- Canada

- /

- Metals and Mining

- /

- TSX:CG

What Do Centerra Gold’s 86% Year-to-Date Gains Mean for Investors in 2025?

Reviewed by Bailey Pemberton

Wondering what to make of Centerra Gold’s recent surge? If you’ve been watching the gold mining sector, you’ve probably noticed Centerra Gold moving up the ranks in market conversations, and its stock is turning heads for good reason. Over the past week alone, the share price shot up by 11.2%. Widen the lens, and it gets even more impressive, with a 32.4% gain in the last month and an eye-catching year-to-date climb of 86.7%. Even when you zoom out to three years, Centerra Gold’s stock has skyrocketed 173.8%. Simply put, there’s clear momentum here, attracting both new and seasoned investors who see potential in precious metals as market volatility and inflation worries persist.

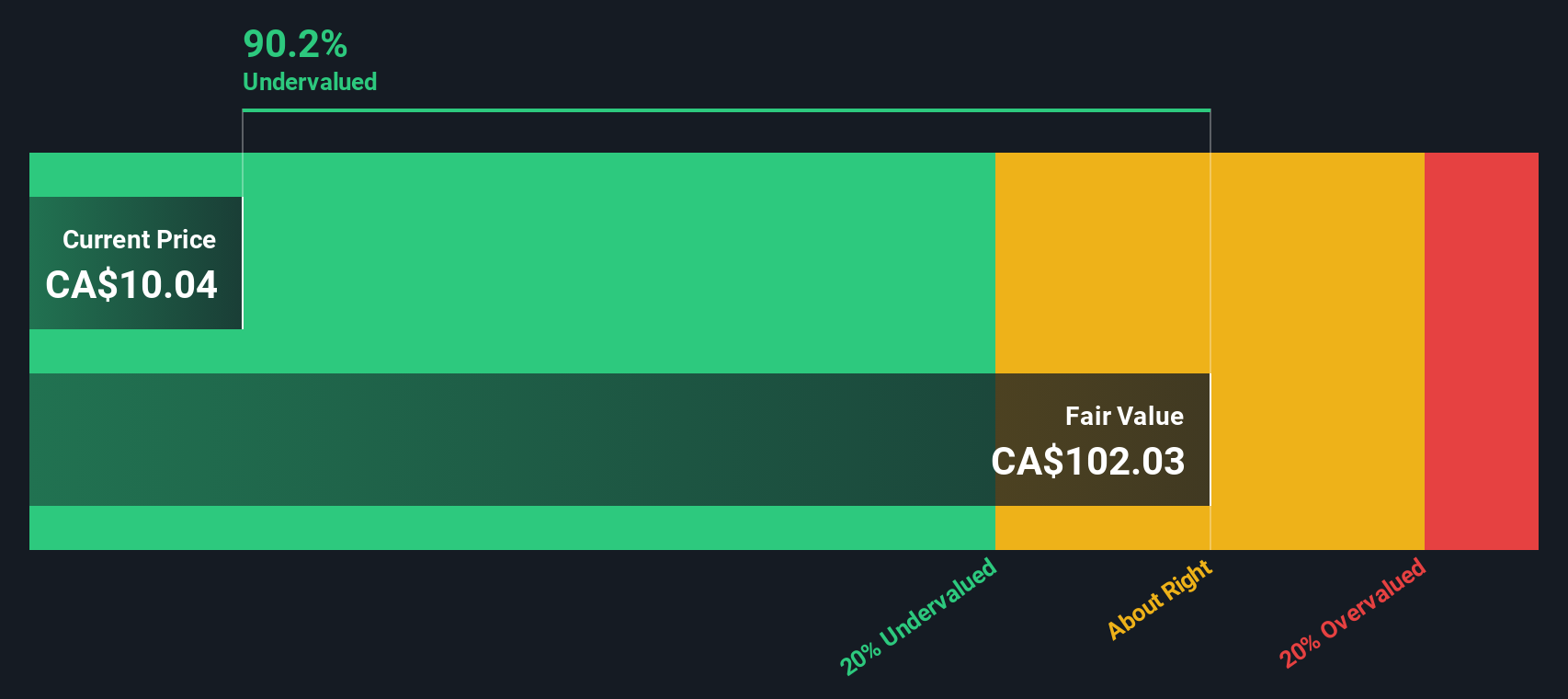

Of course, not all of this excitement comes down to hype or sentiment. While there’s always been a steady appetite for gold as a safe haven, changes in interest rates and global demand for commodities have nudged mining stocks, including Centerra Gold, into the limelight. Yet, before you let FOMO (fear of missing out) take over, it’s smart to check whether the stock’s fundamentals support the current price. Our valuation scorecard isn’t overly generous, awarding Centerra Gold a value score of 1 out of 6, meaning it’s only passing one of the six criteria for being considered undervalued.

So, what goes into that valuation decision, and do these traditional models really tell the whole story? Next, we’ll walk through the major ways professionals measure what Centerra Gold is truly worth. Plus, stick around for a fresh perspective on how you can approach valuation in today’s changing market.

Centerra Gold scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Centerra Gold Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a classic valuation approach that estimates a company’s intrinsic value by projecting its future dividends and discounting them back to today’s value. The key is to assess both the sustainability and growth rate of a company’s dividend payments, as well as their relationship to earnings and return on equity.

For Centerra Gold, analysts have reported a dividend per share of $0.21, with a return on equity of 3.41% and a payout ratio of 14.70%. The projected long-term annual growth rate for dividends is capped at 2.6%, slightly trimmed from a previous estimate of 2.9%. This relatively modest growth outlook reflects Centerra’s approach to maintaining stable and sustainable payouts, rather than aggressively expanding its dividend.

Based on these projections, the DDM estimates Centerra Gold’s intrinsic value at $6.83 per share. This is in stark contrast to the company’s current market price, implying a 132.2% overvaluation according to this model. In other words, investors today are paying significantly more than what the underlying dividend stream is projected to justify.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Centerra Gold may be overvalued by 132.2%. Find undervalued stocks or create your own screener to find better value opportunities.

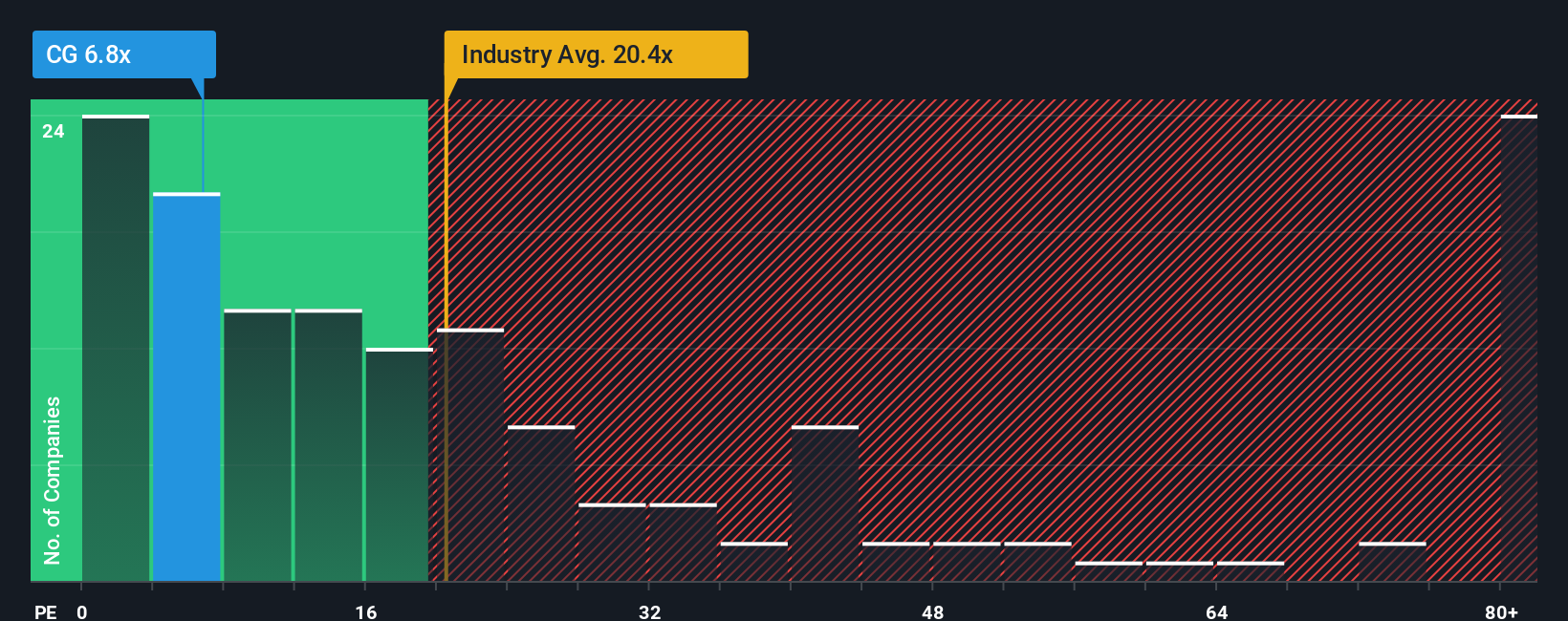

Approach 2: Centerra Gold Price vs Earnings (PE Ratio) Analysis

The Price-to-Earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies like Centerra Gold because it links a company’s share price directly to its net earnings. Investors often use the PE ratio to gauge whether a stock is priced reasonably relative to its potential to generate profits, especially when those profits are consistent and reliable.

Expectations for future growth and perceived risks both play big roles in what is considered a “normal” PE ratio for a stock. High-growth, lower-risk companies can command higher PE ratios, while those with lower growth or greater perceived risks tend to trade closer to or below the market average.

Currently, Centerra Gold trades at a PE ratio of 30.7x, which is below the average among its peers (38.6x) but sits notably above the broader metals and mining industry average of 24.0x. However, instead of just focusing on industry or peer benchmarks, Simply Wall St calculates a proprietary Fair Ratio, which for Centerra Gold is 13.0x. This Fair Ratio is more comprehensive because it adjusts for unique factors such as the company’s actual earnings growth, market risks, profit margins, its place within the industry, and its market capitalization. Compared to the Fair Ratio, Centerra Gold’s current PE stands substantially higher, suggesting the stock is trading at a premium to what its fundamentals and risk profile would typically justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

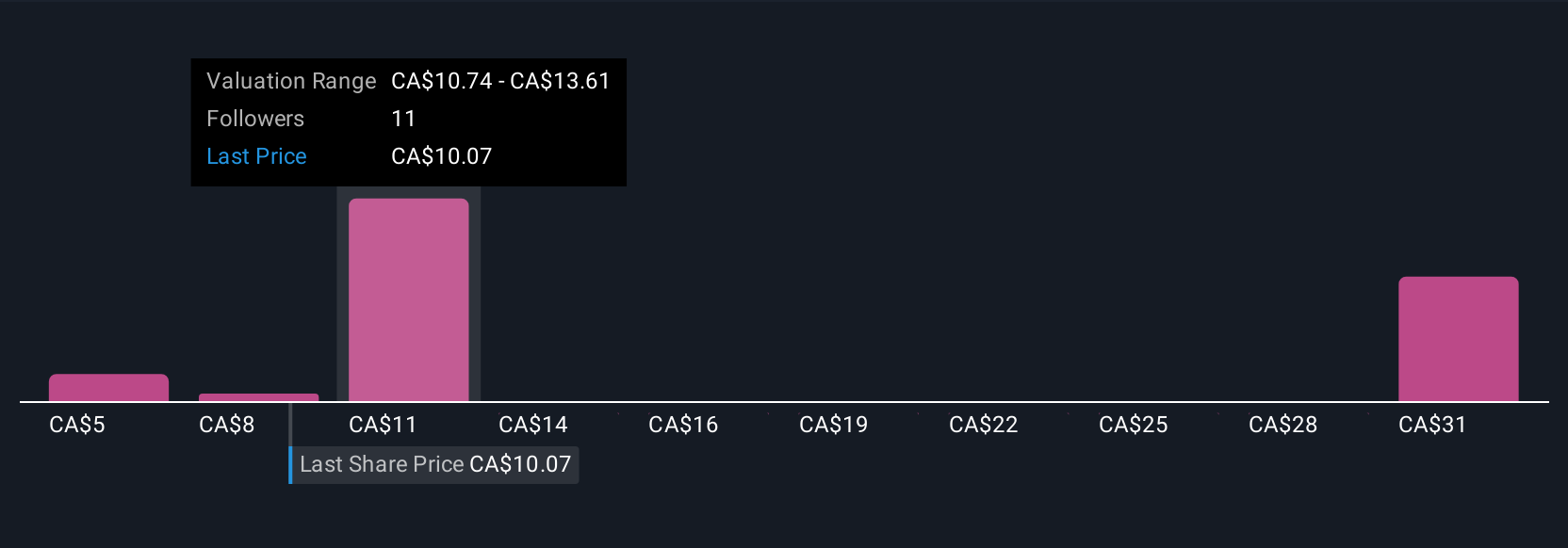

Upgrade Your Decision Making: Choose your Centerra Gold Narrative

Earlier, we mentioned there's a better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company, combining your expectations around its future revenue, earnings, and profit margins to arrive at an estimated fair value. Essentially, it connects the company’s outlook with your perspective on what its shares should be worth. Narratives make the why behind numbers transparent and personal, and on Simply Wall St’s Community page, millions of investors can create and share their own. By comparing your Narrative fair value to the current price, you can quickly decide if a stock like Centerra Gold looks like a buy or sell for you. As the facts change, when new news, earnings, or guidance becomes available, Narratives dynamically update, keeping your thinking relevant and up to date. For example, some investors may see Centerra Gold’s fair value as high as CA$14.86, thanks to bullish views on project upgrades and gold demand, while others forecast just CA$9.48, citing operational risks or sluggish revenue outlooks. Narratives put you in control, making your investment decision smarter, clearer, and truly your own.

Do you think there's more to the story for Centerra Gold? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CG

Centerra Gold

Engages in the acquisition, exploration, development, and operation of gold and copper properties in North America, Turkey, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives