- Canada

- /

- Real Estate

- /

- TSX:CIGI

TSX Value Stocks Including Boyd Group Services That May Be Priced Below Intrinsic Estimates

Reviewed by Simply Wall St

As the Canadian market navigates through potential volatility due to trade uncertainties and emerging credit concerns, investors are encouraged to view any pullbacks as opportunities rather than threats. In such a landscape, identifying stocks that may be undervalued compared to their intrinsic estimates can be particularly advantageous, especially when these companies demonstrate strong fundamentals and potential for growth amidst broader economic resilience.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vitalhub (TSX:VHI) | CA$10.56 | CA$18.87 | 44% |

| Timbercreek Financial (TSX:TF) | CA$7.21 | CA$11.41 | 36.8% |

| Savaria (TSX:SIS) | CA$21.86 | CA$41.14 | 46.9% |

| Magellan Aerospace (TSX:MAL) | CA$17.14 | CA$28.26 | 39.4% |

| Haivision Systems (TSX:HAI) | CA$5.10 | CA$8.28 | 38.4% |

| Boyd Group Services (TSX:BYD) | CA$213.91 | CA$359.40 | 40.5% |

| Bird Construction (TSX:BDT) | CA$30.05 | CA$57.06 | 47.3% |

| Artemis Gold (TSXV:ARTG) | CA$34.10 | CA$64.03 | 46.7% |

| Aritzia (TSX:ATZ) | CA$94.81 | CA$160.43 | 40.9% |

| Americas Gold and Silver (TSX:USA) | CA$5.88 | CA$9.84 | 40.2% |

Let's explore several standout options from the results in the screener.

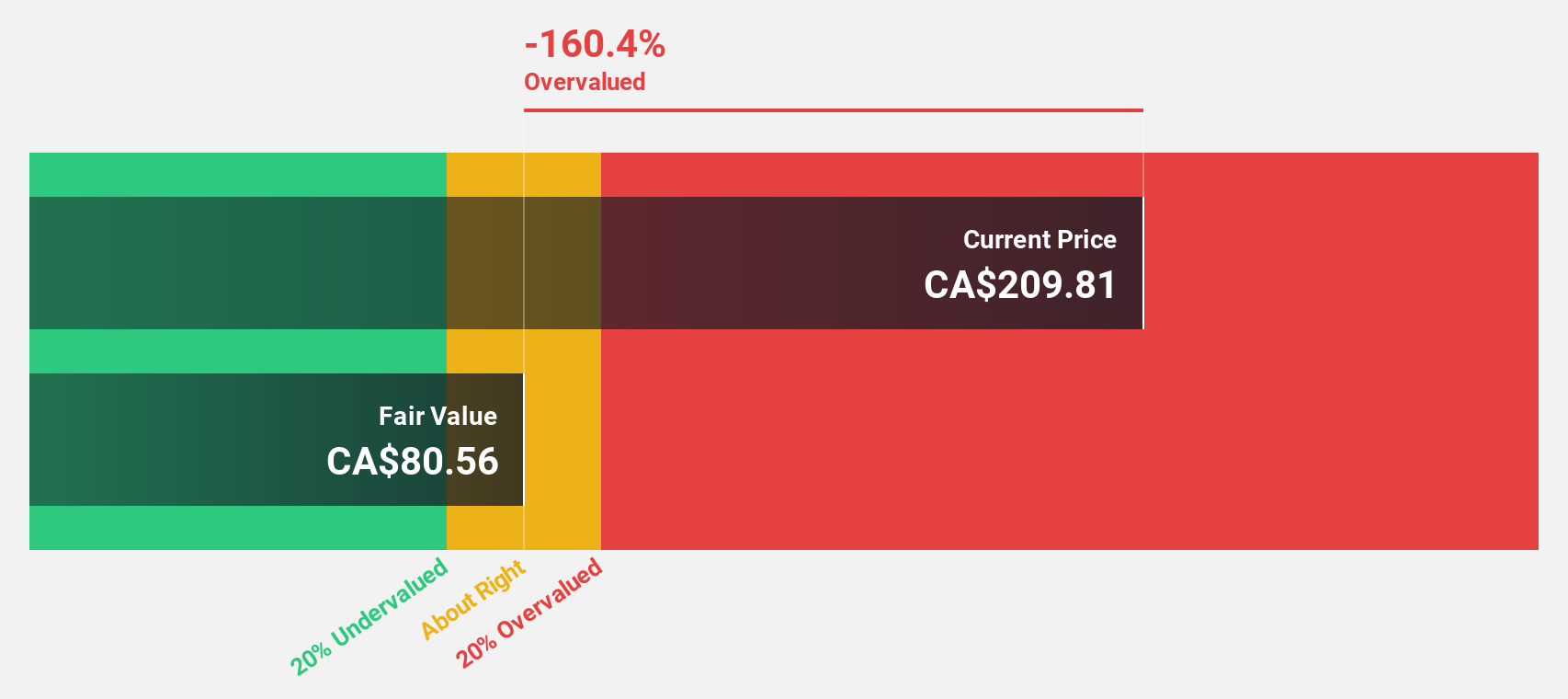

Boyd Group Services (TSX:BYD)

Overview: Boyd Group Services Inc. operates non-franchised collision repair centers across North America and has a market cap of CA$4.62 billion.

Operations: The company generates revenue of $3.06 billion from automotive collision repair and related services in North America.

Estimated Discount To Fair Value: 40.5%

Boyd Group Services is trading at CA$213.91, significantly below its estimated fair value of CA$359.4, suggesting it may be undervalued based on cash flows. Despite a challenging financial position with low profit margins and interest coverage issues, earnings are expected to grow significantly at over 80% annually. Recent debt financing of CAD 275 million aims to improve financial flexibility, although one-off items have impacted earnings quality.

- Our comprehensive growth report raises the possibility that Boyd Group Services is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Boyd Group Services' balance sheet health report.

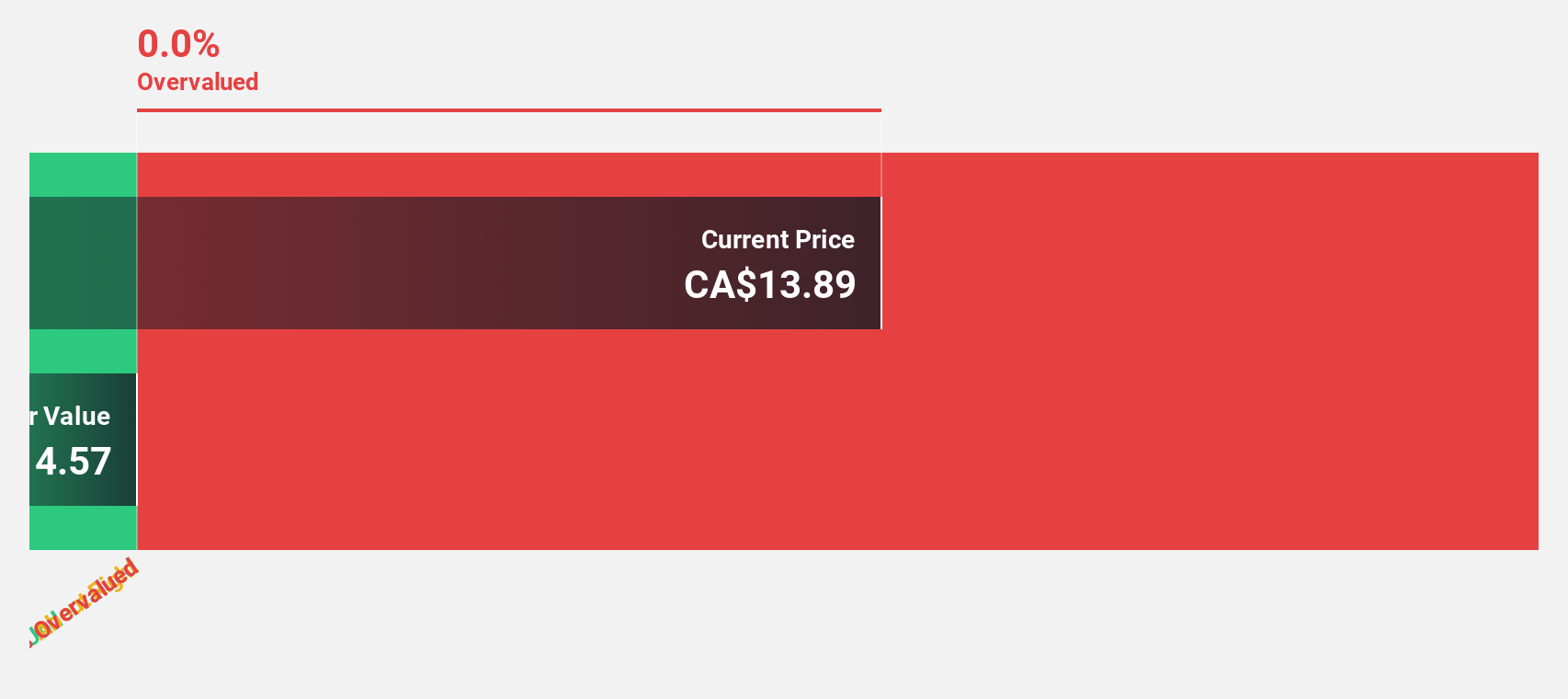

Canfor (TSX:CFP)

Overview: Canfor Corporation is an integrated forest products company operating in the United States, Asia, Canada, Europe, and internationally with a market cap of CA$1.43 billion.

Operations: The company's revenue is primarily derived from its Lumber segment at CA$4.66 billion and its Pulp & Paper segment at CA$730.40 million.

Estimated Discount To Fair Value: 35.4%

Canfor is trading at CA$12.46, significantly below its estimated fair value of CA$19.3, indicating undervaluation based on cash flows. Despite recent losses—CA$202.8 million in Q2 2025—earnings are forecast to grow substantially by 73.33% annually, with profitability expected within three years, surpassing market growth rates. Analysts anticipate a price increase of 27.3%. However, revenue growth at 4.9% annually is slower than desired and return on equity remains low at a forecasted 10.8%.

- The growth report we've compiled suggests that Canfor's future prospects could be on the up.

- Navigate through the intricacies of Canfor with our comprehensive financial health report here.

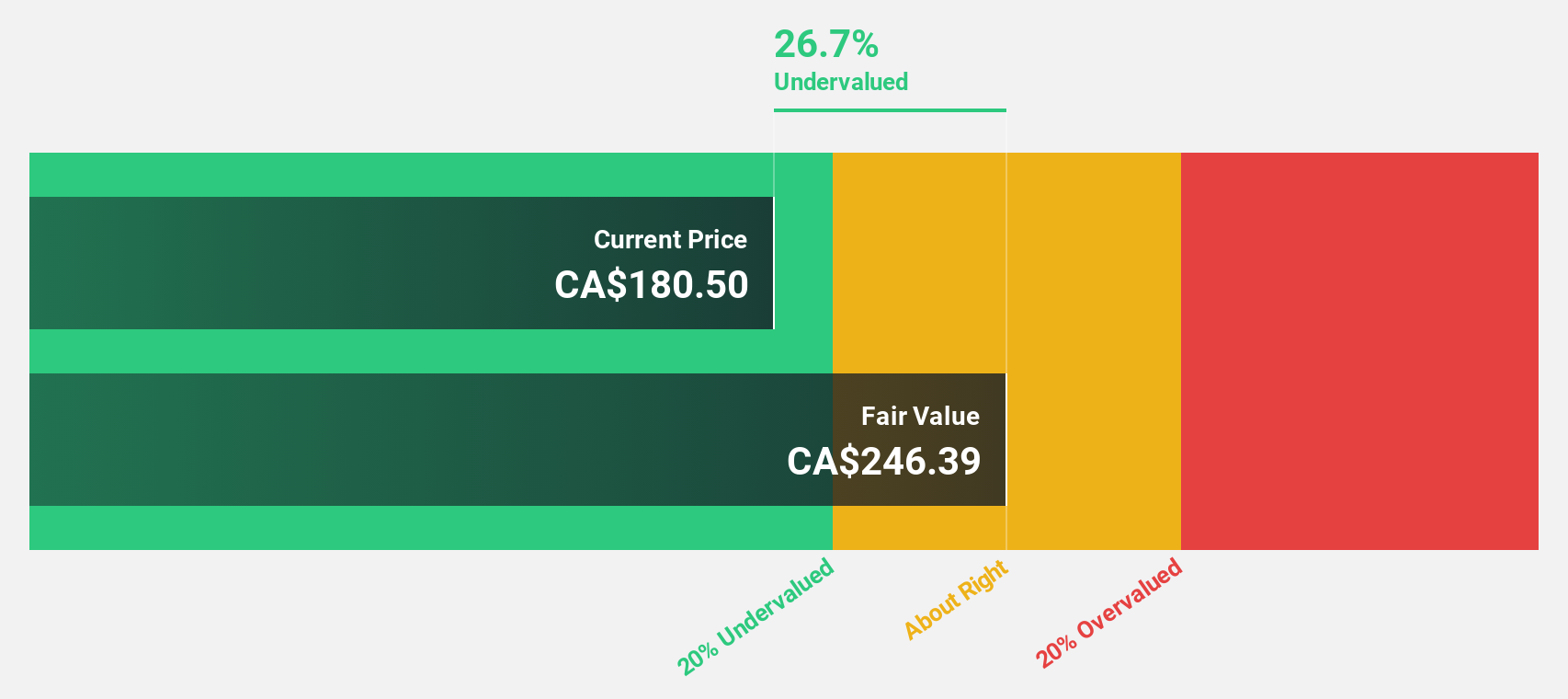

Colliers International Group (TSX:CIGI)

Overview: Colliers International Group Inc. is a global provider of commercial real estate services to corporate and institutional clients across various regions, with a market cap of CA$11.60 billion.

Operations: The company's revenue is primarily derived from Real Estate Services ($3.10 billion), Engineering ($1.55 billion), and Investment Management ($516.36 million).

Estimated Discount To Fair Value: 24.9%

Colliers International Group is trading at CA$236.32, significantly below its fair value estimate of CA$314.82, highlighting potential undervaluation based on cash flows. Despite a decline in profit margins to 2.2% from 3.2%, earnings are expected to grow significantly by 27.17% annually, outpacing the Canadian market's growth rate of 12.2%. However, the company's debt coverage by operating cash flow remains a concern amidst these positive growth forecasts and recent strategic expansions like HS Private Wealth's launch.

- Our earnings growth report unveils the potential for significant increases in Colliers International Group's future results.

- Delve into the full analysis health report here for a deeper understanding of Colliers International Group.

Make It Happen

- Embark on your investment journey to our 24 Undervalued TSX Stocks Based On Cash Flows selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CIGI

Colliers International Group

Provides commercial real estate to corporate and institutional clients in the United States, Canada, Europe, Australia, the United Kingdom, Poland, China, India, and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives