- Canada

- /

- Metals and Mining

- /

- TSX:ASM

Assessing Avino Silver & Gold Mines After Recent 322% Surge and Exploration Updates

Reviewed by Bailey Pemberton

- Wondering if Avino Silver & Gold Mines is still a value play after such a wild ride? You are not alone, and there is plenty to unpack if you are weighing whether to buy, sell, or hold.

- The stock surged an incredible 322.3% year-to-date and is up 255.8% over the past year, but has pulled back recently with a 21.9% drop in the past month.

- Much of the action has been sparked by renewed excitement in precious metals and some high-profile exploration updates from Avino's projects, fueling both optimism and volatility. Headlines about the company securing additional claims and partnerships have also swayed investor sentiment in recent weeks.

- Right now, Avino scores a 2 out of 6 on our valuation checks, meaning it is undervalued in just two areas by traditional measures. Next up, we will break down those valuation approaches, and later in the article, I will share a perspective that goes beyond the numbers you usually see.

Avino Silver & Gold Mines scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Avino Silver & Gold Mines Discounted Cash Flow (DCF) Analysis

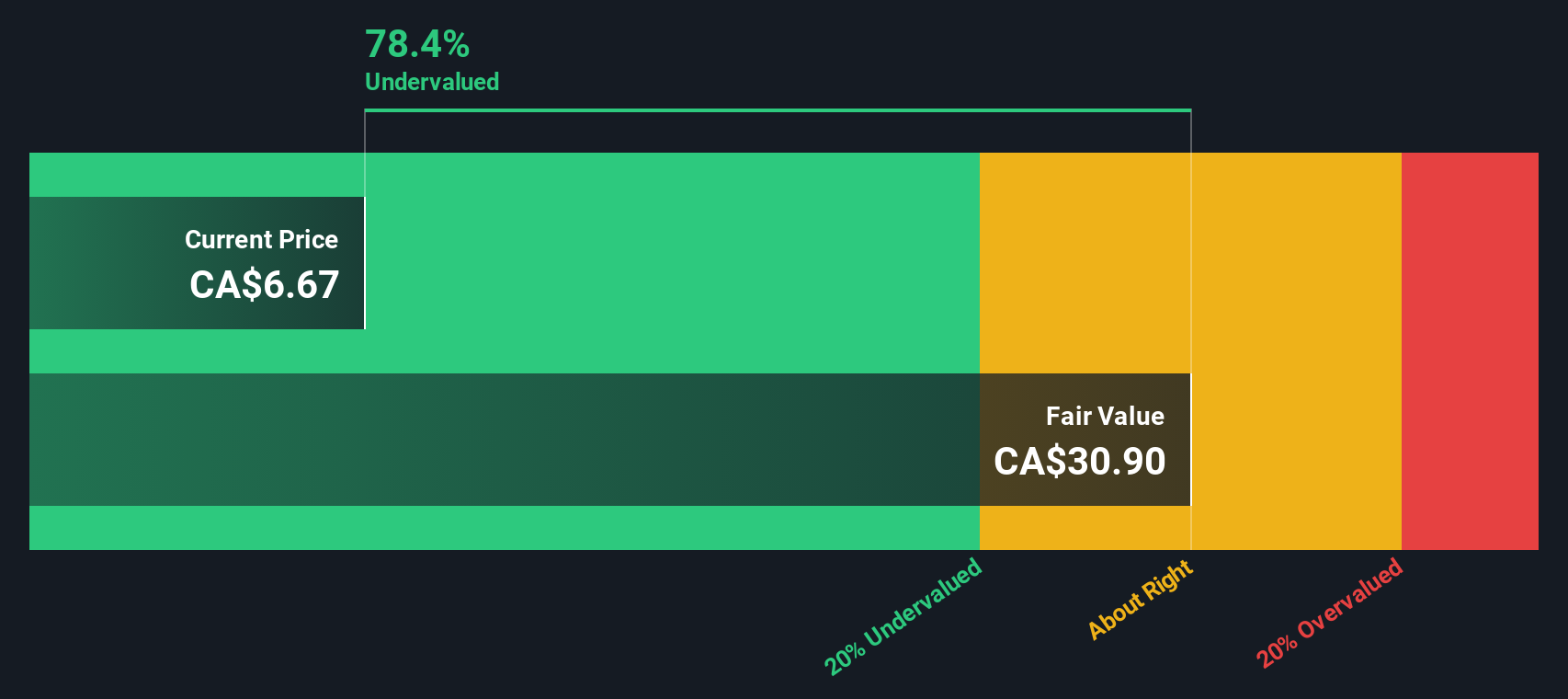

The Discounted Cash Flow (DCF) model works by estimating a company's future cash flows and then discounting those amounts back to their present value. This approach provides an intrinsic value for the company based purely on its expected ability to generate cash going forward.

Avino Silver & Gold Mines currently generates free cash flow (FCF) of $16.76 Million. According to projections, the company is expected to increase its free cash flow substantially over the coming years. By 2026, FCF is estimated at $31.27 Million, growing further each year and potentially reaching up to $191.65 Million by 2035. All projections are in dollars and based on a declining growth rate as years progress beyond analyst coverage.

Applying the DCF model to these figures, the company’s fair value is calculated at $29.31 per share. Compared to its current share price, this suggests that Avino Silver & Gold Mines is trading at an 80.0% discount to its intrinsic value—a significant difference by this metric alone.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Avino Silver & Gold Mines is undervalued by 80.0%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: Avino Silver & Gold Mines Price vs Earnings

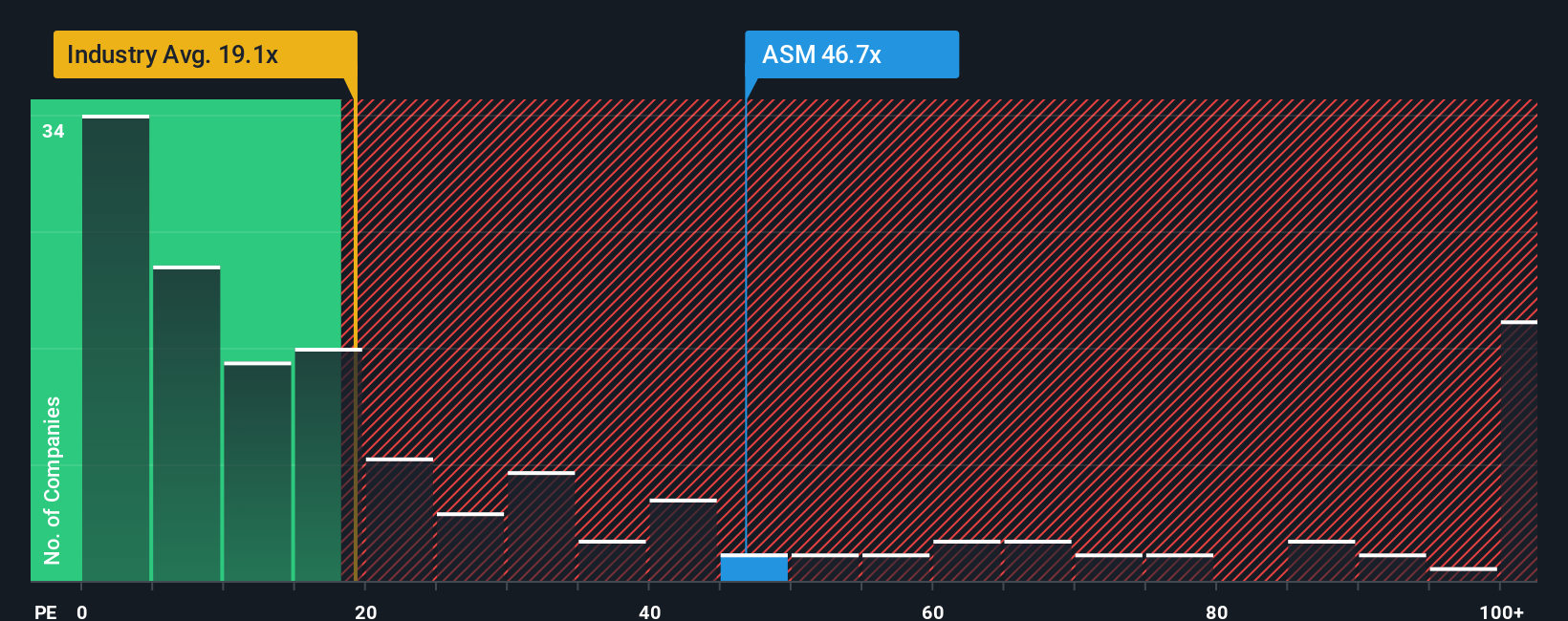

For profitable companies like Avino Silver & Gold Mines, the Price-to-Earnings (PE) ratio is often a preferred metric for valuation. This ratio helps investors assess how much they are paying for each dollar of current earnings, making it a useful tool in comparing companies that are actively generating profits.

When evaluating PE ratios, it is important to consider both growth expectations and risk. A high-growth company or one with stable and predictable earnings typically justifies a higher PE compared to slower-growing or riskier peers. Conversely, elevated risks or below-average growth prospects may warrant a lower PE.

Avino currently trades at 42.3x earnings, which is noticeably higher than the Metals and Mining industry average of 20.4x and well above the peer group average of 0.0x. However, these basic multiples do not account for company-specific factors such as Avino's earnings growth outlook, margins, or risks.

This is where Simply Wall St's proprietary "Fair Ratio" comes in. The Fair Ratio for Avino, calculated at 24.0x, reflects what investors should reasonably pay for the company's earnings after factoring in its expected growth, profitability, industry context, market cap, and associated risks. Unlike a simple industry or peer comparison, this approach provides a more tailored and insightful valuation.

Comparing the Fair Ratio of 24.0x to Avino's current PE of 42.3x, the stock appears to be priced significantly above what would be considered reasonable for its profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Avino Silver & Gold Mines Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives, a smarter and more powerful tool that anyone can use to invest more confidently. A Narrative is your personal story behind a company's numbers: it blends your view of Avino Silver & Gold Mines' future (such as forecasts for revenue, earnings, and margin) with the data, linking the company's story to a tailored financial forecast and, ultimately, your own fair value estimate.

On Simply Wall St's Community page, millions of investors are already using Narratives to map out their rationale for buying or selling, set their fair value, and see in real-time how that fair value stacks up against the latest share price. Narratives are dynamically updated as soon as news breaks, financials are released, or new data emerges, helping you stay on top of what matters and quickly adjust your perspective.

For Avino Silver & Gold Mines, one investor may build a Narrative around a bullish scenario, projecting a possible $20 share price if precious metal prices skyrocket, while another may highlight rising costs and project a fair value closer to CA$4.25 if execution risks play out. This puts you in the driver’s seat, letting you decide what you believe is likely and what price you are willing to pay, all backed by a transparent, story-driven process.

For Avino Silver & Gold Mines, we’ll make it really easy for you with previews of two leading Avino Silver & Gold Mines Narratives:

- 🐂 Avino Silver & Gold Mines Bull Case

Fair Value: $26.79

Undervalued by: 78.1%

Revenue Growth Rate: 78.01%

- Projects Avino’s share price could reach $19–$20 per share by 2026 in a bullish metals environment, with a fair value estimate of $26.79.

- Highlights the company’s strong financial performance, debt-free status, ambitious production growth from new projects, and exposure to rising silver and gold prices.

- Emphasizes significant upside from higher-than-expected silver and gold prices, while noting potential risks such as regulatory changes and rising costs.

- 🐻 Avino Silver & Gold Mines Bear Case

Fair Value: $5.30

Overvalued by: 10.8%

Revenue Growth Rate: 21.92%

- Argues that current market optimism may be overestimating future demand and pricing power, given rising costs and single-region operational risks.

- Points to concentration risk, possible execution delays at new projects, and analyst consensus that the current share price is above fair value.

- States that, despite strong current results, analysts see a more moderate fair value and urge careful sense checks of optimistic assumptions.

Do you think there's more to the story for Avino Silver & Gold Mines? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ASM

Avino Silver & Gold Mines

Engages in the acquisition, exploration, and advancement of mineral properties in Mexico.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion