- Canada

- /

- Metals and Mining

- /

- TSX:ALS

Altius Minerals (TSX:ALS) Valuation in Focus After Dividend Boost and Upbeat Analyst Ratings

Reviewed by Simply Wall St

Altius Minerals (TSX:ALS) just gave investors something to think about, as its stock hit a fresh 52-week high on Friday. The latest spark appears to be a combination of upbeat analyst coverage, with several firms raising their outlook on the company, and an announced dividend bump from $0.09 to $0.10 per share. With upbeat ratings and concrete improvements to shareholder returns, Altius is clearly catching the market’s attention right now.

Taking a step back, this is not a sudden move out of nowhere. Over the past year, Altius Minerals has logged a return of 21%, and momentum seems to be building, with a 16% gain in the past three months. The company’s recent annual revenue growth of 15% stands out even as net income dipped, and its push to reward shareholders with a higher dividend adds another layer to the story. All of this comes against a backdrop of surging investor optimism about mining royalties as a business model.

So, after this year’s upward ride and analyst enthusiasm, is this a rare buying window for Altius Minerals, or is the market already pricing in its growth story?

Price-to-Earnings of 14.6x: Is it Justified?

Altius Minerals is currently trading at a price-to-earnings (P/E) ratio of 14.6x, which is below both the average P/E of the Canadian market and the Canadian Metals and Mining industry.

The price-to-earnings ratio compares a company’s share price with its earnings per share. For mining companies like Altius, it is a useful way to gauge how the market values current and potential profitability relative to industry peers.

This below-average P/E suggests that the market sees Altius as attractively valued compared to its sector. Investors might be underpricing its earnings potential, especially given recent growth and higher profitability margins compared to last year. However, factors such as forecast earnings declines could also be influencing these valuation levels.

Result: Fair Value of $31.24 (UNDERVALUED)

See our latest analysis for Altius Minerals.However, slowing net income growth and the potential for earnings declines remain risks. These factors could quickly shift sentiment on Altius Minerals' outlook.

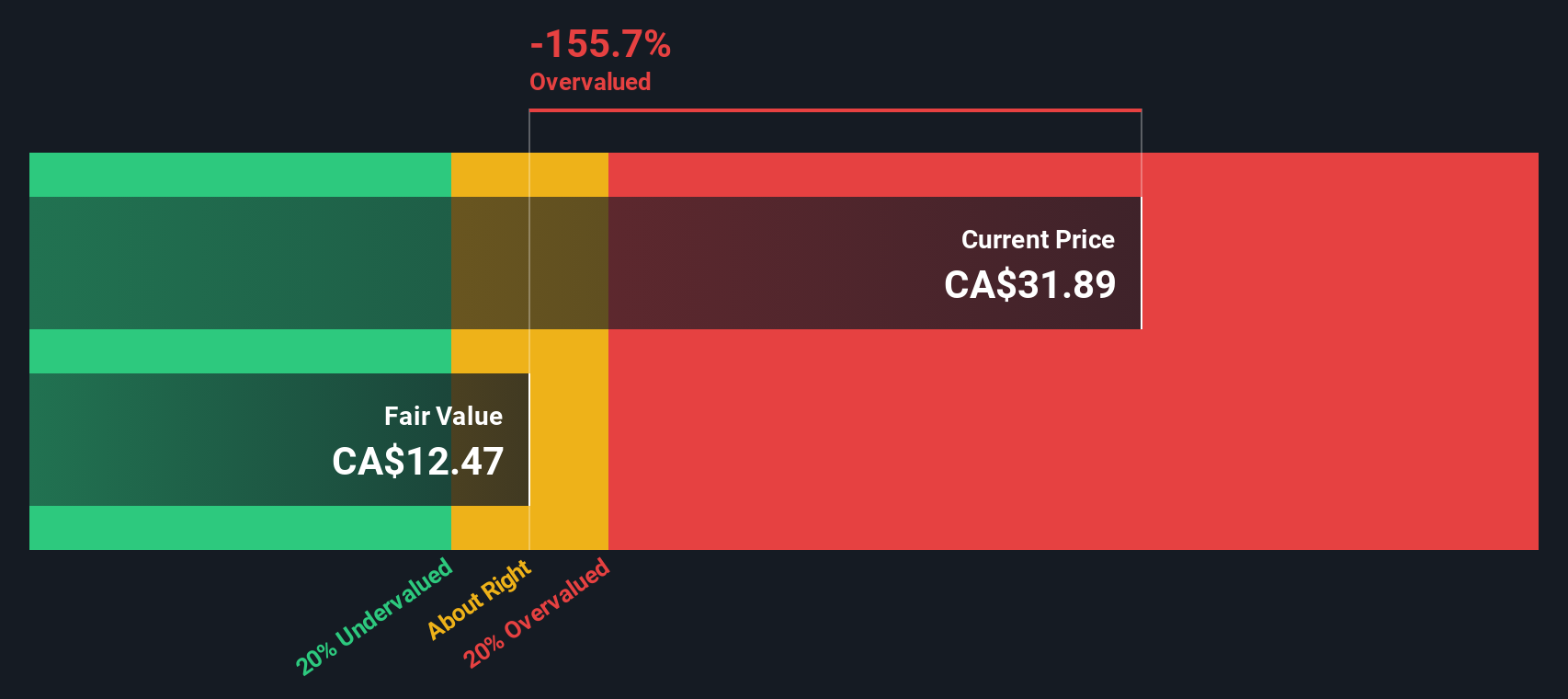

Find out about the key risks to this Altius Minerals narrative.Another View: SWS DCF Model Tells a Different Story

While the market compares Altius Minerals to industry averages, the SWS DCF model suggests a very different valuation perspective, challenging the idea that shares are attractively priced. Which approach is closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Altius Minerals Narrative

If you see things differently or would rather dig into the numbers yourself, you can put together your own view in just minutes. Do it your way.

A great starting point for your Altius Minerals research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't let your next big winner slip away. Uncover fresh, high-potential stocks by tapping into new trends and ideas using these hand-picked screeners:

- Catch top income generators on your radar with reliable dividend stocks with yields > 3% offering yields above 3%. This approach is ideal for building steady portfolio growth.

- Pursue growth in tomorrow’s world by targeting quantum computing stocks that powers breakthroughs in advanced computing and next-generation technologies.

- Grab bargains before the masses notice by spotting undervalued stocks based on cash flows trading below their true worth and primed for upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ALS

Altius Minerals

Engages in the mineral and renewable royalties and project generation businesses in Canada, Brazil, and the United States.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives