- Canada

- /

- Metals and Mining

- /

- TSX:ASM

Is Now the Right Moment for Avino Silver After Wild 21% Weekly Drop?

Reviewed by Bailey Pemberton

If you have been tracking Avino Silver & Gold Mines lately, you have probably noticed some dramatic ups and downs. Maybe you are wondering if now is the right moment to step in, cash out, or simply watch from the sidelines. After all, not every stock can boast a year-to-date return of over 418.7%, or a three-year surge of 738.4%. But those big numbers come with a twist: the stock dipped 21.1% in the past week, even though it climbed 10.1% over the last month. These wild swings are showing up front and center for anyone curious about the potential (and the risks) in this unique mining name.

What has been driving these moves? Recent news from the company has focused on operational developments at their flagship Durango project, along with progress in resource expansion that some investors see as evidence of long-term growth potential. These updates have, in part, fueled optimism and uncertainty, as investors attempt to balance the intrinsic value of Avino’s assets with current market realities. It is no surprise then that opinions are sharply divided right now: are we witnessing a pullback before the next leg up, or are the wheels beginning to wobble after a gravitational-defying climb?

For those trying to weigh up whether Avino is undervalued, it might help to start with the numbers. Out of six standard valuation checks, Avino comes out as undervalued in two. That lands the company with a value score of 2, which is a decent starting point, but it does not tell the full story. So how should we interpret this score? Is there a smarter way to decide if this miner deserves a spot in your portfolio? Let’s dig into the key valuation approaches analysts use, and then look beyond the usual scorecard to uncover a richer perspective on Avino Silver & Gold Mines’ true worth.

Avino Silver & Gold Mines scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Avino Silver & Gold Mines Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to their value today. For Avino Silver & Gold Mines, this method uses a 2 Stage Free Cash Flow to Equity model based on projected and current cash flows in $.

Currently, Avino generates free cash flow of around $16.76 million. Analysts expect this figure to climb sharply over the next decade, with projections reaching approximately $191.65 million by 2035. These forecasts involve rapid annual growth in the early years, moderating as time goes on. While professional estimates typically only extend five years ahead, the numbers beyond that are calculated via extrapolation to help capture longer-term trends.

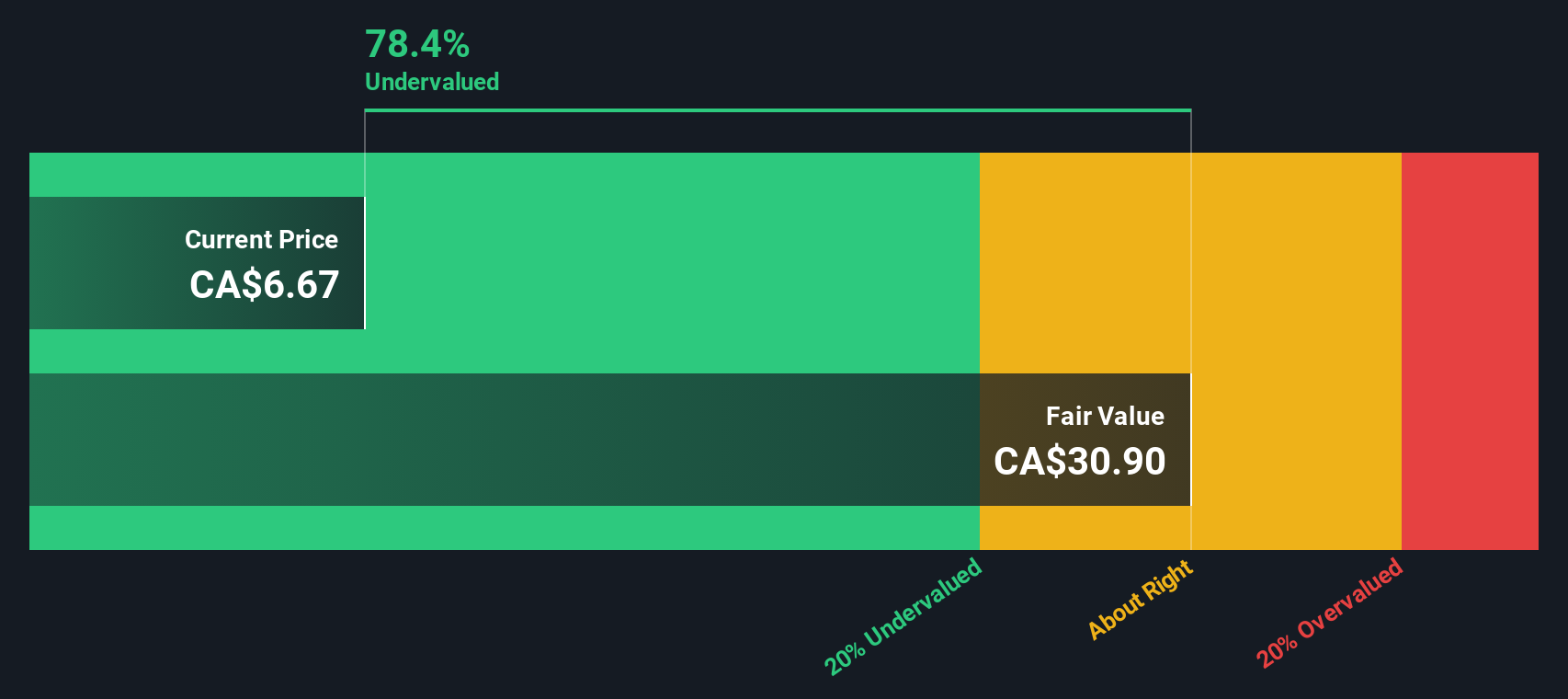

According to the DCF analysis, the intrinsic value of Avino Silver & Gold Mines is estimated at $31.24 per share. Given this figure, the stock is trading at a substantial discount. It is currently about 76.9% below its fair value. That suggests the shares are trading well beneath what the model calculates as their worth based on projected cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Avino Silver & Gold Mines is undervalued by 76.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Avino Silver & Gold Mines Price vs Earnings

When analyzing profitable companies like Avino Silver & Gold Mines, the Price-to-Earnings (PE) ratio is a go-to metric for assessing valuation. This ratio is popular because it reveals how much investors are willing to pay for each dollar of earnings. It serves as a helpful guide for weighing value, especially when earnings are positive and relatively stable.

What counts as a “normal” or “fair” PE ratio is often shaped by earnings growth expectations, potential risks, and the broader industry climate. Higher growth prospects usually justify a higher PE, while greater uncertainty or risk tends to pull it lower.

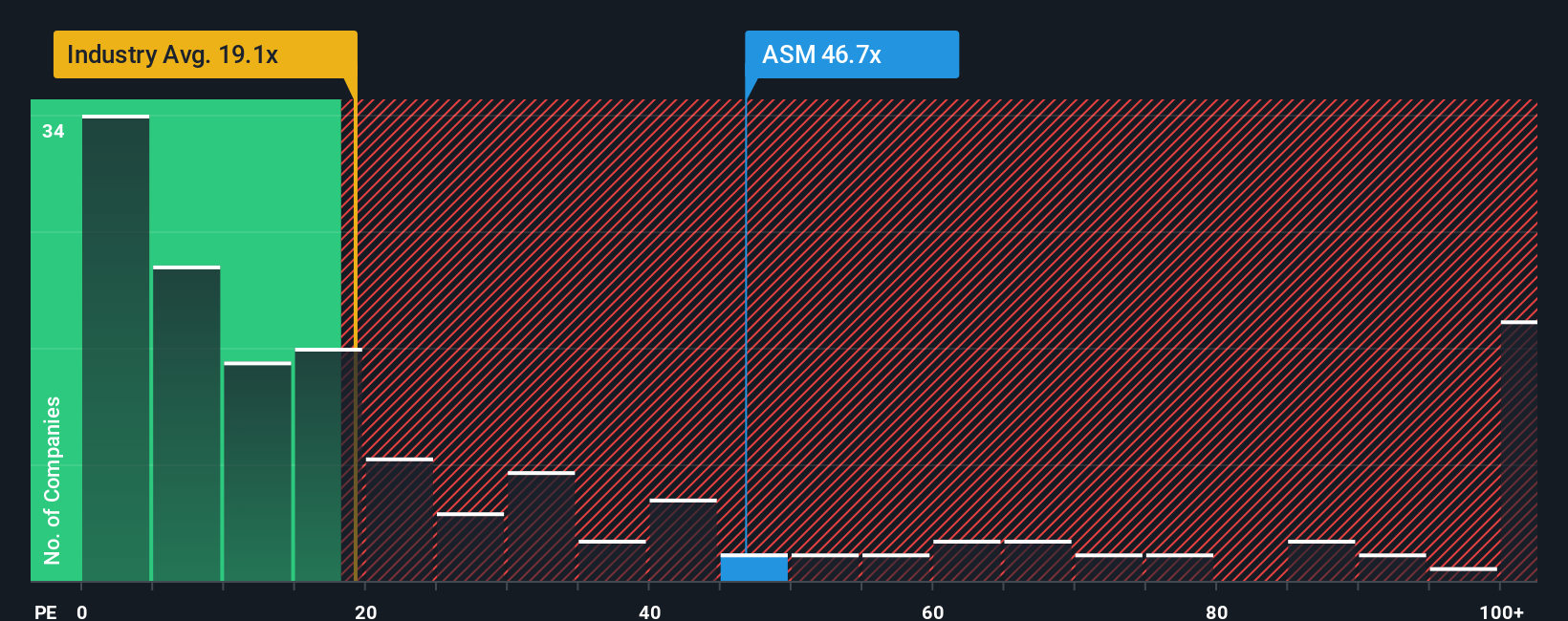

Avino Silver & Gold Mines currently trades at a PE ratio of 52.4x. In comparison, the average for metals and mining peers sits at -0.8x, while the industry average is around 20.27x. On the surface, Avino’s multiple is much higher than those benchmarks, which may catch some investors off guard.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. More than a simple average, the Fair Ratio (35.48x for Avino) factors in not just earnings growth, but also profit margins, the company’s industry, size, and its unique risks. As a result, it provides a tailored measure of what is reasonable to pay for a company like Avino, rather than relying solely on broad industry or peer numbers that may not fit the company’s profile.

Comparing the current PE (52.4x) with the Fair Ratio (35.48x) shows that Avino stock is currently priced well above what would be considered fair given its growth and risk profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Avino Silver & Gold Mines Narrative

Earlier, we mentioned there is an even better way to interpret valuation than simply crunching ratios. That approach is by using Narratives. In simple terms, a Narrative is the story you build about a company: it is where you connect your perspective on Avino Silver & Gold Mines (such as optimism about project expansion or caution about market risks) with your assumptions about future revenue, profit margins, and fair value. Narratives bridge the gap between a company's story and actual financial forecasts, empowering you to translate your view of the business into a dynamic fair value estimate.

This approach is easy and highly accessible, and it is available to you on Simply Wall St’s Community page, where millions of investors share their perspectives and compare them with the current stock price. Narratives can help you decide when to buy or sell by making it easy to see exactly how your story and your numbers stack up against real-time market prices. The best part is, Narratives update automatically when new earnings, news, or market-moving events are released, helping you stay current and confident in your thesis.

For example, different investors analyzing Avino have set fair values as wide-ranging as $19.33 (with a highly bullish view based on surging gold and silver prices) and $5.22 (a much more conservative outlook accounting for future execution and market risks).

For Avino Silver & Gold Mines, we’ll make it easy for you with previews of two leading Avino Silver & Gold Mines Narratives:

- 🐂 Avino Silver & Gold Mines Bull Case

Fair Value: $26.79

Current Price is 73.1% below narrative fair value

Estimated Revenue Growth Rate: 78.01%

- Sees Avino as significantly undervalued with potential for share price to reach $20 or more if precious metal prices increase and La Preciosa ramps up.

- Highlights debt-free balance sheet, strong free cash flow, and robust mineral resources as advantages supporting multi-year growth.

- Scenario modeling suggests substantial upside if silver or gold experience historic price increases, but notes investors should weigh cyclical and operational risks.

- 🐻 Avino Silver & Gold Mines Bear Case

Fair Value: $5.30

Current Price is 36.0% above narrative fair value

Estimated Revenue Growth Rate: 5.41%

- Argues the current market price factors in overly optimistic assumptions about demand, pricing, and project execution that may prove difficult to sustain.

- Warns about risk from cost inflation, regulatory changes, and single-region operational concentration in Mexico.

- Consensus valuation expects improvement, but sees the stock as overvalued unless future revenues and profit margins significantly outperform base-case forecasts.

Do you think there's more to the story for Avino Silver & Gold Mines? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ASM

Avino Silver & Gold Mines

Engages in the acquisition, exploration, and advancement of mineral properties in Mexico.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives