Stock Analysis

- Canada

- /

- Metals and Mining

- /

- TSX:CG

Exploring June 2024's Undervalued Small Caps With Insider Actions

Reviewed by Simply Wall St

As the broader Canadian market responds to a moderated inflation environment and anticipatory central bank policies, small-cap stocks in Canada present a unique landscape for potential value. Given the current economic indicators and rate adjustments, understanding the intrinsic qualities that define promising small-cap stocks becomes crucial for investors looking to capitalize on these conditions.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Dundee Precious Metals | 8.2x | 2.8x | 46.22% | ★★★★★★ |

| Nexus Industrial REIT | 2.3x | 2.8x | 19.44% | ★★★★★☆ |

| Calfrac Well Services | 2.2x | 0.2x | 2.88% | ★★★★★☆ |

| Primaris Real Estate Investment Trust | 11.4x | 3.0x | 35.33% | ★★★★★☆ |

| Guardian Capital Group | 10.4x | 4.0x | 32.16% | ★★★★☆☆ |

| Sagicor Financial | 1.2x | 0.4x | -95.64% | ★★★★☆☆ |

| Westshore Terminals Investment | 14.1x | 3.8x | 1.89% | ★★★☆☆☆ |

| Gear Energy | 18.7x | 1.3x | 33.08% | ★★★☆☆☆ |

| Freehold Royalties | 15.1x | 6.5x | 48.34% | ★★★☆☆☆ |

| AutoCanada | 11.5x | 0.1x | -122.38% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Centerra Gold (TSX:CG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Centerra Gold is a gold mining company with operations primarily focused on extracting molybdenum and gold, particularly from its Mount Milligan mine, and has a market capitalization of approximately $1.17 billion.

Operations: In 2023, the company reported a revenue of $963.24 million and a net loss of $182.59 million, with a gross profit margin of 23.70%. Over the past year, cost of goods sold was $734.97 million while operating expenses totaled $294.88 million.

PE: 25.6x

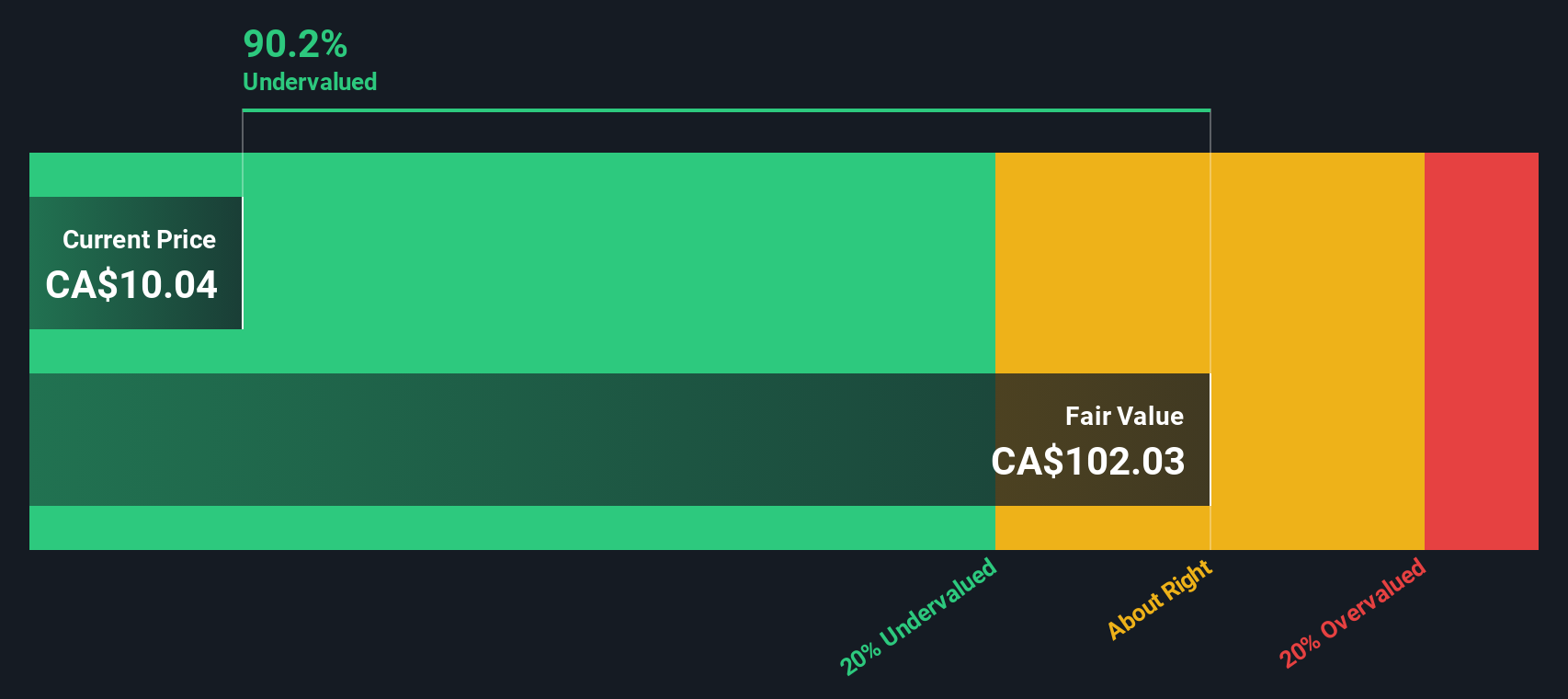

Centerra Gold, reflecting a solid financial rebound, reported a significant earnings turnaround with first-quarter sales soaring to US$305.88 million from US$226.53 million year-over-year and net income hitting US$66.43 million compared to a previous loss of US$73.45 million. This resurgence is underscored by robust production forecasts for 2024, targeting 370–410 koz of gold and 55-65 Mlbs of copper. Adding to investor confidence, insiders recently purchased shares under the buyback program announced in November 2023, totaling 2,145,300 shares for US$12.1 million by March end. The firm also sustains shareholder returns with a consistent quarterly dividend set at CAD 0.07 per share due in June.

- Unlock comprehensive insights into our analysis of Centerra Gold stock in this valuation report.

Assess Centerra Gold's past performance with our detailed historical performance reports.

Chemtrade Logistics Income Fund (TSX:CHE.UN)

Simply Wall St Value Rating: ★★★★★★

Overview: Chemtrade Logistics Income Fund operates in the chemical manufacturing sector, focusing on electrochemicals and sulphur and water chemicals, with a market capitalization of approximately CA$0.74 billion.

Operations: EC and SWC segments collectively generated CA$1.80 billion in revenue, with a notable gross profit margin of 22.76% as of the latest reported period. The company's cost of goods sold was approximately CA$1.43 billion during the same timeframe.

PE: 5.1x

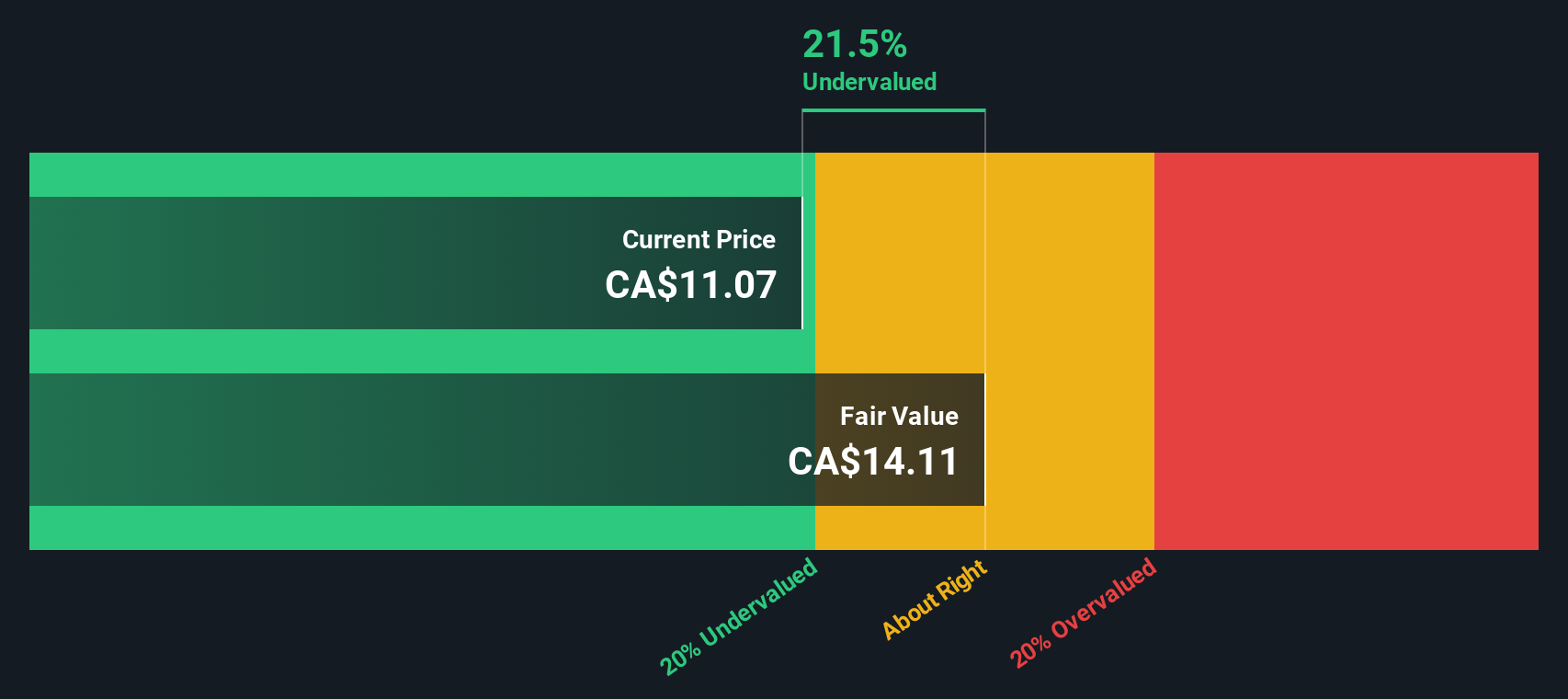

Chemtrade Logistics Income Fund, grappling with a high debt level and a forecasted earnings decline of 24.1% annually over the next three years, still demonstrates resilience through consistent monthly cash distributions, recently affirming a $0.055 per unit for June 2024. Notably, the firm announced a significant share repurchase program on May 15, aiming to buy back nearly 10% of its shares by mid-2025—reflecting insider confidence in the company's prospects despite current financial challenges. This move underscores their commitment to enhancing shareholder value and suggests potential for recalibration and growth ahead.

Dundee Precious Metals (TSX:DPM)

Simply Wall St Value Rating: ★★★★★★

Overview: Dundee Precious Metals is a gold mining company with operations at Ada Tepe and Chelopech, boasting a market capitalization of approximately $1.10 billion.

Operations: Ada Tepe and Chelopech generated revenues of $243.33 million and $274.18 million respectively, reflecting the company's diversified revenue streams across multiple mining operations. The gross profit margin has shown significant fluctuations, with a notable increase to 0.53 in the most recent period from 0.32 five years ago, indicating a potential improvement in operational efficiency or market conditions favorable to the company's product mix.

PE: 8.2x

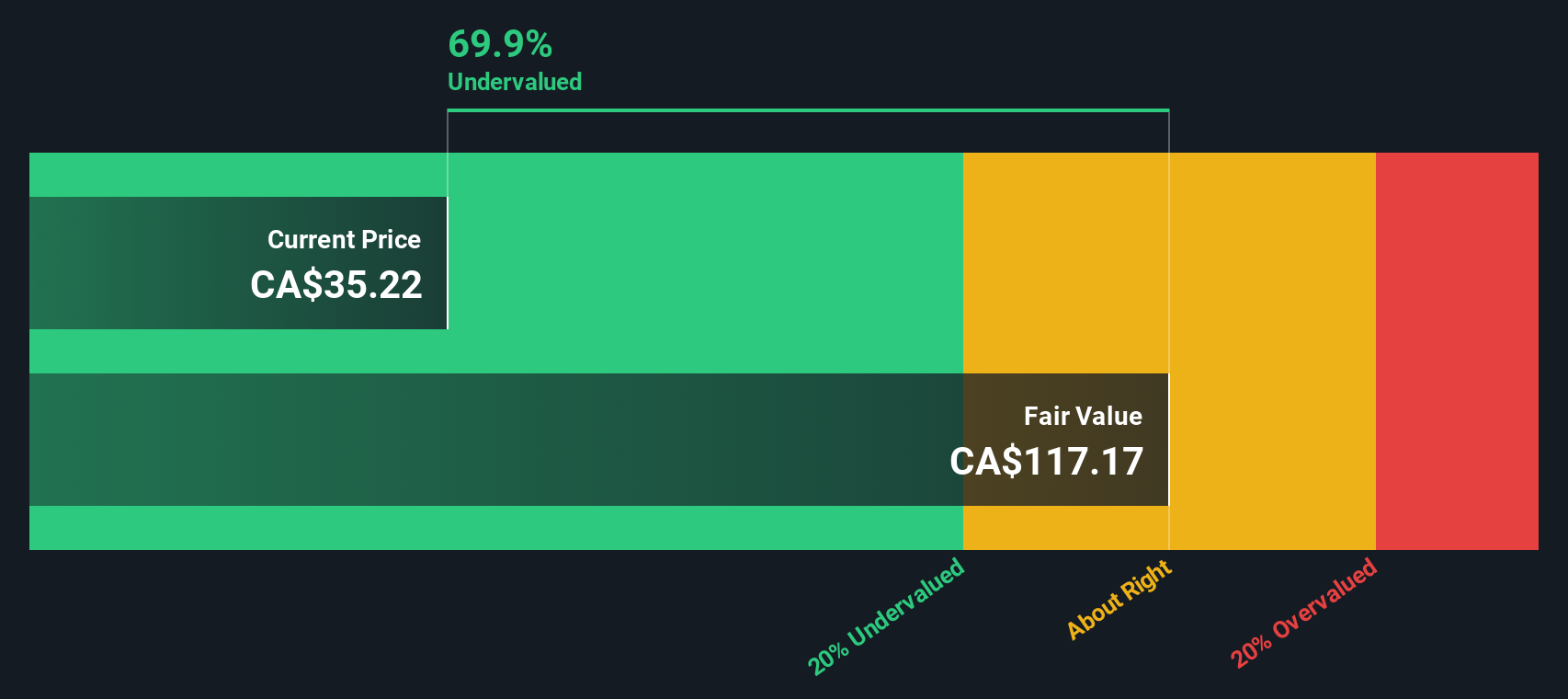

Dundee Precious Metals, a lesser-known yet intriguing player in the Canadian mining sector, recently underscored its growth prospects with the appointment of W. John DeCooman Jr. as Executive Vice President, leveraging his extensive industry experience. Despite a slight dip in Q1 2024 earnings to US$45.74 million from US$46.6 million year-over-year, the company maintains robust production guidance for 2024 and continues to invest in high-potential projects like Coka Rakita in Serbia. This project alone showcases promising economics with expected strong margins based on current gold prices, enhancing Dundee's strategic position within Eastern Europe's mining landscape. Notably reflecting insider confidence, recent months saw significant share purchases by insiders, signaling their belief in the company’s undervalued status and future potential.

Summing It All Up

- Click this link to deep-dive into the 32 companies within our Undervalued TSX Small Caps With Insider Buying screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Centerra Gold is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CG

Centerra Gold

A gold mining company, engages in the acquisition, exploration, development, and operation of gold and copper properties in North America, Turkey, and internationally.

Flawless balance sheet average dividend payer.