- Canada

- /

- Metals and Mining

- /

- TSX:AG

How U.S.-China Trade Talks May Shift the Outlook for First Majestic Silver (TSX:AG) Investors

Reviewed by Sasha Jovanovic

- In late October 2025, President Trump indicated the potential for a U.S.-China trade deal, easing trade tensions that had previously stimulated safe haven demand for precious metals such as silver.

- This development has shifted investor expectations for silver, reducing demand for the metal and impacting sentiment toward silver mining companies like First Majestic Silver.

- We'll now explore how an easing of safe haven demand for silver may affect First Majestic Silver's investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

First Majestic Silver Investment Narrative Recap

To own shares of First Majestic Silver, an investor typically needs to believe in the company’s ability to capture value from silver price cycles and deliver production growth at a sustainable cost. The recent easing of U.S.-China trade tensions has temporarily reduced safe haven demand for silver, which could weaken the main near-term catalyst for the stock, higher silver prices, while raising the importance of cost control as the most immediate risk. This shift in macro conditions could reduce the material impact of external silver price rallies that previously benefited the company. Of First Majestic Silver’s recent announcements, the October operating results stand out given the context of falling silver prices; the company posted a 96% year-over-year increase in silver output and 39% growth in total silver equivalent production. While production gains are impressive, their benefit may be dampened in the short term if soft silver prices persist, emphasizing that cost discipline and operational efficiency will be crucial for offsetting any revenue headwinds. However, with ongoing high exploration spending and significant investments to grow output, one risk investors should closely monitor is the possibility that costs continue to outpace any incremental production gains...

Read the full narrative on First Majestic Silver (it's free!)

First Majestic Silver's outlook forecasts $1.2 billion in revenue and $94.0 million in earnings by 2028. This is based on a projected annual revenue growth rate of 12.2% and represents a $79.3 million increase in earnings from the current $14.7 million.

Uncover how First Majestic Silver's forecasts yield a CA$23.25 fair value, a 31% upside to its current price.

Exploring Other Perspectives

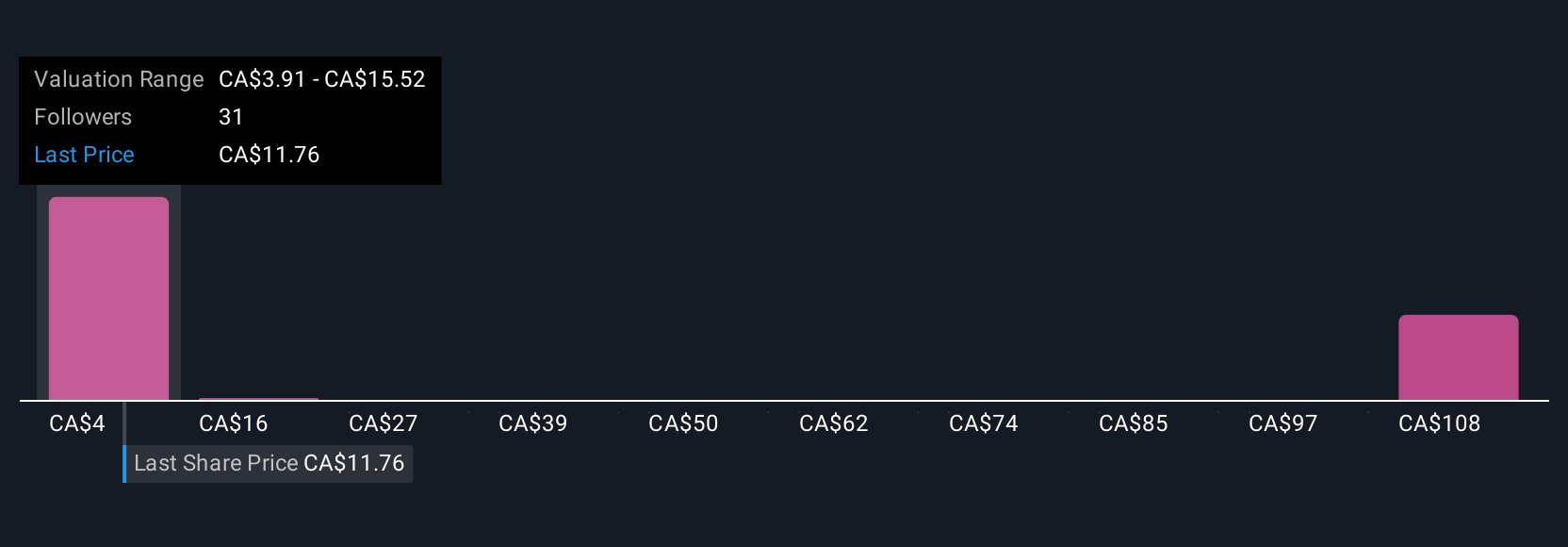

Nine Simply Wall St Community fair value estimates span US$3.91 to US$71.02, showing sharp splits among retail investors. This diversity comes against a backdrop where the company’s ongoing high operating and capital expenditures place pressure on margins if silver prices remain subdued.

Explore 9 other fair value estimates on First Majestic Silver - why the stock might be worth less than half the current price!

Build Your Own First Majestic Silver Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Majestic Silver research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free First Majestic Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Majestic Silver's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives