- Canada

- /

- Metals and Mining

- /

- TSX:AG

First Majestic Silver (TSX:AG) Is Up 34.8% After Record Output and Net Income Surge – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- First Majestic Silver Corp. recently reported a strong third quarter, reversing a prior net loss with net income of US$43 million and record revenues driven by higher output and rising silver prices, and announced an upcoming dividend for shareholders.

- An interesting detail is that the company achieved a very large year-over-year production increase, benefiting from tight silver supply and growing demand, while options trading activity surged amid market speculation and sector momentum.

- We'll examine how record silver output and a return to net income may influence the company's broader investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

First Majestic Silver Investment Narrative Recap

First Majestic Silver appeals to investors who see opportunity in rising silver prices and believe the company can sustain high output and capitalize on robust demand. While the recent surge in silver production and return to net income reinforce this bullish thesis, they also intensify focus on whether current price levels and production momentum can be maintained; the most immediate catalyst remains silver price performance, while rising operational costs are still a potential risk, both largely unchanged by this quarter's results. In the short term, the impact of these strong numbers appears directionally positive, but meaningful cost pressures remain a key watchpoint.

Among the company's key recent announcements, the declaration of a cash dividend for Q3 stands out as most relevant to this news event. This dividend aligns with renewed profitability and record revenues, reflecting management’s confidence in operational cash flow strength, the same operational improvements fueling higher production and revenues, which are central to near-term catalysts for First Majestic Silver.

However, investors should also be aware that, despite strong quarterly results, persistent cost increases at core Mexican mines may present a challenge if silver prices ...

Read the full narrative on First Majestic Silver (it's free!)

First Majestic Silver's narrative projects $1.2 billion in revenue and $94.0 million in earnings by 2028. This requires 12.2% yearly revenue growth and a $79.3 million earnings increase from $14.7 million today.

Uncover how First Majestic Silver's forecasts yield a CA$22.25 fair value, a 5% upside to its current price.

Exploring Other Perspectives

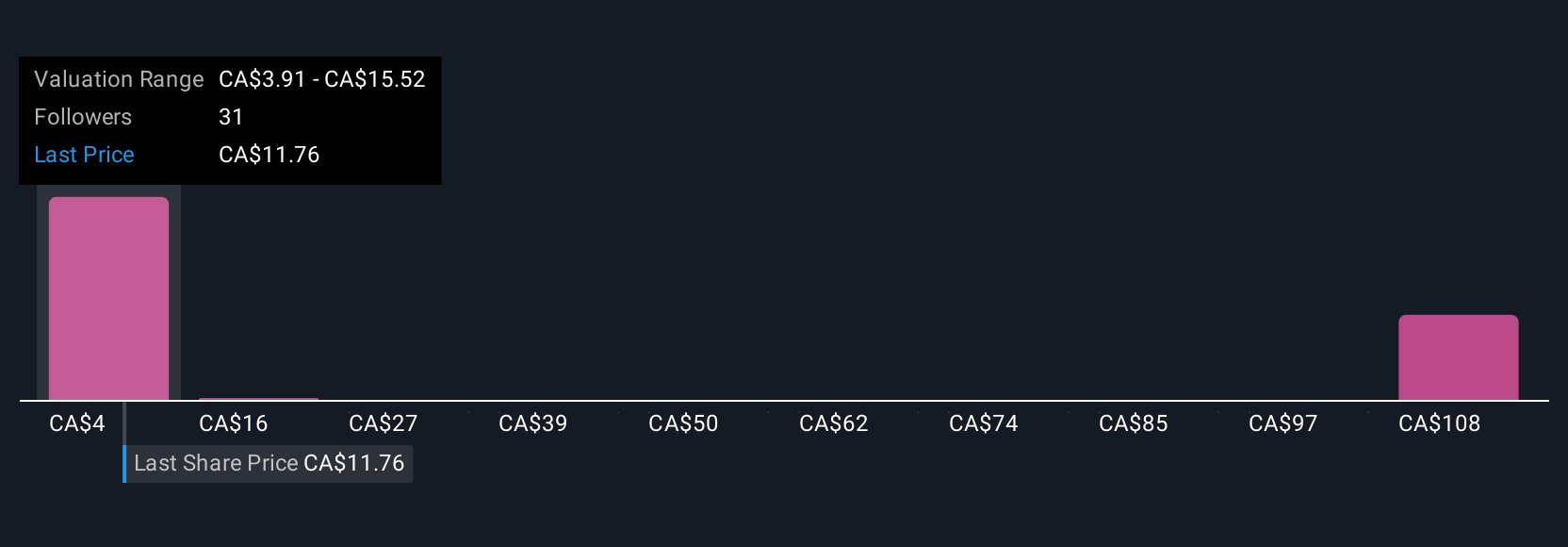

Nine community-sourced fair value estimates for First Majestic Silver span from US$3.91 to US$28.42, with wide-ranging target prices from the Simply Wall St Community. While many see strong revenue growth as a key driver for returns, opinions differ sharply on the company’s ability to manage rising costs and deliver sustainable profitability.

Explore 9 other fair value estimates on First Majestic Silver - why the stock might be worth less than half the current price!

Build Your Own First Majestic Silver Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Majestic Silver research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free First Majestic Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Majestic Silver's overall financial health at a glance.

No Opportunity In First Majestic Silver?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026