- Canada

- /

- Metals and Mining

- /

- TSX:ABX

Is Barrick Gold’s Surge Justified After New Joint Ventures and 100% YTD Rally?

Reviewed by Bailey Pemberton

- Curious if Barrick Mining is a great value right now? You are not alone, as investors are watching closely to see whether opportunity is knocking or if the price has run too far.

- The stock has delivered a staggering 100.1% gain year-to-date and is up 76.1% over the last twelve months, even after a slight 2.8% dip in the past month.

- What is catching everyone's attention is Barrick Mining's progress in ramping up operations at key sites and recent headlines highlighting new joint ventures in Latin America. These developments have fueled both optimism and debate about long-term growth prospects.

- By our numbers, Barrick Mining scores a 3 out of 6 for value, reflecting strength in some areas but room for improvement in others. Next, we will dig into how that score breaks down across common valuation approaches and hint at an even smarter way to look at value investors won’t want to miss.

Approach 1: Barrick Mining Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to today's dollars. This approach helps investors understand whether the stock price reflects realistic expectations about future performance.

For Barrick Mining, the latest reported Free Cash Flow stands at approximately $1.43 billion. Analysts anticipate steady growth, with projections reaching $2.42 billion by 2029. Beyond that, Simply Wall St extrapolates further figures, though these become less certain further out in time.

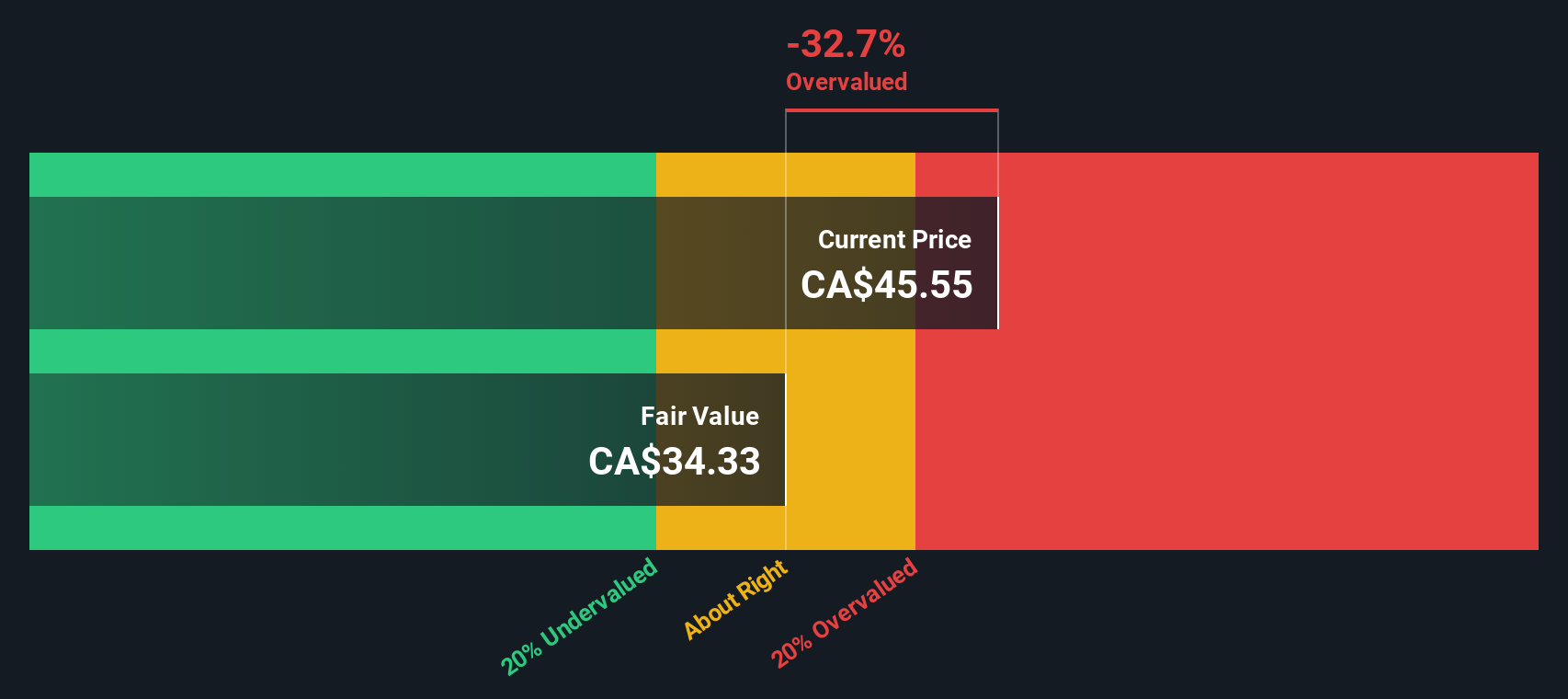

To arrive at the estimated fair value, cash flow estimates for the next ten years are used and discounted to their present value. These projections, paired with Barrick Mining’s growth profile and the risks that come with forecasting so far ahead, produce an intrinsic value of $34.58 per share. This suggests the stock is currently trading at a premium, sitting 33.2% above its DCF-estimated fair value.

Based on the DCF results, Barrick Mining appears to be overvalued at present compared to its underlying cash-generating potential.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Barrick Mining may be overvalued by 33.2%. Discover 839 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Barrick Mining Price vs Earnings

For profitable companies like Barrick Mining, the Price-to-Earnings (PE) ratio is a widely used valuation metric. It allows investors to compare how much they are paying for each dollar of actual earnings, making it easier to line up opportunities across different companies within the same industry.

Growth prospects and company-specific risks play a big role in what constitutes a “normal” or “fair” PE ratio. Businesses expected to expand quickly, or those with less risk, often command higher PE multiples. Conversely, slower growth or elevated risk should pull a company’s PE ratio downward toward more conservative levels.

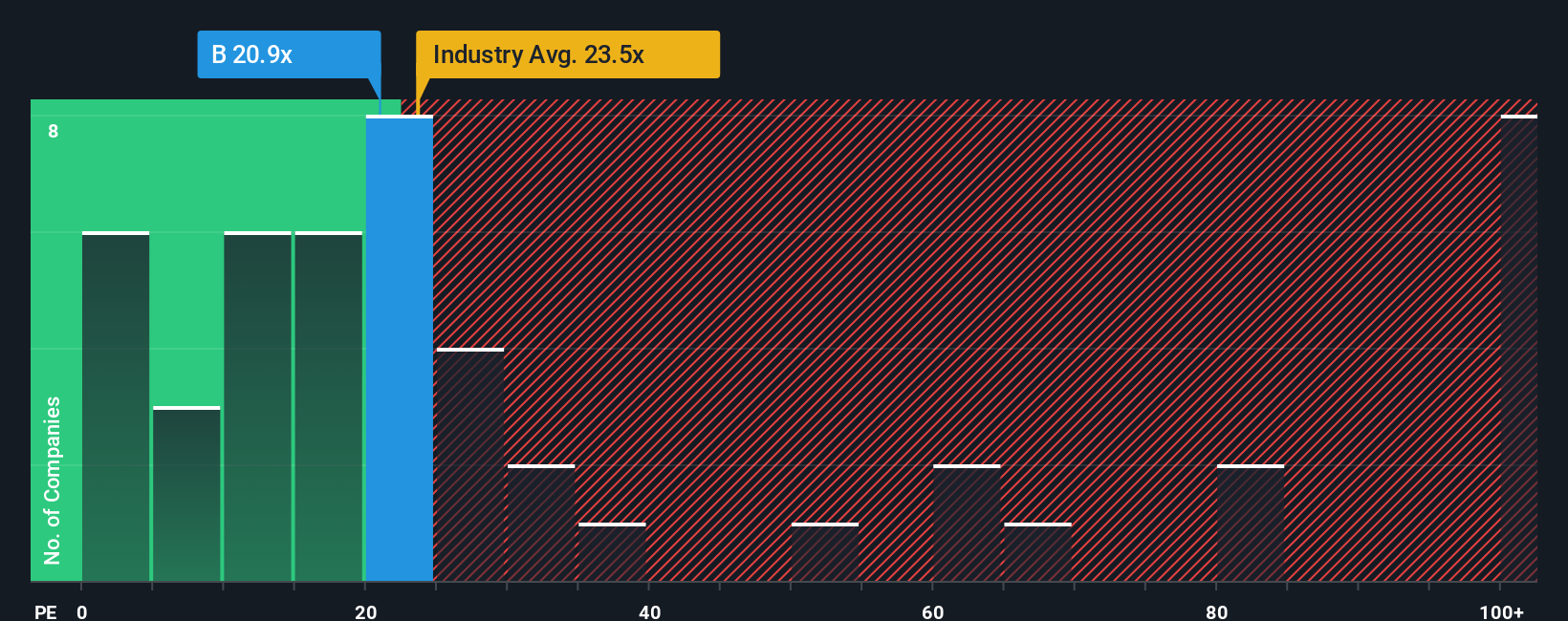

Barrick Mining is currently trading at a PE ratio of 20.3x. Compared to the metals and mining industry average of 20.9x and the peer group average of a higher 36.7x, Barrick looks reasonably priced. However, rather than create a direct comparison with these benchmarks, Simply Wall St’s Fair Ratio comes into play. This proprietary metric, calculated at 25.2x for Barrick, takes into account not just industry averages but also company-specific factors like profit margins, earnings growth, market capitalization, and risk profile. This holistic approach offers a more nuanced and relevant benchmark than the blunt comparison against peers or sector averages alone.

Given Barrick Mining’s current PE of 20.3x versus its Fair Ratio of 25.2x, the stock appears to be undervalued on this metric, suggesting that the market may be underestimating its earnings power and prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Barrick Mining Narrative

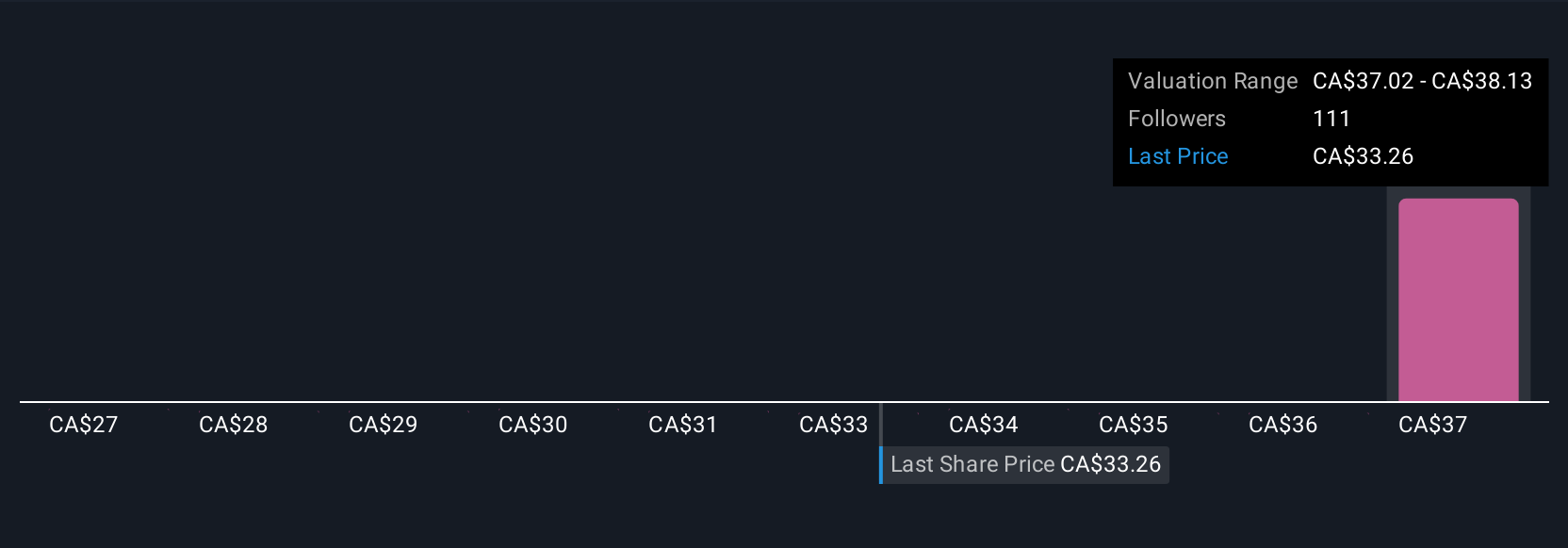

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, powerful idea: it ties together your perspective on a company’s future, such as projected revenue growth, profit margins and risks, into a clear story and links that story directly to a data-driven financial forecast and a fair value estimate.

Narratives let you go beyond static numbers by capturing your expectations about Barrick Mining in real time. On Simply Wall St’s Community page, millions of investors use easy, accessible tools to describe their outlook, set their own assumptions, and instantly see the fair value that flows from their personal view of the company.

What makes Narratives truly valuable is how they react to new information dynamically. When there is news, a fresh earnings report, or a price swing, your Narrative and fair value update automatically, giving you decision support that evolves as quickly as the market itself. This makes it easier to decide when to buy, hold, or sell based on whether the current price is above or below what you believe is fair.

For example, some Barrick Mining Narratives see fair value near CA$60 on safe-haven gold demand during U.S. political gridlock, while others project as low as CA$31 when factoring in commodity risk, showing just how much your own perspective can shape your investment decisions.

Do you think there's more to the story for Barrick Mining? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barrick Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ABX

Barrick Mining

Engages in the exploration, development, production, and sale of mineral properties.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives