- Canada

- /

- Metals and Mining

- /

- TSX:AYA

Aya Gold & Silver (TSX:AYA): Assessing Valuation After Record Q3 Production and Surpassing Feasibility Targets

Reviewed by Kshitija Bhandaru

Aya Gold & Silver (TSX:AYA) just released its third quarter operating results, showing record silver production and significant improvements across key operating metrics at its Zgounder Silver Mine in Morocco. The results surpassed prior expectations.

See our latest analysis for Aya Gold & Silver.

Momentum has clearly picked up for Aya Gold & Silver. The company’s 19.1% share price gain over the past month and 67.4% return year-to-date show that investors are tuning in to improving fundamentals. The 1-year total shareholder return has barely moved, but those who have held for the long term have seen a remarkable 495% total return over five years. This demonstrates Aya’s steady operational progress and market potential.

If you’re looking for more companies capturing growth and attention, now’s the perfect moment to discover fast growing stocks with high insider ownership

But after this surge in performance and share price, the key question remains: Is Aya Gold & Silver still trading at an attractive valuation, or have investors already factored in all future growth? Could there still be a buying opportunity, or is the market one step ahead?

Most Popular Narrative: 9.6% Undervalued

With the most widely followed narrative assigning a fair value of CA$20.80, Aya Gold & Silver’s last close at CA$18.80 suggests the company’s potential remains underappreciated despite its recent rally. The analysis places the focus on long-term operational and strategic strengths as key catalysts behind this price target.

Aya's exploration success at both Zgounder and Boumadine, combined with ongoing property acquisition and aggressive regional drilling programs, is poised to drive significant long-term growth in reserves and production volumes, supporting multi-year revenue and earnings expansion.

Want the inside story on how future production upgrades and bolder expansion plans are fueling ambitious profits? The valuation here hinges on bold forecasts and rapid margin improvement usually seen in sector leaders. Get the details behind these bullish projections. The numbers may surprise you.

Result: Fair Value of $20.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing operational issues or geopolitical instability in Morocco could quickly reverse Aya Gold & Silver’s recent gains and challenge the current bullish outlook.

Find out about the key risks to this Aya Gold & Silver narrative.

Another View: Is the Market Already Ahead?

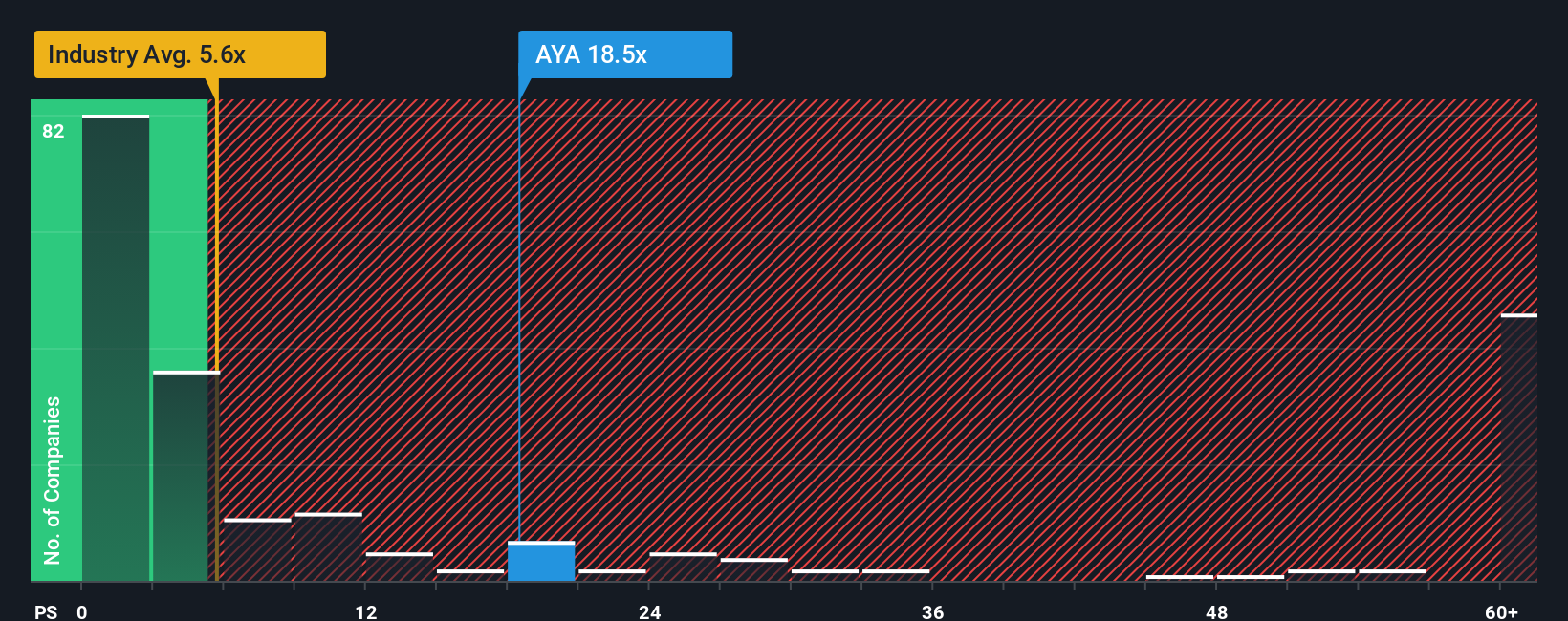

While the consensus sees Aya Gold & Silver as undervalued based on long-term growth, a look at its price-to-sales ratio tells a different story. The company trades at 20.5 times its sales, which is far above the Canadian Metals and Mining industry average of 6.3x and even higher than its fair ratio of 3.3x. This suggests that investors have already priced in much of the future optimism, leaving less room for upside unless new catalysts emerge. Are expectations running too far ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aya Gold & Silver Narrative

If you want to go beyond the consensus view and form your own perspective, you can analyze the key numbers yourself and share your take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Aya Gold & Silver.

Looking for More Investment Ideas?

Great investing means always having your finger on the pulse of fresh opportunities. Don’t let these top stock themes pass you by. There's something extraordinary waiting for every investor.

- Tap into tomorrow’s winners by reviewing these 873 undervalued stocks based on cash flows that show real value others may have missed, based on proven cash flow potential.

- Catch the momentum in tech innovation by browsing these 24 AI penny stocks, featuring companies leading the AI revolution with strong growth prospects.

- Enhance your portfolio stability by checking out these 20 dividend stocks with yields > 3% offering steady income with yields exceeding 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AYA

Aya Gold & Silver

Engages in the exploration, evaluation, and development of precious metals projects in Morocco.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives