- Canada

- /

- Metals and Mining

- /

- TSX:CGG

How Inclusion in a Major Index Will Impact China Gold International Resources (TSX:CGG) Investors

Reviewed by Sasha Jovanovic

- China Gold International Resources Corp. Ltd was recently added to the Hang Seng China Affiliated Corporations Index, marking a significant milestone for the company.

- This inclusion could attract heightened interest from index-tracking funds and institutional investors, potentially expanding the company's profile within the regional market.

- Let's explore how joining a major index may influence China Gold International Resources' investment narrative, especially regarding institutional investor attention.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is China Gold International Resources' Investment Narrative?

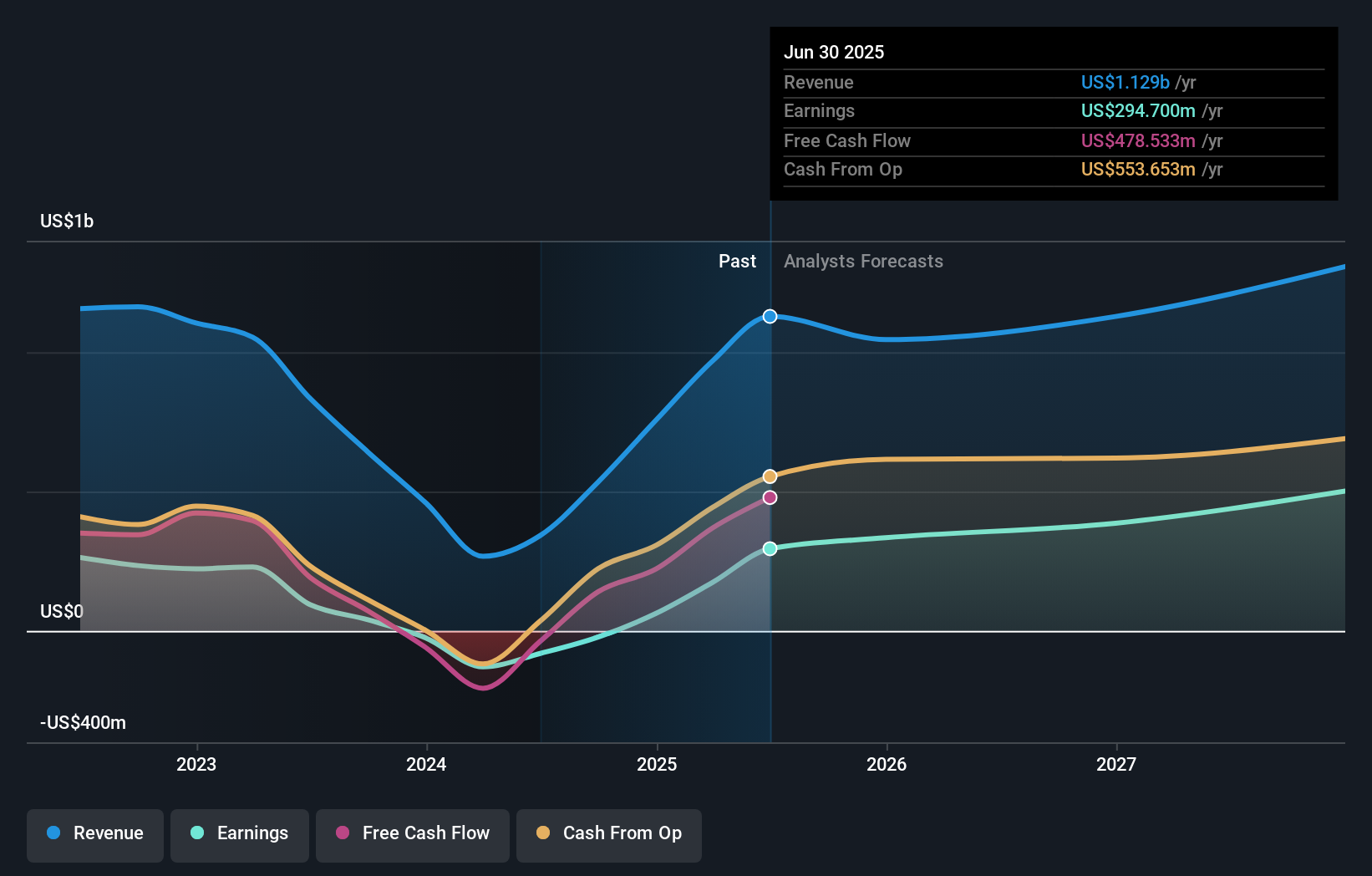

For anyone considering China Gold International Resources, the core of the investment story is anchored in its recent rapid return to profitability and significant production growth in both gold and copper. The company’s addition to the Hang Seng China Affiliated Corporations Index brings potential for greater visibility and additional liquidity in the near term, especially from institutional investors who follow such indices. While this milestone alone may not alter the company's most important fundamental catalysts, namely, continued delivery of robust earnings and operational performance, it could amplify the effect of positive updates or exacerbate downside risks, like volatility from broader market flows. At the same time, investors should continue to weigh sector risks, execution certainty, and valuation concerns, as CGG trades at a premium to its peers. The recent inclusion may raise short-term interest, but the bigger question is whether long-term profitability can keep pace with growing expectations.

However, increased index visibility does not shield the company from volatility tied to sector or commodity price shifts.

Exploring Other Perspectives

Explore 3 other fair value estimates on China Gold International Resources - why the stock might be a potential multi-bagger!

Build Your Own China Gold International Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Gold International Resources research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free China Gold International Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Gold International Resources' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CGG

China Gold International Resources

A gold and base metal mining company, acquires, explores, develops, and mines mineral resources in the People’s Republic of China and Canada.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives