- Canada

- /

- Metals and Mining

- /

- TSX:AG

First Majestic Silver (TSX:AG) Is Down 5.0% After Mixed Q2 Results and 2025 Production Guidance - Has The Bull Case Changed?

Reviewed by Simply Wall St

- Earlier this month, First Majestic Silver announced its 2025 production guidance and reported second-quarter operating results, highlighting significant year-over-year growth in both ore processed and silver output.

- An interesting insight is that while silver production saw strong gains, gold production for the quarter was lower than the previous year, illustrating some variability in mined metals performance.

- We'll assess how the boost in silver production impacts First Majestic Silver's investment narrative and long-term outlook.

First Majestic Silver Investment Narrative Recap

To be a shareholder in First Majestic Silver, you have to believe in the company's ability to capitalize on growing silver production and successful mine integrations, particularly as it continues scaling up from its expanded asset base. The latest production update, with strong increases in silver output and ore processed, reinforces the near-term catalyst of delivering on integration synergies at recent acquisitions, while the main risk, exposure to Mexico’s regulatory and currency shifts, remains unchanged and was not materially affected by this news.

Among recent announcements, the 2025 annual production guidance stands out for its relevance: First Majestic projects 14.8 to 15.8 million ounces of silver and 135,000 to 144,000 ounces of gold, alongside sizable zinc and lead output. This forward-looking guidance directly ties to the core investment thesis around operational scale and resource delivery, supporting the view that production expansion could drive both top-line momentum and bottom-line improvement, if execution stays on track.

However, before considering new exposures, it’s important to remember that despite strong production numbers, risks from Mexican currency swings and regulatory uncertainty still present meaningful challenges that investors should be aware of…

Read the full narrative on First Majestic Silver (it's free!)

First Majestic Silver's outlook calls for $1.1 billion in revenue and $73.5 million in earnings by 2028. This projection relies on 16.6% annual revenue growth and a $159.6 million increase in earnings from the current level of -$86.1 million.

Exploring Other Perspectives

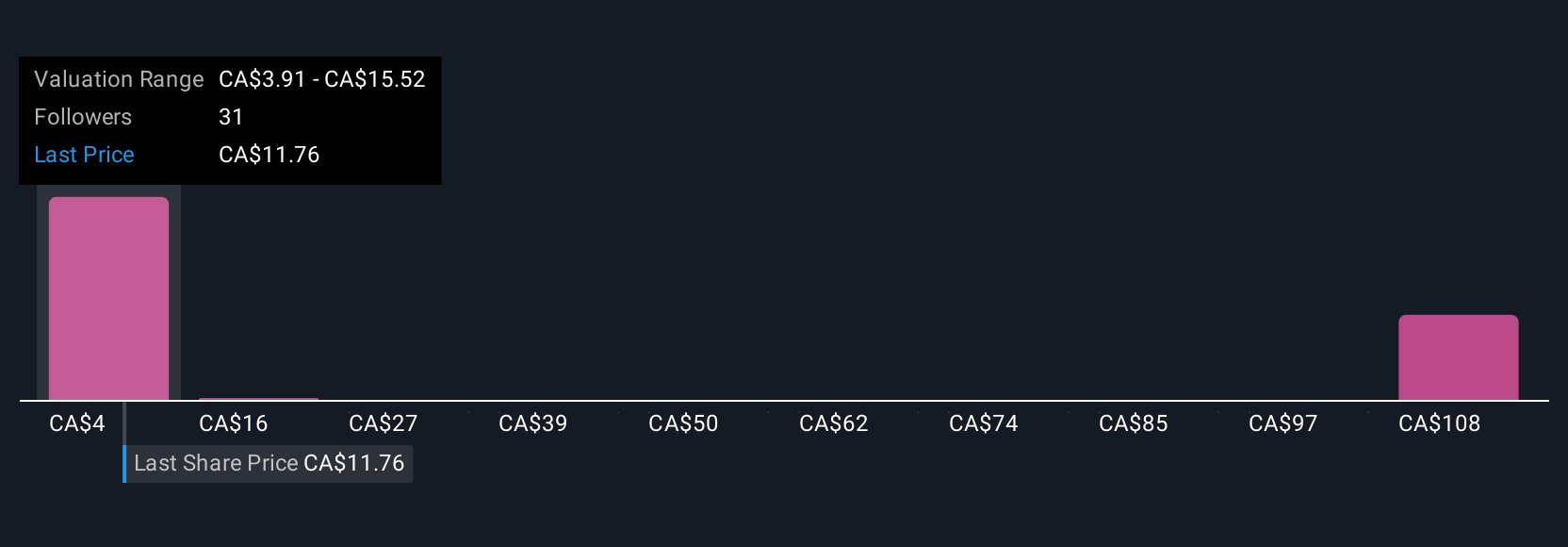

Seven members of the Simply Wall St Community value First Majestic from CA$3.91 up to CA$120 per share, showcasing strikingly different outlooks. When you weigh this against ongoing regulatory risk from the company’s Mexican operations, it becomes clear why investor opinions sharply diverge, take the time to review several viewpoints before making any conclusions.

Build Your Own First Majestic Silver Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Majestic Silver research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free First Majestic Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Majestic Silver's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives