- Canada

- /

- Metals and Mining

- /

- TSX:ASM

TSX Value Picks Featuring Avino Silver & Gold Mines And Two More Stocks Trading Below Estimated Worth

Reviewed by Simply Wall St

As Canadian and U.S. stocks continue to reach new highs, buoyed by trade optimism and solid corporate earnings, investors are navigating a landscape of elevated valuations and potential volatility. In this environment, identifying undervalued stocks that offer quality and diversification becomes crucial; Avino Silver & Gold Mines along with two other Canadian stocks present intriguing opportunities for those seeking value amid the market's steady ascent.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| West Fraser Timber (TSX:WFG) | CA$98.36 | CA$165.39 | 40.5% |

| Trisura Group (TSX:TSU) | CA$44.38 | CA$86.93 | 48.9% |

| TerraVest Industries (TSX:TVK) | CA$170.31 | CA$316.19 | 46.1% |

| OceanaGold (TSX:OGC) | CA$19.32 | CA$32.95 | 41.4% |

| Magellan Aerospace (TSX:MAL) | CA$16.79 | CA$26.80 | 37.3% |

| Ivanhoe Mines (TSX:IVN) | CA$11.15 | CA$18.54 | 39.9% |

| goeasy (TSX:GSY) | CA$188.97 | CA$368.58 | 48.7% |

| Foraco International (TSX:FAR) | CA$1.71 | CA$3.26 | 47.5% |

| Blackline Safety (TSX:BLN) | CA$6.34 | CA$9.91 | 36% |

| Avino Silver & Gold Mines (TSX:ASM) | CA$4.71 | CA$9.24 | 49.1% |

Let's review some notable picks from our screened stocks.

Avino Silver & Gold Mines (TSX:ASM)

Overview: Avino Silver & Gold Mines Ltd. is involved in acquiring, exploring, and advancing mineral properties in Mexico, with a market cap of CA$665.04 million.

Operations: The company's revenue is primarily derived from its Metals & Mining segment, specifically Gold & Other Precious Metals, amounting to $72.62 million.

Estimated Discount To Fair Value: 49.1%

Avino Silver & Gold Mines is trading at CA$4.71, significantly below its estimated fair value of CA$9.24, suggesting it may be undervalued based on cash flows. Despite recent insider selling, the company's earnings grew substantially by 778.6% over the past year and are forecast to grow at 36.7% annually, outpacing the Canadian market's 11.8%. Recent production increases and index inclusion further bolster its investment profile amidst a $40 million equity offering plan.

- In light of our recent growth report, it seems possible that Avino Silver & Gold Mines' financial performance will exceed current levels.

- Take a closer look at Avino Silver & Gold Mines' balance sheet health here in our report.

First National Financial (TSX:FN)

Overview: First National Financial Corporation, with a market cap of CA$2.89 billion, operates in Canada where it originates, underwrites, and services residential and commercial mortgages through its subsidiaries.

Operations: The company's revenue segments include CA$217.42 million from commercial mortgages and CA$433.73 million from residential mortgages in Canada.

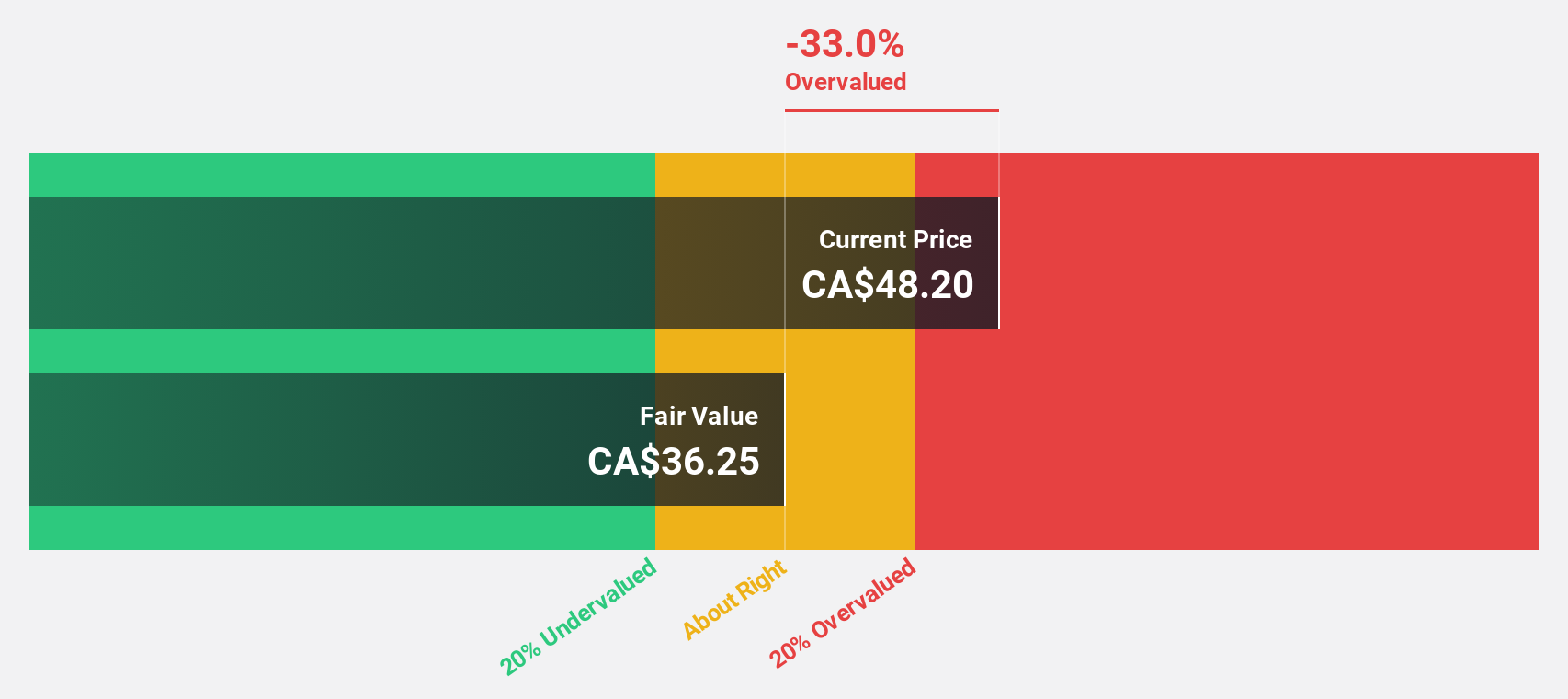

Estimated Discount To Fair Value: 28.7%

First National Financial is trading at CA$48.25, which is 28.7% below its estimated fair value of CA$67.68, indicating potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 20.74% annually, surpassing the Canadian market's growth rate of 11.7%. However, its dividend yield of 5.18% isn't well covered by free cash flow and debt coverage by operating cash flow remains weak amidst an ongoing acquisition valued at CA$2.9 billion by Birch Hill and Brookfield Asset Management.

- Upon reviewing our latest growth report, First National Financial's projected financial performance appears quite optimistic.

- Navigate through the intricacies of First National Financial with our comprehensive financial health report here.

goeasy (TSX:GSY)

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands, with a market cap of CA$3.02 billion.

Operations: The company's revenue segments include CA$150.86 million from Easyhome and CA$1.41 billion from Easyfinancial.

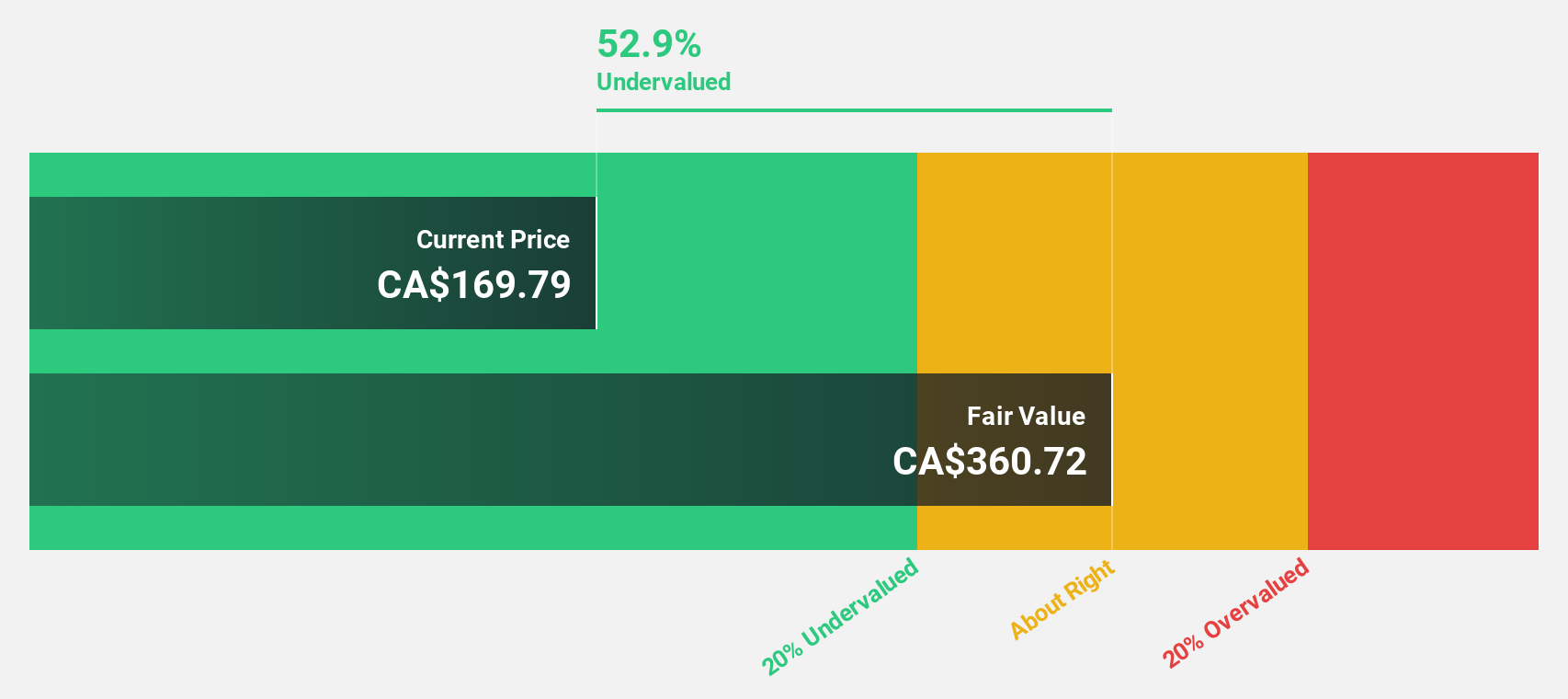

Estimated Discount To Fair Value: 48.7%

goeasy Ltd. trades at CA$188.97, significantly undervalued compared to its fair value estimate of CA$368.58, based on cash flows. Despite a decline in net income to CA$39.4 million for Q1 2025, revenue increased to CA$391.86 million from the previous year. Earnings are projected to grow 18.36% annually, outpacing the Canadian market's growth rate of 11.8%. However, debt coverage by operating cash flow is weak and dividends aren't well covered by free cash flows.

- According our earnings growth report, there's an indication that goeasy might be ready to expand.

- Unlock comprehensive insights into our analysis of goeasy stock in this financial health report.

Turning Ideas Into Actions

- Dive into all 24 of the Undervalued TSX Stocks Based On Cash Flows we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ASM

Avino Silver & Gold Mines

Engages in the acquisition, exploration, and advancement of mineral properties in Mexico.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives