- Canada

- /

- Paper and Forestry Products

- /

- TSX:CFP

Should Canfor's (TSX:CFP) Narrowing Losses on Modest Sales Growth Influence Investor Decisions?

Reviewed by Sasha Jovanovic

- Canfor Corporation recently reported its third quarter and nine-month earnings for 2025, disclosing sales of C$1,259.8 million and a net loss of C$172.4 million for the quarter, with reduced losses compared to the prior year.

- An interesting highlight is that both quarterly and nine-month net losses narrowed materially despite only modest sales growth year-over-year, suggesting progress on cost control or operational efficiency.

- To explore how reduced losses amid rising sales shapes Canfor's investment narrative, we'll examine the implications of these earnings results.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Canfor's Investment Narrative?

To be a long-term shareholder in Canfor requires conviction that its operational changes and focus on cost control can create a path to profitability, despite ongoing industry challenges and recent unprofitability. The latest quarterly update, showing a narrowing net loss alongside only slight revenue growth, signals possible momentum toward better margins, but this shift is still emerging and remains tenuous. These results may influence investor sentiment on key short-term catalysts like successful restructuring, smooth leadership transition with the new CEO, and execution of planned facility investments. However, given Canfor’s production cuts, sawmill closures, and the broader weakness shown in its year-to-date total returns, the risk profile remains heightened, especially related to demand volatility, soft product pricing, and high sensitivity to North American lumber markets. While recent earnings mark a step forward, most fundamental risks and near-term uncertainties still hold weight.

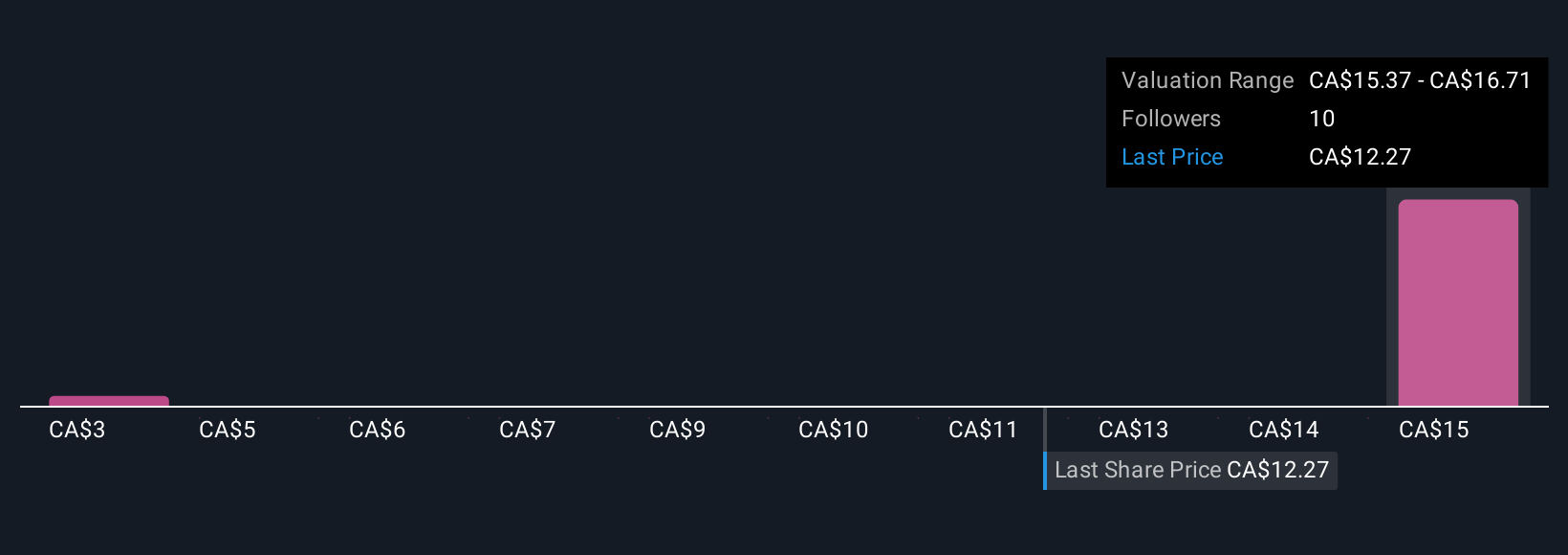

But with ongoing mill closures, supply challenges are a concern investors shouldn’t overlook. Despite retreating, Canfor's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on Canfor - why the stock might be worth less than half the current price!

Build Your Own Canfor Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canfor research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Canfor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canfor's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CFP

Canfor

Operates as an integrated forest products company in the United States, Asia, Canada, Europe, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives