- Canada

- /

- Metals and Mining

- /

- TSX:ARIS

How Aris Mining’s Juby Sale and Project Focus Will Impact Investors (TSX:ARIS)

Reviewed by Simply Wall St

- In recent days, Aris Mining reported second-quarter output closely aligned with expectations, reaffirmed progress on its main project studies, and announced the sale of its non-core Juby asset to prioritize growth-focused operations.

- This operational focus signals management's intent to streamline the business and accelerate development at key assets in its portfolio.

- We’ll explore how divesting the Juby asset and doubling down on growth projects shapes Aris Mining’s investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Aris Mining's Investment Narrative?

For investors considering Aris Mining, the core belief centers on the company's ability to efficiently scale output while sharpening its operational focus on higher-value projects. The latest move to divest the non-core Juby asset reinforces this disciplined approach, funneling resources toward assets like Segovia and the Soto Norte and Toroparu studies. Management is signaling a tighter portfolio and, at least in the near term, minimizing dilution of focus as they target growth and production scale. The fact that Q2 results tracked in line with expectations and guidance remains unchanged suggests the announced asset sale may not significantly alter near-term catalysts such as the upcoming project study releases or 2025 production targets. However, risks remain around the execution of new expansions, management team experience, and whether a young board and leadership group can manage increased complexity as the business grows.

But despite stronger operations, not all investors will be comfortable with the board’s limited track record.

Exploring Other Perspectives

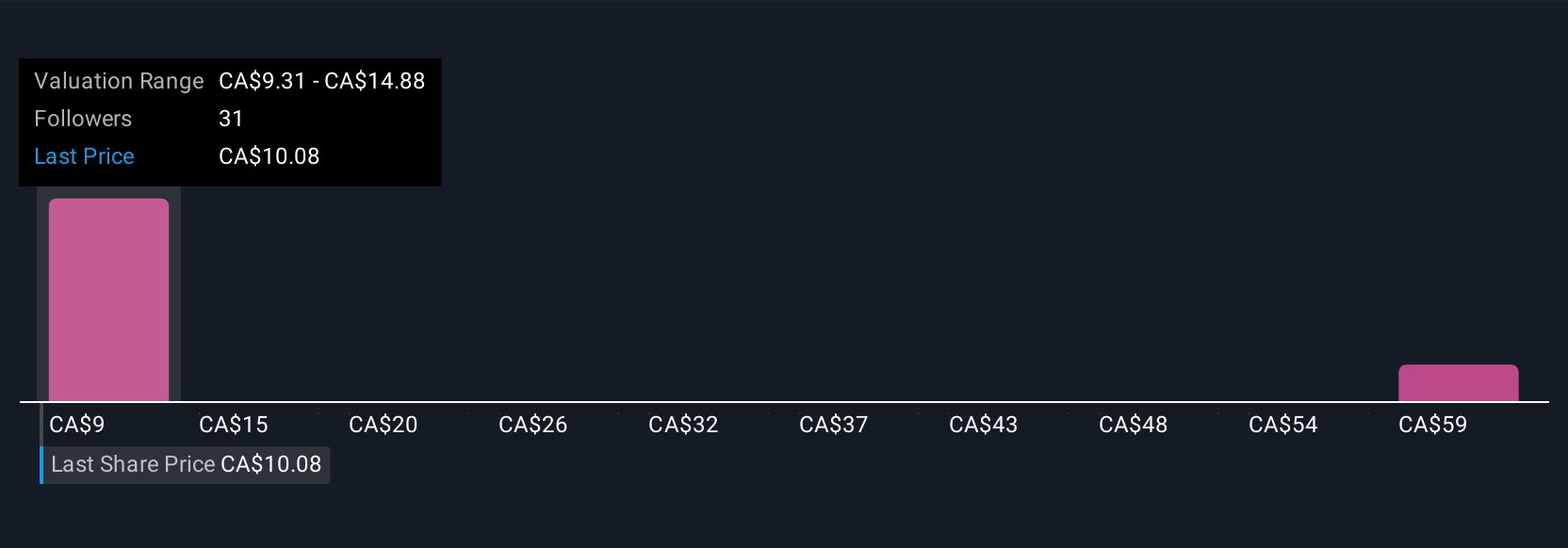

Explore 5 other fair value estimates on Aris Mining - why the stock might be worth 5% less than the current price!

Build Your Own Aris Mining Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aris Mining research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Aris Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aris Mining's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARIS

Aris Mining

Engages in the acquisition, exploration, development, and operation of gold properties in Canada, Colombia, and Guyana.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives