Top 3 Undervalued Small Caps In Canada With Insider Buying For August 2024

Reviewed by Simply Wall St

The Canadian market has experienced significant volatility in 2024, with sharp daily swings and modest overall changes despite dramatic headlines. In such an environment, identifying undervalued small-cap stocks with insider buying can provide unique opportunities for investors seeking to capitalize on potential growth while navigating market turbulence.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Calfrac Well Services | 2.6x | 0.2x | 34.80% | ★★★★★★ |

| Nexus Industrial REIT | 2.7x | 3.3x | 22.31% | ★★★★★☆ |

| Obsidian Energy | 6.8x | 1.1x | 46.75% | ★★★★★☆ |

| Primaris Real Estate Investment Trust | 10.8x | 2.9x | 45.89% | ★★★★★☆ |

| Bragg Gaming Group | NA | 1.2x | 17.90% | ★★★★★☆ |

| Trican Well Service | 8.1x | 1.0x | 6.60% | ★★★★☆☆ |

| Hemisphere Energy | 6.8x | 2.5x | 14.04% | ★★★☆☆☆ |

| Information Services | 23.8x | 2.1x | -65.05% | ★★★☆☆☆ |

| ADENTRA | 16.7x | 0.3x | 8.43% | ★★★☆☆☆ |

| Sagicor Financial | 1.2x | 0.4x | -69.60% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Centerra Gold (TSX:CG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Centerra Gold is a mining company engaged in the exploration, development, and production of gold and copper with operations primarily in North America and Asia, boasting a market cap of approximately CAD 1.58 billion.

Operations: Centerra Gold generates revenue primarily from its Öksüt, Molybdenum, and Mount Milligan segments. The company's gross profit margin has shown variability over the periods, with recent figures such as 0.4422% for Q2 2024 and 0.23698% for Q3 2023 indicating fluctuations in profitability.

PE: 10.7x

Centerra Gold, a small-cap Canadian miner, reported Q2 2024 sales of US$282.31 million, up from last year's US$184.52 million, with net income swinging to US$37.67 million from a loss of US$39.68 million. Despite earnings forecasted to decline by 13.7% annually over the next three years and reliance on external borrowing for funding, insider confidence is evident with recent share purchases in July 2024. The company expects gold production between 370-410 koz for the year and has declared a quarterly dividend of CAD 0.07 per share payable on August 29, signaling potential value amidst current market conditions.

- Click here and access our complete valuation analysis report to understand the dynamics of Centerra Gold.

Gain insights into Centerra Gold's historical performance by reviewing our past performance report.

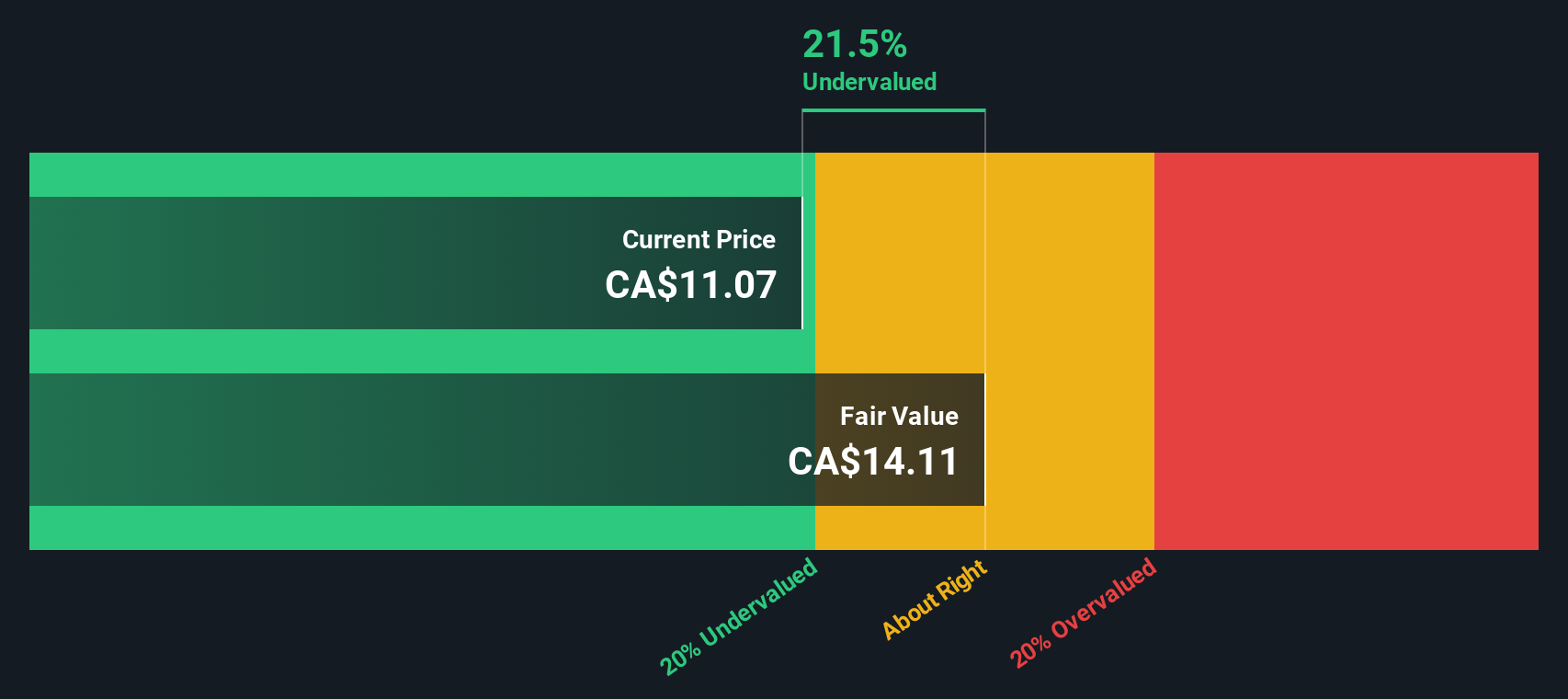

Chemtrade Logistics Income Fund (TSX:CHE.UN)

Simply Wall St Value Rating: ★★★★★★

Overview: Chemtrade Logistics Income Fund operates in the chemical industry, providing industrial chemicals and services, with a market cap of approximately CA$0.84 billion.

Operations: The company generates revenue primarily from its Electrochemicals (EC) and Sulphur and Water Chemicals (SWC) segments. In recent periods, the gross profit margin has shown an upward trend, reaching 23.62% in Q3 2023.

PE: 5.4x

Chemtrade Logistics Income Fund, a small-cap Canadian stock, has recently attracted insider confidence with significant share purchases over the past few months. Despite its high debt levels and reliance on external borrowing, the company continues to distribute monthly dividends of C$0.055 per unit, with the latest payout scheduled for August 30, 2024. However, earnings are expected to decline by an average of 24.1% annually over the next three years.

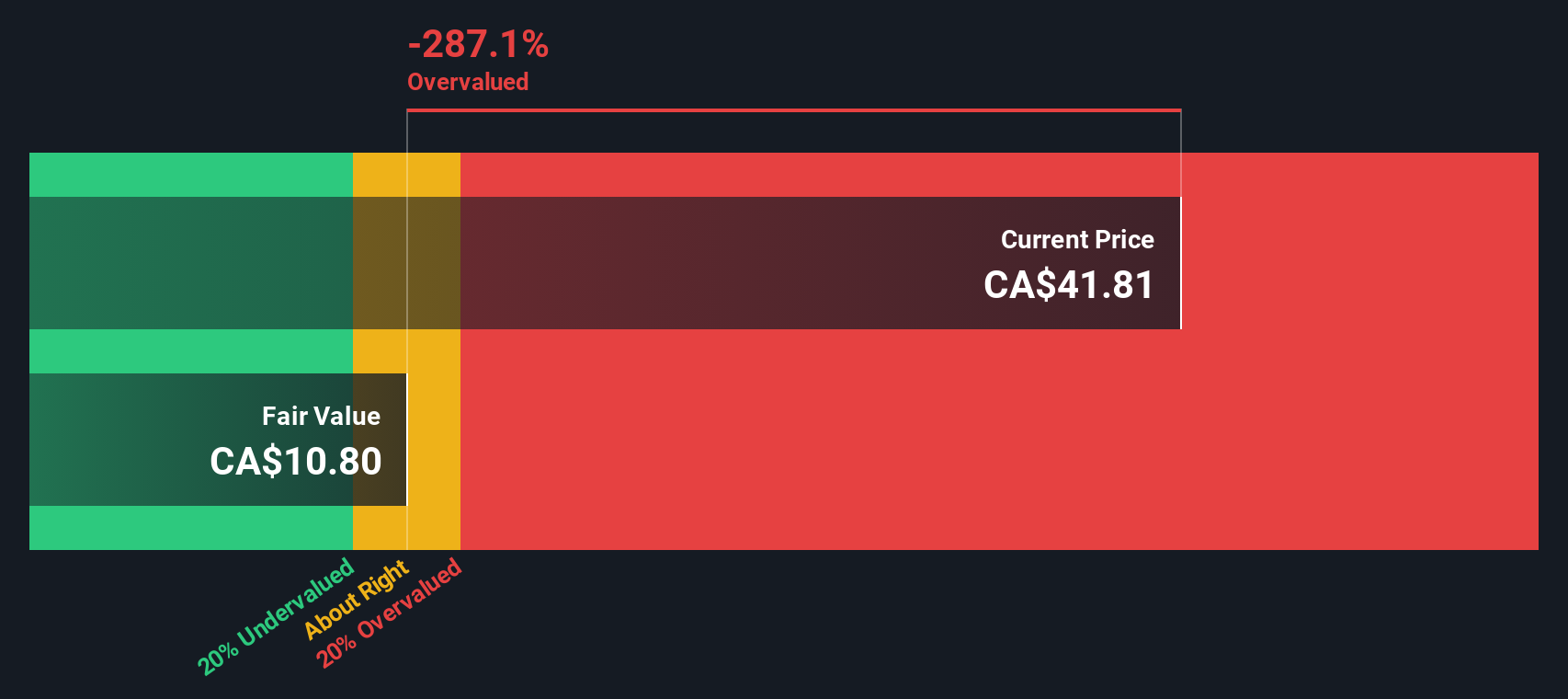

MDA Space (TSX:MDA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: MDA Space specializes in geointelligence, robotics and space operations, and satellite systems, with a market cap of CA$1.29 billion.

Operations: MDA Space generates revenue from Geointelligence, Robotics & Space Operations, and Satellite Systems. The company reported a gross profit margin of 32.41% for the latest period ending on August 15, 2024. Operating expenses include significant allocations to R&D and General & Administrative costs.

PE: 37.6x

MDA Space recently reported second-quarter sales of C$242 million, up from C$196 million the previous year, with net income rising to C$11 million. The company has raised its full-year revenue guidance to between $1.02 billion and $1.06 billion. Insider confidence is evident as Independent Chairman Brendan Paddick purchased 85,000 shares worth over C$1 million in the past year, reflecting a 7.84% increase in their holdings. The company also secured a significant $1 billion contract from the Canadian Space Agency for the Canadarm3 program, enhancing its position in commercial space robotics and technology development.

- Click to explore a detailed breakdown of our findings in MDA Space's valuation report.

Review our historical performance report to gain insights into MDA Space's's past performance.

Where To Now?

- Reveal the 28 hidden gems among our Undervalued TSX Small Caps With Insider Buying screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CHE.UN

Chemtrade Logistics Income Fund

Offers industrial chemicals and services in Canada, the United States, and South America.

Undervalued moderate and pays a dividend.