- Canada

- /

- Metals and Mining

- /

- TSX:APM

Could Andean Precious Metals' (TSX:APM) Shelf Filing Reshape Its Approach to Growth and Capital Flexibility?

Reviewed by Sasha Jovanovic

- Andean Precious Metals Corp. recently filed a US$200 million shelf registration, allowing for future issuance of common shares, warrants, debt securities, and units.

- This broad shelf registration gives the company significant flexibility to pursue new funding opportunities or strategic initiatives as market conditions evolve.

- With this new capacity to raise capital, we’ll assess how Andean’s shelf filing could influence its outlook and investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Andean Precious Metals Investment Narrative Recap

To be optimistic about Andean Precious Metals, an investor needs to believe in the company’s ability to execute on its production ramp-ups and expansion plans in Bolivia, despite risks tied to permitting and regional regulatory environments. The newly filed US$200 million shelf registration further boosts Andean’s financial flexibility, but does not immediately resolve short-term challenges, as the primary catalyst remains the successful progress at San Bartolomé, while the biggest risk is still potential delays securing new environmental and social licenses for the COMIBOL agreement. Of the company’s recent announcements, the May 7 confirmation of a long-term purchase agreement with COMIBOL is most relevant to the shelf filing. This agreement unlocks 7 million tonnes of future ore supply beginning in 2026 and, combined with the new capital-raising flexibility, could be foundational for ongoing production growth, pending timely permitting. In contrast, investors should be aware of how permitting delays for new ore agreements could...

Read the full narrative on Andean Precious Metals (it's free!)

Andean Precious Metals is projected to reach $352.0 million in revenue and $83.1 million in earnings by 2028. This reflects an annual revenue growth rate of 8.3% and nearly doubles earnings, increasing by $41.2 million from the current $41.9 million.

Uncover how Andean Precious Metals' forecasts yield a CA$6.97 fair value, a 20% downside to its current price.

Exploring Other Perspectives

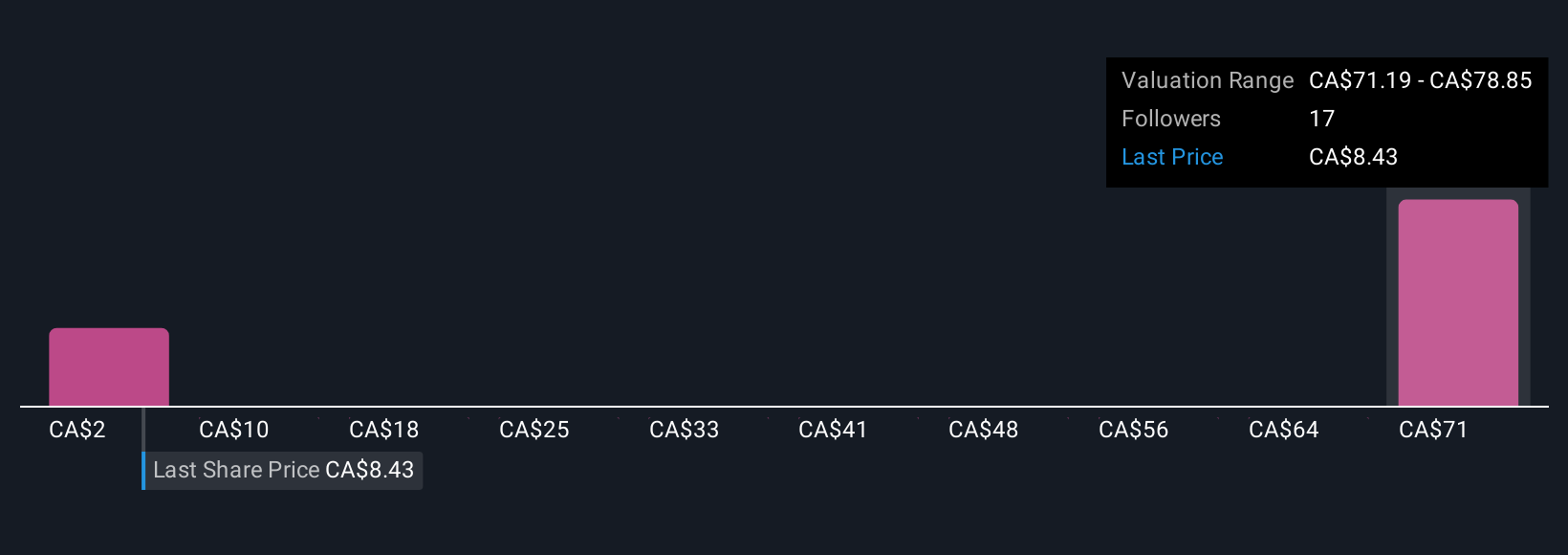

Three individual estimates from the Simply Wall St Community place fair value between US$2.30 and US$79.54. While future expansion potential fuels optimism, sustained reliance on Bolivian permitting remains central to the company’s outlook, consider the range of perspectives before deciding where you stand.

Explore 3 other fair value estimates on Andean Precious Metals - why the stock might be worth less than half the current price!

Build Your Own Andean Precious Metals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Andean Precious Metals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Andean Precious Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Andean Precious Metals' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:APM

Andean Precious Metals

Engages in the acquisition, exploration, development, and processing of mineral resource properties in the United States.

Flawless balance sheet and good value.

Market Insights

Community Narratives