- Canada

- /

- Metals and Mining

- /

- TSX:CG

Can Centerra Gold’s Stock Rally Continue After Major Expansion Announcement?

Reviewed by Bailey Pemberton

- Ever wondered if Centerra Gold is truly a bargain, or if you might be catching the stock just as it takes off? You are not alone in wanting to know whether it is time to jump in, hold, or wait for a better entry point.

- Shares have surged impressively, climbing 6.7% over the last week, up 13.1% in the last month, and delivering a staggering 119% year-to-date return. This kind of run grabs attention and raises questions about whether the rally can last.

- Fueling this momentum, Centerra Gold recently announced a major expansion project at one of its core mining sites. The company also provided updates on environmental permitting that have reassured investors about long-term growth and operational stability. These developments sent a clear signal to the market and added confidence to the company’s outlook.

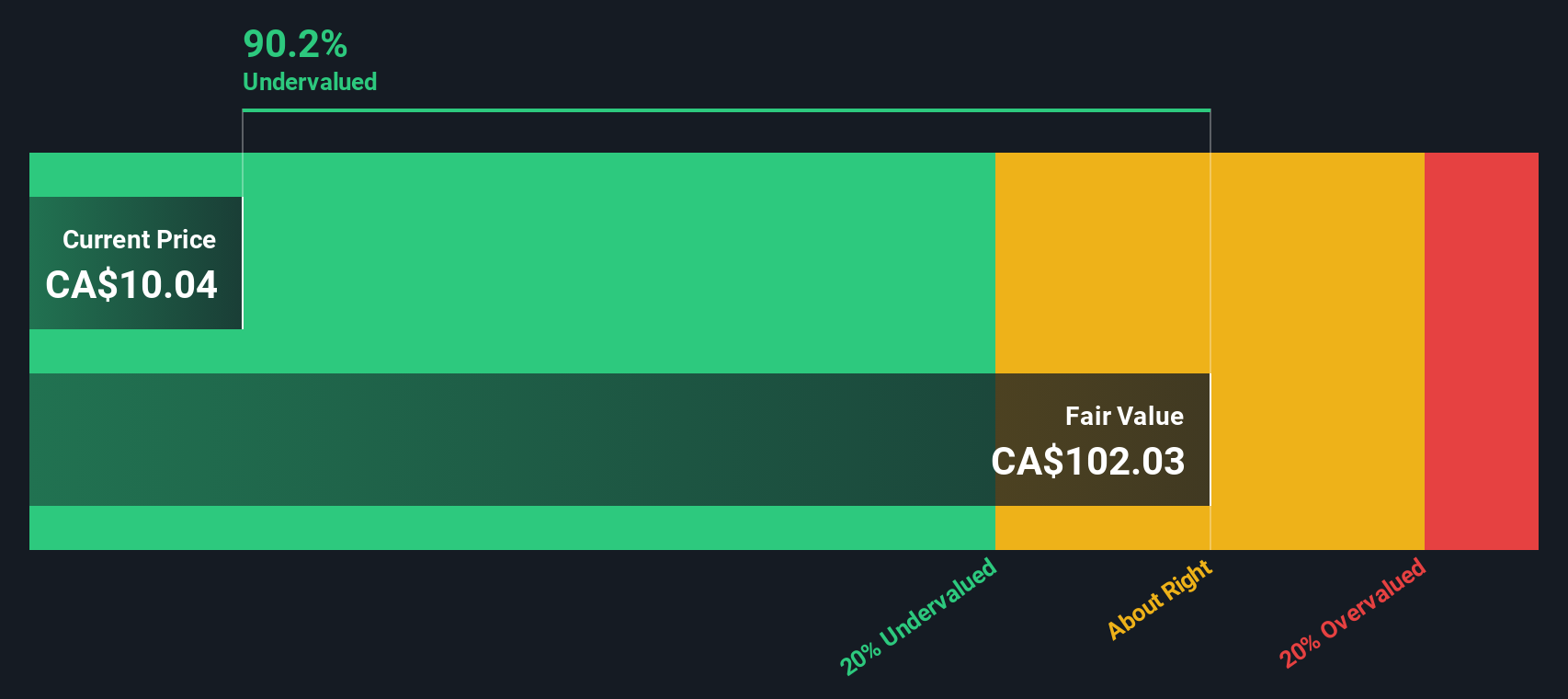

- According to our valuation checks, Centerra Gold scores a 5 out of 6 for being undervalued, suggesting it could still offer room for upside. We will break down the usual valuation methods next, so keep reading for a fresh perspective on valuing the stock that goes beyond the numbers.

Approach 1: Centerra Gold Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common way to estimate a company’s intrinsic value by projecting its future cash flows and then discounting them to today’s value. For Centerra Gold, this model relies on forecasts for Free Cash Flow (FCF), which essentially reflects the cash that could be returned to shareholders after all expenses and investments.

Centerra Gold’s latest reported Free Cash Flow was $171.4 million, and analysts forecast this figure will steadily climb, with an estimate of $217.4 million in 2027. Beyond that, cash flows are projected to continue rising for the next decade, reaching over $318 million by 2035. It is important to note that while cash flow estimates up to five years are provided directly by analysts, longer-term projections are extrapolated using reasoned assumptions.

Using these projections, the DCF model calculates an estimated fair value of $38.34 per share. Compared to Centerra Gold’s current share price, this implies the stock is trading at a 51.5% discount to its intrinsic value. This suggests there could be potential upside for investors who are comfortable with the assumptions behind long-term cash flow forecasting.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Centerra Gold is undervalued by 51.5%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Centerra Gold Price vs Earnings

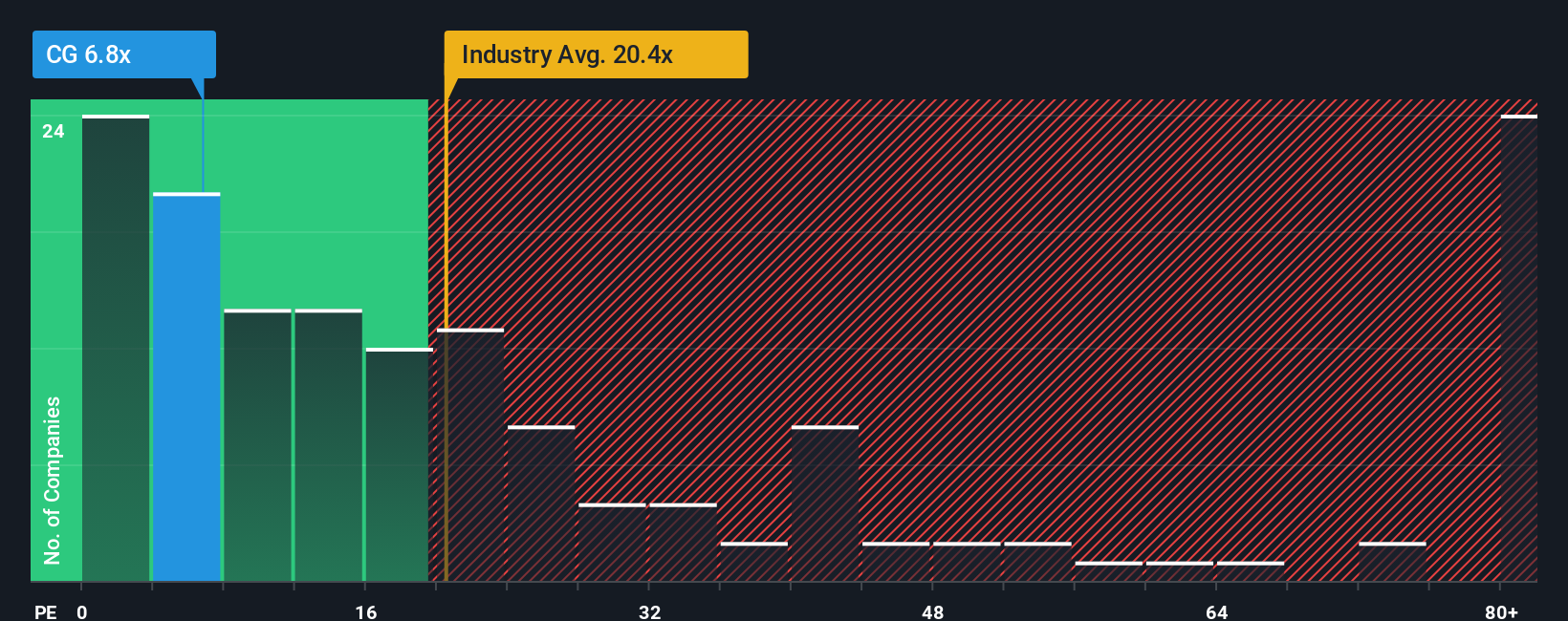

For profitable companies like Centerra Gold, the Price-to-Earnings (PE) ratio is a widely used and effective valuation measure. It tells investors how much they are paying for each dollar of earnings, making it particularly relevant for a business consistently generating profits. The "right" PE ratio is influenced by expectations of future earnings growth and the risks the company faces. Faster-growing and lower-risk companies typically command higher PE ratios, while those with more uncertainty or slower growth tend to trade at lower multiples.

Centerra Gold currently trades at a PE of 7.9x, which stands out when compared to both the Metals and Mining industry average of 20.6x and a peer group average of 24.0x. This immediate comparison suggests Centerra Gold may be trading at a discount to its sector. However, simple comparisons can sometimes be misleading as they do not take into account key details like profitability, growth outlook, and risks unique to the company.

This is where Simply Wall St's "Fair Ratio" comes in. The Fair Ratio is a proprietary metric that identifies the most reasonable PE multiple for a company by factoring in growth prospects, industry, profit margins, market cap, and risks. This makes it a much more tailored benchmark than just looking at peers or the industry in isolation. For Centerra Gold, the Fair Ratio is calculated to be 12.2x. Comparing this to the company’s current PE ratio of 7.9x suggests the stock is trading below what would be expected for a business with Centerra Gold’s profile, even after accounting for key risk and growth factors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

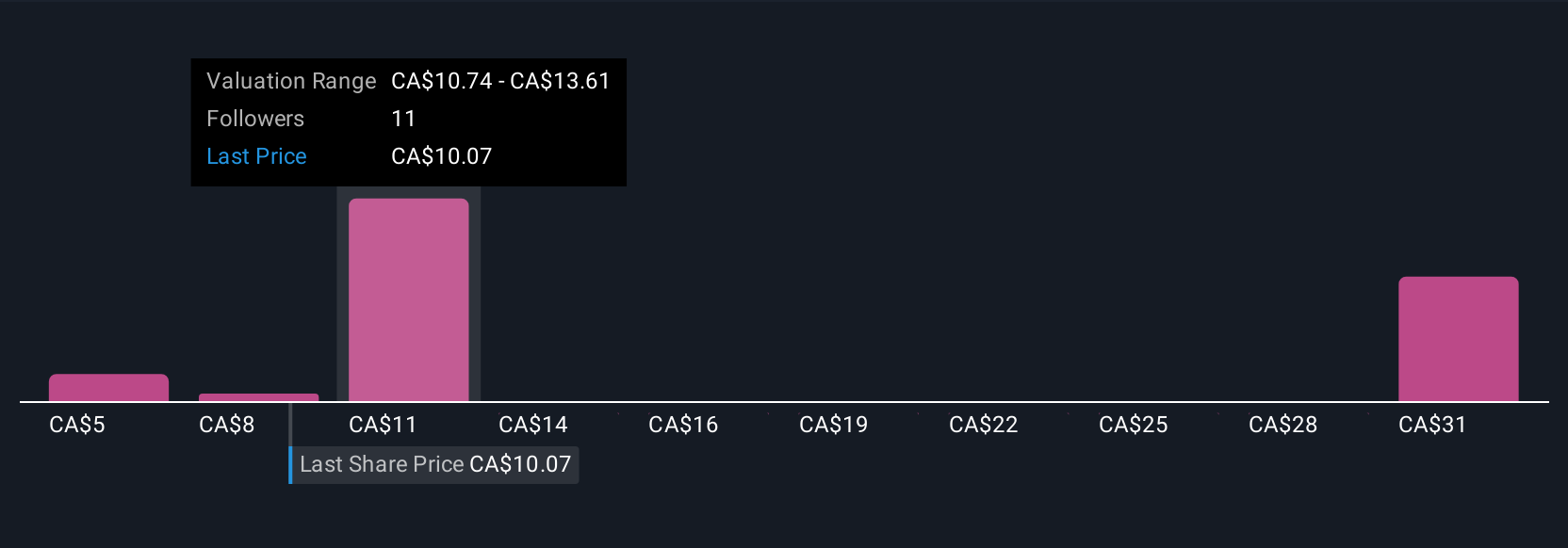

Upgrade Your Decision Making: Choose your Centerra Gold Narrative

Earlier, we mentioned there's an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your perspective or story about a company like Centerra Gold, combining what you believe will happen, such as future revenue, earnings, and margin changes, with what that means for its fair value. Narratives connect the company’s real-world story to financial forecasts and distill it all into an easy-to-interpret fair value estimate. On Simply Wall St’s Community page, used by millions of investors, you can build or follow Narratives with just a few clicks and see how others are viewing the stock.

Narratives allow you to make smarter decisions by comparing your fair value to the current market price and seeing if the stock is a buy or a hold, based not just on numbers, but on the reasoning behind them. As new earnings or news come in, Narratives are updated automatically, so your view always reflects the latest developments and consensus. For example, one investor may see Centerra Gold’s future earnings reaching $350 million and a target price near CA$14.86, while another expects just $52 million in earnings and a target as low as CA$9.48, showing how Narratives turn forecasts into actionable, personalized insights.

Do you think there's more to the story for Centerra Gold? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CG

Centerra Gold

Engages in the acquisition, exploration, development, and operation of gold and copper properties in North America, Turkey, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026