- Canada

- /

- Metals and Mining

- /

- TSX:CG

Did Centerra Gold’s (TSX:CG) Q3 Profit Surge and Board Shift Signal a New Growth Trajectory?

Reviewed by Sasha Jovanovic

- Centerra Gold Inc. recently reported third-quarter 2025 results, highlighting a jump in sales to US$395.16 million and net income to US$292.19 million, while also announcing a quarterly dividend of C$0.07 per share and confirming a leadership transition on its Board of Directors effective January 2026.

- An extraordinary gain contributed to the margin uplift this quarter, as the company continues to pursue self-funded growth initiatives across its operating mines despite lower year-on-year gold and copper output.

- We’ll now explore how Centerra Gold’s sharp increase in net income this quarter impacts its investment narrative of self-funded growth and efficiency.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Centerra Gold Investment Narrative Recap

To be a shareholder in Centerra Gold, you generally need to believe in the company’s ability to convert its extensive growth pipeline and operational improvements into consistent, self-funded growth, despite industry-wide cost pressures and fluctuating gold output. The recent surge in net income, driven by an extraordinary gain, doesn’t materially change the most important short-term catalyst, the successful extension and optimization of Mount Milligan, and does little to mitigate persistent risks from ore grade uncertainty and high all-in sustaining costs.

Among the recent announcements, the Board’s approval of a quarterly dividend stands out. Even with significant one-off earnings, the continuation of dividend payments signals a commitment to returning value to shareholders, aligning with the company’s focus on capital management during a period shaped by the need for robust, predictable cash flows to fund ongoing project development.

However, investors should keep in mind that despite strong results, ongoing variability in gold output at Mount Milligan remains a critical concern for...

Read the full narrative on Centerra Gold (it's free!)

Centerra Gold's narrative projects $1.6 billion in revenue and $106.3 million in earnings by 2028. This requires 9.2% yearly revenue growth and a $31 million earnings increase from the current $75.3 million.

Uncover how Centerra Gold's forecasts yield a CA$16.59 fair value, in line with its current price.

Exploring Other Perspectives

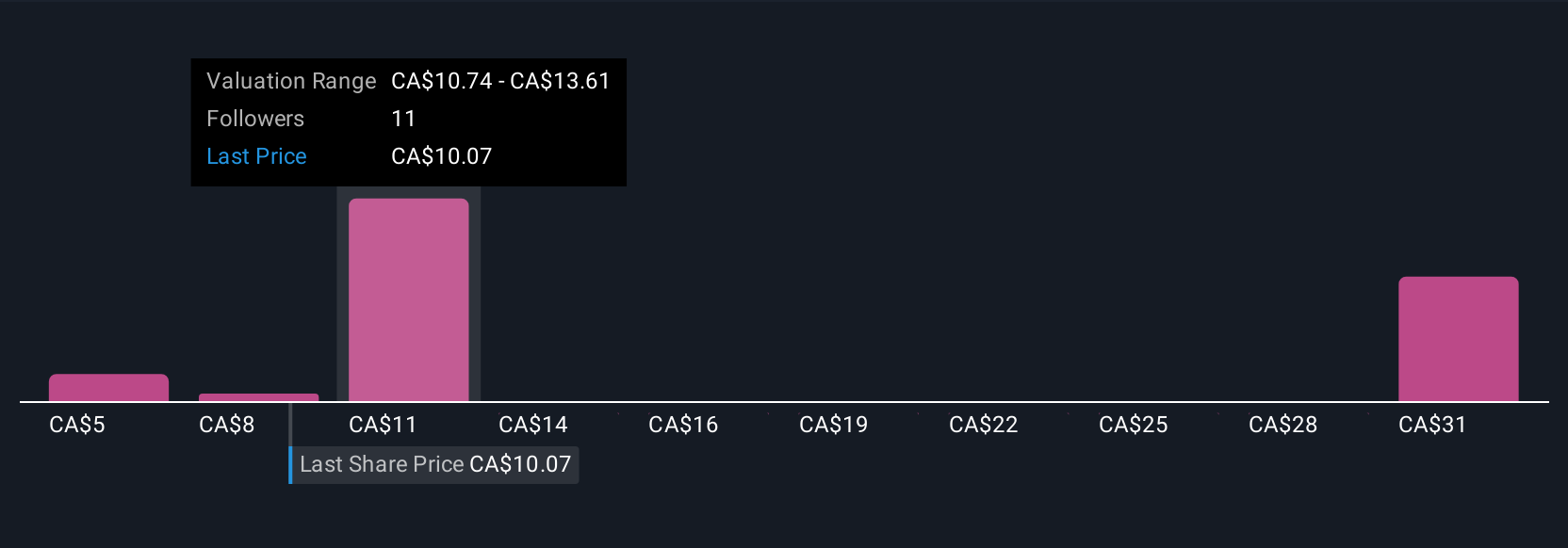

Eight fair value estimates from the Simply Wall St Community span a wide C$7.07 to C$82.50 range. While some see substantial upside, unresolved challenges in sustaining predictable production at Mount Milligan remain central to future performance, explore more views and see how your outlook compares.

Explore 8 other fair value estimates on Centerra Gold - why the stock might be worth less than half the current price!

Build Your Own Centerra Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centerra Gold research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Centerra Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centerra Gold's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CG

Centerra Gold

Engages in the acquisition, exploration, development, and operation of gold and copper properties in North America, Turkey, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives