- Canada

- /

- Paper and Forestry Products

- /

- TSX:ADN

Acadian Timber (TSE:ADN) Has Announced A Dividend Of CA$0.29

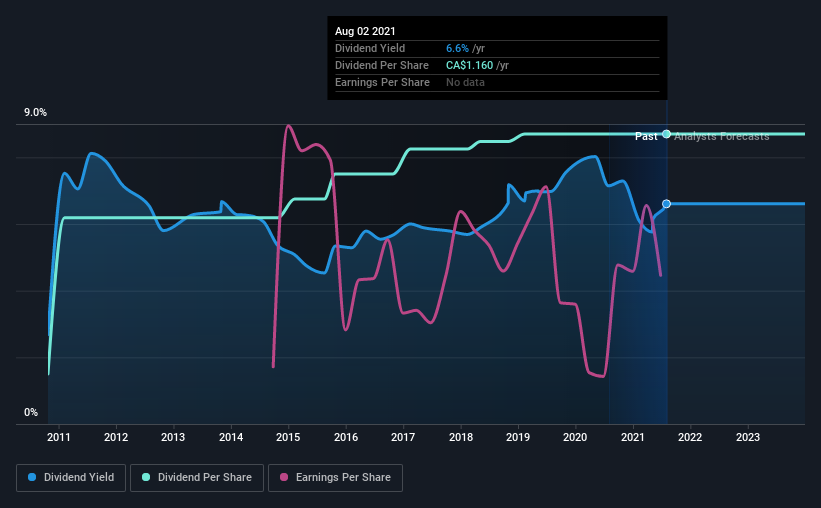

The board of Acadian Timber Corp. (TSE:ADN) has announced that it will pay a dividend on the 15th of October, with investors receiving CA$0.29 per share. The dividend yield will be 6.6% based on this payment which is still above the industry average.

Check out our latest analysis for Acadian Timber

Acadian Timber Is Paying Out More Than It Is Earning

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Before making this announcement, Acadian Timber was paying out quite a large proportion of both earnings and cash flow, with the dividend being 114% of cash flows. Paying out such a high proportion of cash flows certainly exposes the company to cutting the dividend if cash flows were to reduce.

Looking forward, earnings per share is forecast to fall by 7.0% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could reach 102%, which could put the dividend in jeopardy if the company's earnings don't improve.

Acadian Timber Has A Solid Track Record

The company has an extended history of paying stable dividends. The first annual payment during the last 10 years was CA$0.20 in 2011, and the most recent fiscal year payment was CA$1.16. This works out to be a compound annual growth rate (CAGR) of approximately 19% a year over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

Dividend Growth May Be Hard To Achieve

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Although it's important to note that Acadian Timber's earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time. Earnings are not growing quickly at all, and the company is paying out most of its profit as dividends. When a company prefers to pay out cash to its shareholders instead of reinvesting it, this can often say a lot about that company's dividend prospects.

Acadian Timber's Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. Although they have been consistent in the past, we think the payments are a little high to be sustained. We don't think Acadian Timber is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 3 warning signs for Acadian Timber (of which 2 can't be ignored!) you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:ADN

Acadian Timber

Provides forest products in Eastern Canada and the Northeastern United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives