Why CCL Industries (TSX:CCL.B) Is Up 10.9% After Strong Q3 Results and C$100M Buyback Completion

Reviewed by Sasha Jovanovic

- CCL Industries recently reported third quarter results, posting sales of C$1.97 billion and net income of C$210.8 million, along with affirming its quarterly dividend and completing a C$100 million share buyback tranche.

- Quarterly sales and earnings grew year over year, while the company continued cash returns to shareholders through dividends and buybacks, reflecting operational execution and active capital management.

- We'll explore how the combination of stronger quarterly earnings and substantial buybacks informs CCL Industries' investment case going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

CCL Industries Investment Narrative Recap

To see CCL Industries as a potential holding, an investor needs confidence in the company’s ability to grow earnings through operational discipline, product innovation, and global expansion despite a mature industry backdrop. The recent third quarter results, marked by higher sales, earnings growth, and a continuation of shareholder-friendly actions, support the key near-term catalyst of steady demand for smart labeling solutions, while the major risk remains margin pressure from cost competition and regulatory change; this news does not materially shift the risk balance or the investment thesis in the short run.

The most relevant recent announcement is the completion of a C$100 million share buyback tranche, highlighting CCL’s disciplined capital return policy. This visible commitment to returning capital complements the strong quarterly earnings, supporting the catalyst of shareholder value creation even as the company manages investments in innovation and sustainability.

However, the challenges from evolving regulatory pressures on plastics and required investment in eco-friendly packaging remain information investors should be aware of if ...

Read the full narrative on CCL Industries (it's free!)

CCL Industries' narrative projects CA$8.5 billion revenue and CA$891.0 million earnings by 2028. This requires 4.1% yearly revenue growth and a CA$99.0 million earnings increase from CA$792.0 million.

Uncover how CCL Industries' forecasts yield a CA$92.70 fair value, a 6% upside to its current price.

Exploring Other Perspectives

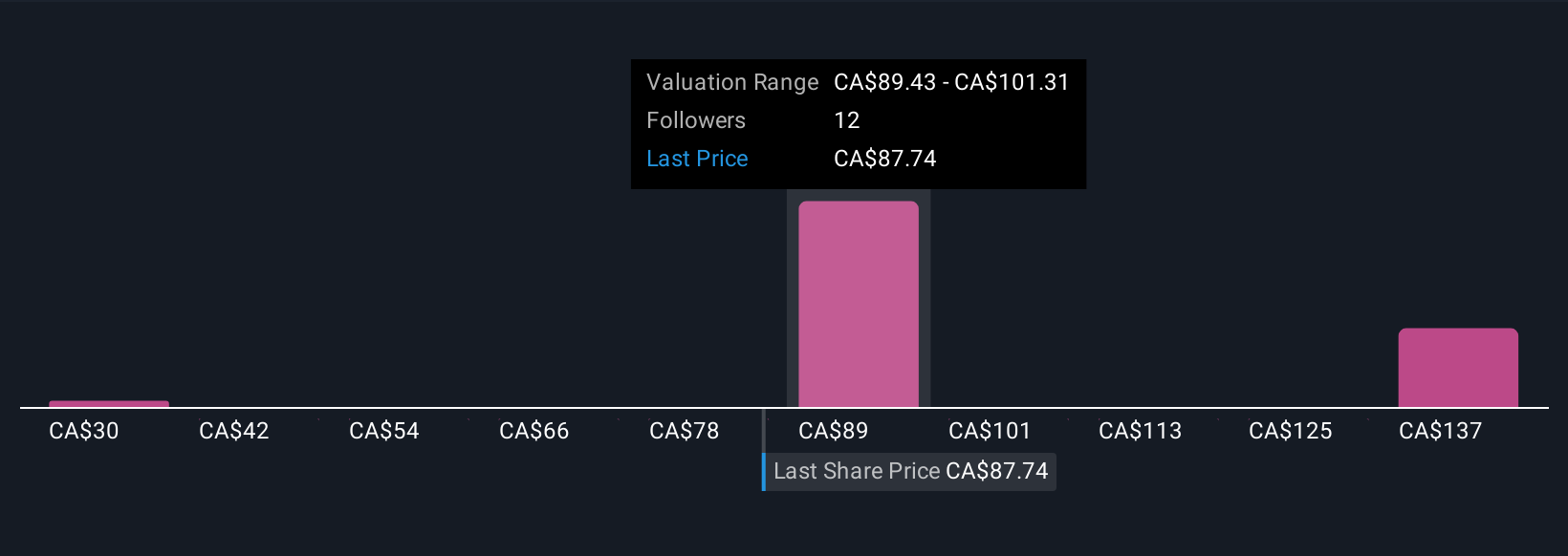

Simply Wall St Community fair value estimates for CCL Industries range from C$30 to C$145, based on three individual analyses. While opinions differ widely, the ongoing pressure from regulatory changes and sustainability initiatives continues to shape the company’s path and warrants a closer look at future growth assumptions.

Explore 3 other fair value estimates on CCL Industries - why the stock might be worth less than half the current price!

Build Your Own CCL Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CCL Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CCL Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CCL Industries' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCL.B

CCL Industries

Manufactures and sells labels, consumer printable media products, technology-driven label solutions, polymer banknote substrates, and specialty films.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives