- Canada

- /

- Metals and Mining

- /

- TSX:ASM

Avino Silver & Gold Mines (TSX:ASM) Stock Surges 109% This Quarter Following Strong Earnings Report

Reviewed by Simply Wall St

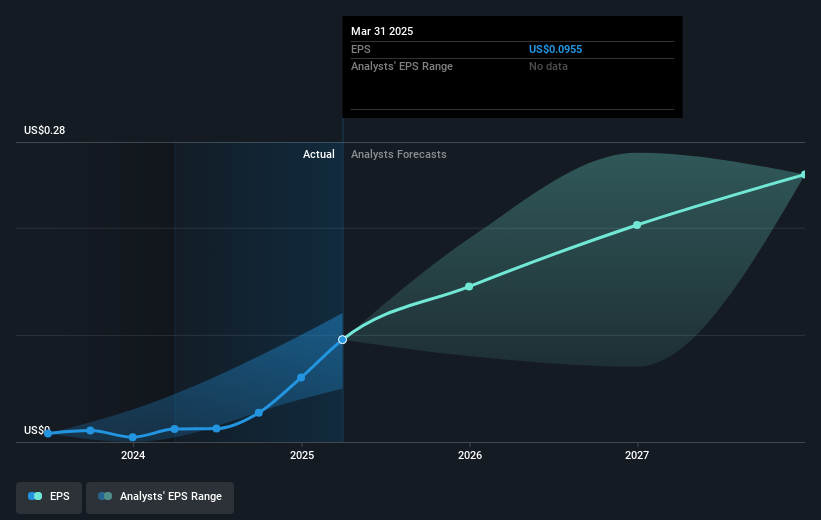

Avino Silver & Gold Mines (TSX:ASM) recently witnessed significant developments with its addition to the S&P/TSX Global Mining Index and the filing of a $40 million follow-on equity offering. These movements occurred alongside the company's impressive price surge of 109% over the past quarter. This notable price movement further coincided with their strong earnings report, showing robust sales and net income growth. While the broader market experienced a 13% uptick over the past year, Avino's sharp increase closely aligned with its strategic announcements, production growth, and leadership changes, likely reinforcing its market presence and enhancing investor sentiment.

Avino Silver & Gold Mines has 1 possible red flag we think you should know about.

Avino Silver & Gold Mines' recent inclusion in the S&P/TSX Global Mining Index and the filing of a CA$40 million follow-on equity offering are likely to have implications for its revenue and earnings forecasts. The developments could enhance investor confidence and provide the capital required for expanding operations, especially as the company progresses with its La Preciosa underground development. This additional capital injection may support strategic initiatives and operational scaling, thus potentially boosting revenue and future earnings.

Over a longer-term period of three years, Avino's total shareholder return was an extremely large 761.19%, reflecting a significant outperformance compared to the broader market's 17.9% increase over the past year. This impressive performance suggests strong investor faith in the company's long-term potential, partially driven by its substantial gains in production efficiency and metal prices. Relative to the Canadian Metals and Mining industry, which saw a one-year gain of 26.7%, Avino's returns over the past year also stand out significantly.

The company's share price current standing at CA$3.01 posits a 27% rise potential to reach the consensus analyst price target of CA$4.12. The financial community's optimistic price targets range from CA$2.75 to CA$5.5, indicating varying levels of confidence in its future trajectory. However, with high expectations for earnings growth and profit margins, deriving substantial returns might depend on continued operational success, stable metal prices, and efficient cost management.

Evaluate Avino Silver & Gold Mines' prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ASM

Avino Silver & Gold Mines

Engages in the acquisition, exploration, and advancement of mineral properties in Mexico.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives