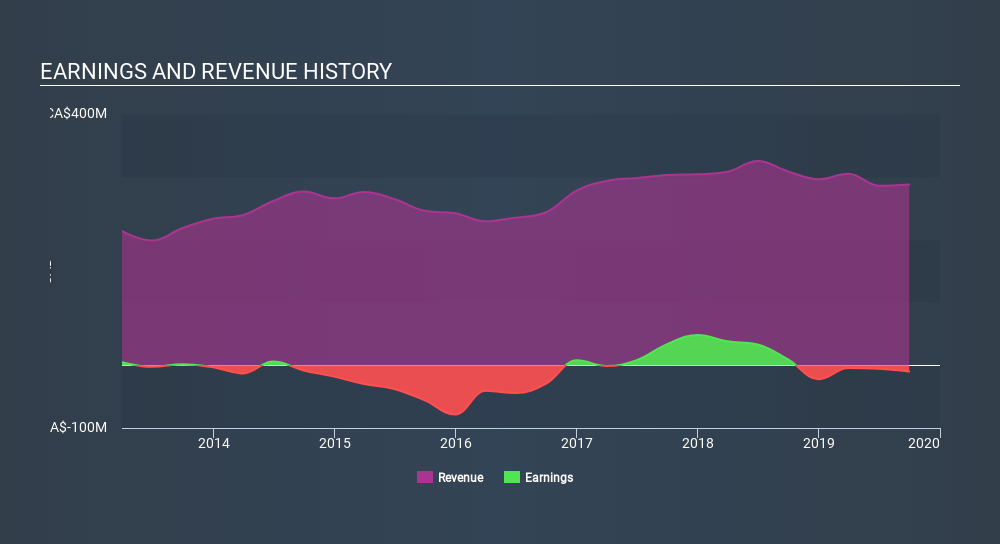

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. You can see what analysts are predicting for Copper Mountain Mining in this interactive graph of future profit estimates.

A Different Perspective

While the broader market gained around 13% in the last year, Copper Mountain Mining shareholders lost 4.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 5.0% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Copper Mountain Mining better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Copper Mountain Mining , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:CMMC

Copper Mountain Mining

Copper Mountain Mining Corporation engages in the mining, exploration, and development of mineral properties in Canada.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)