- Canada

- /

- Metals and Mining

- /

- TSX:AGI

Alamos Gold (TSX:AGI) Margin Surge Reinforces Bullish Narratives Despite One-Off Gain

Reviewed by Simply Wall St

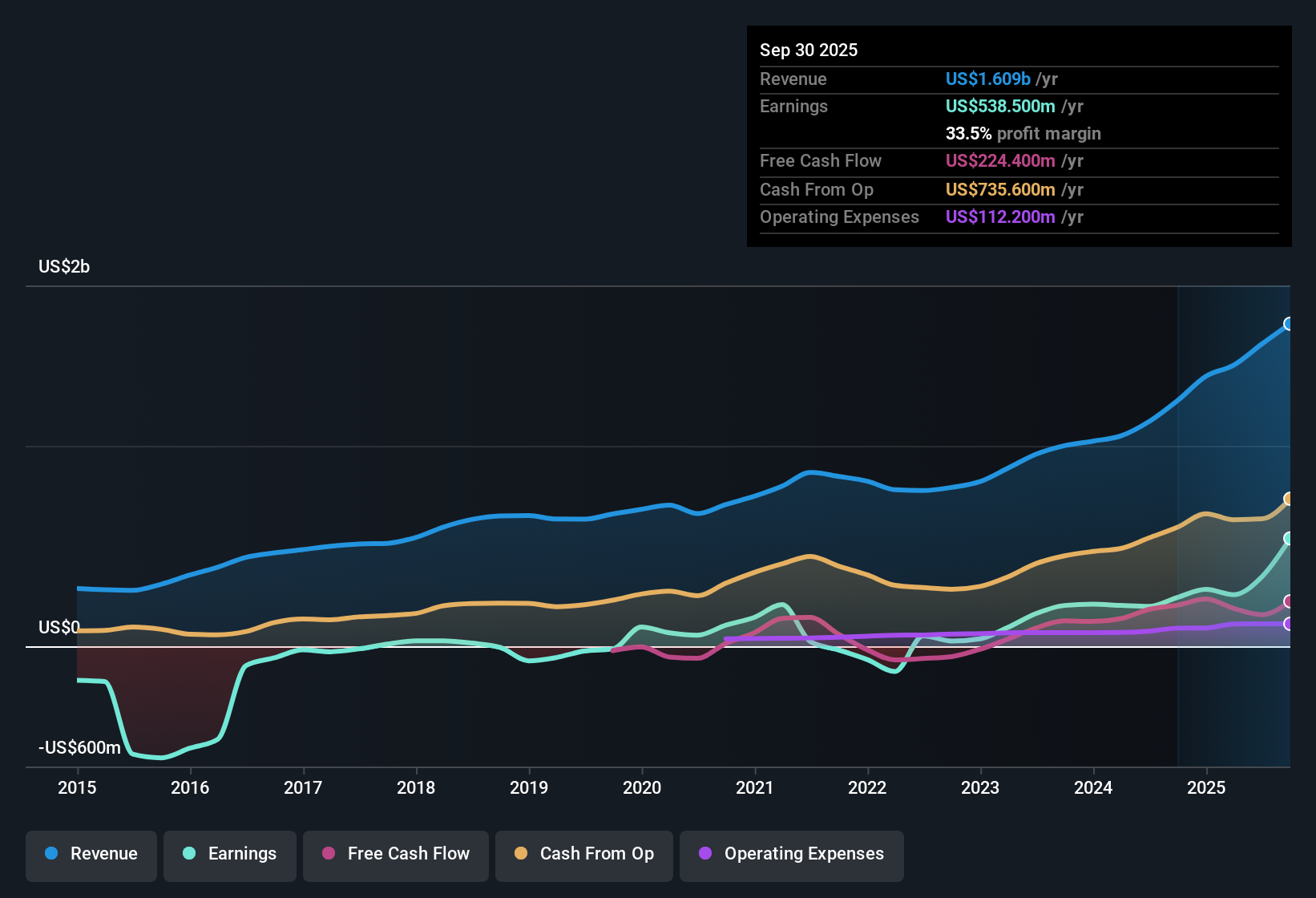

Alamos Gold (TSX:AGI) posted strong momentum in its latest financial year, with earnings up 120.9% over the prior year. This reflects a distinct acceleration from its five-year average growth rate of 41.6% per year. Margins also saw substantial improvement, moving from 19.9% last year to 33.5%. The full-year results were notably affected by a one-off gain of $244.7 million. With earnings forecast to grow 26% and revenue projected to expand at 19.4% per year, investors are now weighing these numbers against the backdrop of a generally positive market sentiment and limited major risks.

See our full analysis for Alamos Gold.Next up, we will set the latest results against the community narratives at Simply Wall St to see how well the numbers reinforce or disrupt the prevailing views.

See what the community is saying about Alamos Gold

Margins Surge to 33.5%, Driven by Cost Synergies

- Profit margins climbed from 19.9% to 33.5% year over year, topping analyst expectations and signaling strong cost discipline amid production expansions.

- According to the analysts' consensus narrative, ongoing integration of high-grade Island Gold ore into the Magino mill is projected to unlock further cost savings, with

- the expectation that margins will approach 33.6% over the next three years, sustaining this momentum

- while this outlook depends on continued success in production ramp-ups and efficiency gains at both sites

- What stands out is how sustained gold prices and exploration wins have created a supportive backdrop for improving margins, reinforcing analyst optimism that Alamos Gold is positioned for durable profitability.

- Grab the full story on Alamos Gold’s margin acceleration and where consensus expects it to go. See the inside track in the Consensus Narrative. 📊 Read the full Alamos Gold Consensus Narrative.

One-Off Gain Skews Growth Snapshot

- Reported net income received a $244.7 million boost from a non-recurring gain, making recent profit growth look even stronger than the underlying trend.

- Consensus narrative points out that while long-term production growth (toward 900,000 to 1,000,000 ounces) and ongoing exploration are driving optimism,

- investors should recognize the current earnings surge is significantly influenced by this exceptional item, not just core operations

- and watch for future updates to see whether Alamos Gold can sustain elevated profits as one-off effects normalize

Market Values Still Trail Analyst Targets

- Alamos Gold’s current share price of CA$43.43 remains 33% below its DCF fair value of CA$224.08, and 35% below the latest analyst price target of CA$65.36. This offers considerable potential upside if analyst forecasts are reached.

- As highlighted by the consensus narrative, the market's discount reflects some caution about execution on cost and production plans,

- yet, the share price also signals opportunity if margins hold and ramp-ups materialize, moving toward the projected CA$797.7 million in 2028 earnings

- making future operational progress and gold price trends crucial to closing this valuation gap

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Alamos Gold on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these figures from another angle? Shape your own viewpoint and contribute your narrative in just a few minutes. Do it your way

A great starting point for your Alamos Gold research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Alamos Gold’s surging earnings received a boost from non-recurring gains, there is uncertainty about whether these elevated profits reflect core, sustainable growth.

If you prefer companies with a steadier track record of revenue and profit expansion, use our stable growth stocks screener (2113 results) to focus on businesses delivering consistent, reliable performance every year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AGI

Alamos Gold

Operates as a gold producer in Canada, Mexico, and the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion