- Canada

- /

- Metals and Mining

- /

- TSX:AR

Argonaut Gold Inc. (TSE:AR) Might Not Be As Mispriced As It Looks After Plunging 41%

The Argonaut Gold Inc. (TSE:AR) share price has fared very poorly over the last month, falling by a substantial 41%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 49% share price drop.

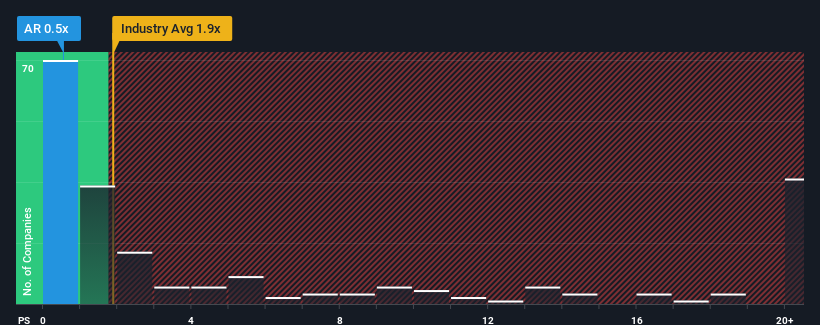

Following the heavy fall in price, Argonaut Gold may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.5x, considering almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 1.9x and even P/S higher than 14x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Argonaut Gold

What Does Argonaut Gold's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Argonaut Gold's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Argonaut Gold will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Argonaut Gold?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Argonaut Gold's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. Regardless, revenue has managed to lift by a handy 21% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next three years should generate growth of 12% per annum as estimated by the three analysts watching the company. With the industry predicted to deliver 10% growth per annum, the company is positioned for a comparable revenue result.

With this information, we find it odd that Argonaut Gold is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Argonaut Gold's P/S?

Argonaut Gold's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It looks to us like the P/S figures for Argonaut Gold remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Argonaut Gold you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:AR

Argonaut Gold

Engages in production and sale of gold, and mine development and exploration businesses in North America.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives