- Canada

- /

- Metals and Mining

- /

- TSX:ASND

Some Ascendant Resources (TSE:ASND) Shareholders Have Taken A Painful 75% Share Price Drop

It's not possible to invest over long periods without making some bad investments. But really big losses can really drag down an overall portfolio. So spare a thought for the long term shareholders of Ascendant Resources Inc. (TSE:ASND); the share price is down a whopping 75% in the last three years. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And over the last year the share price fell 35%, so we doubt many shareholders are delighted. Even worse, it's down 25% in about a month, which isn't fun at all.

Check out our latest analysis for Ascendant Resources

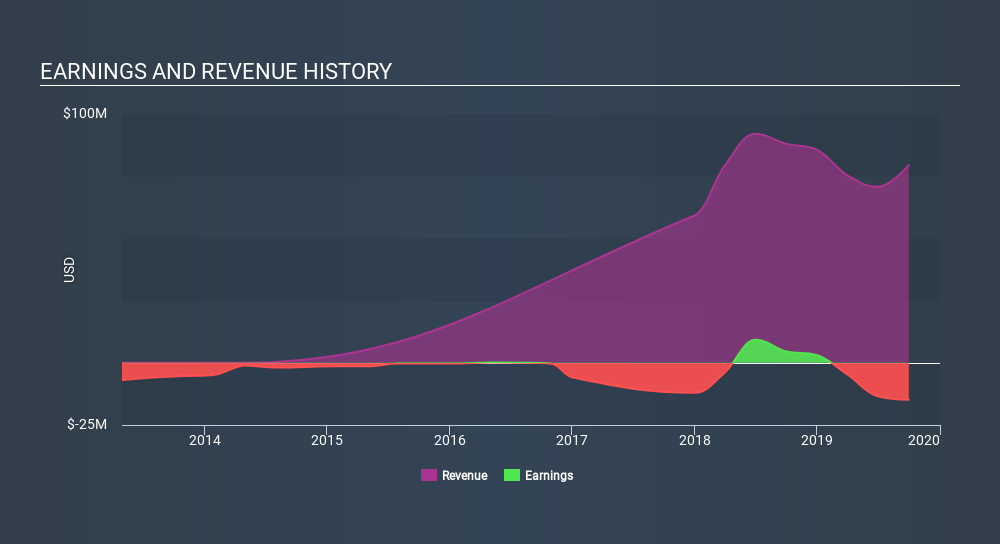

Given that Ascendant Resources didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Ascendant Resources's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 11% in the last year, Ascendant Resources shareholders lost 35%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 3.7%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Ascendant Resources has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:ASND

Ascendant Resources

Explores and develops mineral properties in Portugal.

Medium-low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives