- Canada

- /

- Metals and Mining

- /

- CNSX:UUSA

3 TSX Penny Stocks With Market Caps Over CA$2M

Reviewed by Simply Wall St

As the global financial landscape navigates through shifting economic policies and interest rate adjustments, Canada's market remains influenced by broader trends such as U.S. monetary strategies and trade negotiations. Penny stocks, though often considered a niche investment area, continue to offer intriguing opportunities for growth, particularly among smaller or newer companies with strong fundamentals. This article highlights three Canadian penny stocks that stand out for their potential to deliver value amidst evolving market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.80 | CA$175.36M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.66 | CA$275.23M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.31 | CA$117.56M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.32M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.30 | CA$311.07M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.65 | CA$593.16M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.17 | CA$5.34M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.17 | CA$214.74M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.05 | CA$28.21M | ★★★★★★ |

Click here to see the full list of 963 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

nDatalyze (CNSX:NDAT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: nDatalyze Corp. offers technology-based health solutions across Canada, the United States, and internationally with a market cap of CA$4.67 million.

Operations: The company's revenue is derived from its Machinery & Industrial Equipment segment, totaling CA$0.05 million.

Market Cap: CA$4.67M

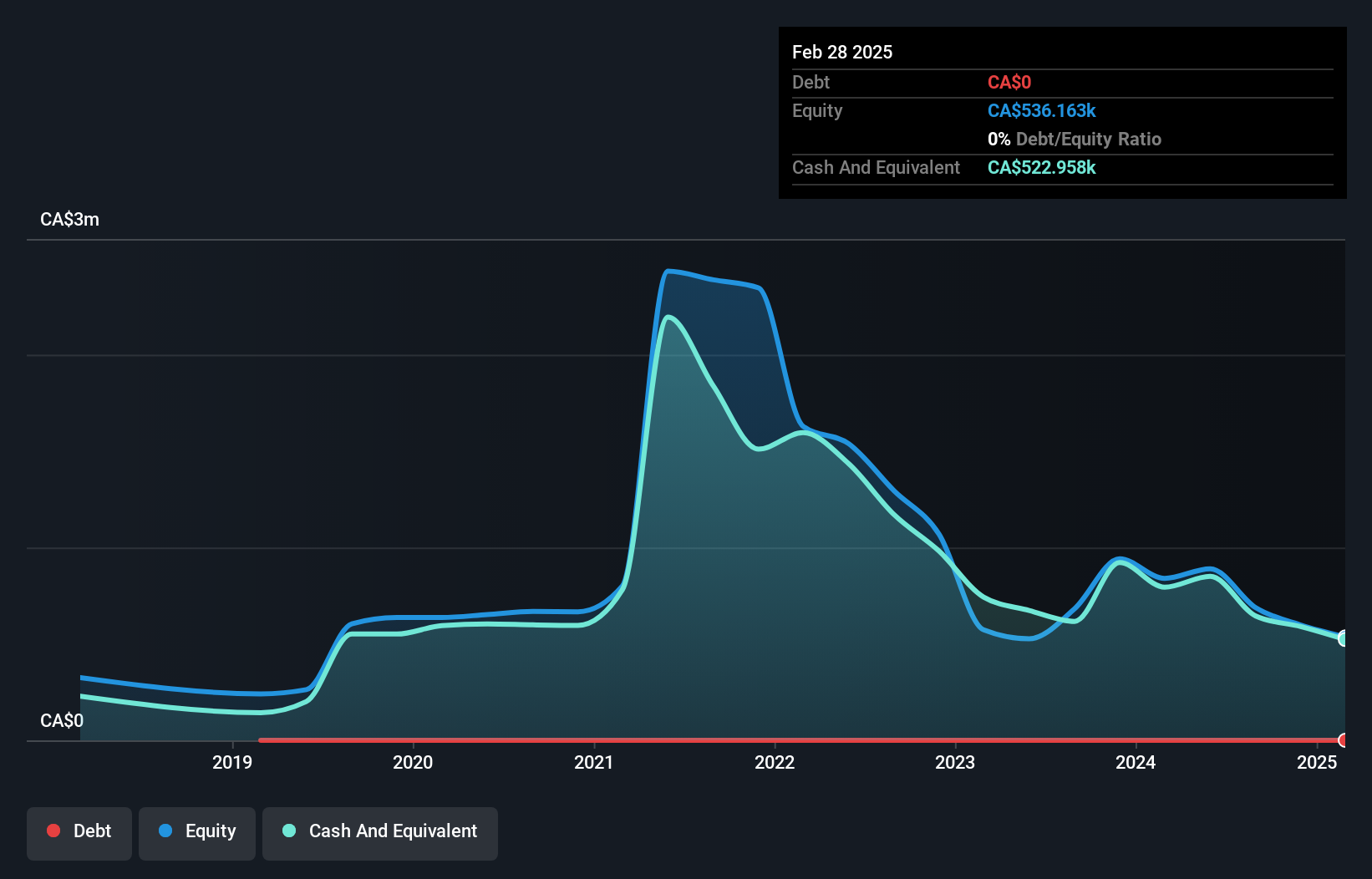

nDatalyze Corp., with a market cap of CA$4.67 million, is pre-revenue and has shown volatility in its share price recently. The company reported a significant decline in earnings for the second quarter of 2024, with sales dropping to CA$0.000887 million from CA$0.037283 million the previous year, resulting in a net loss of CA$0.20167 million. Despite these challenges, nDatalyze's recent positive clinical study results offer potential growth avenues through advanced digital therapeutics and mental health assessment tools like YMI. The management team is experienced, and the company remains debt-free with sufficient cash runway for over a year.

- Navigate through the intricacies of nDatalyze with our comprehensive balance sheet health report here.

- Understand nDatalyze's track record by examining our performance history report.

Kraken Energy (CNSX:UUSA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kraken Energy Corp. is engaged in the acquisition and exploration of mineral properties in North America, with a market cap of CA$2.69 million.

Operations: Kraken Energy Corp. currently does not report any revenue segments.

Market Cap: CA$2.69M

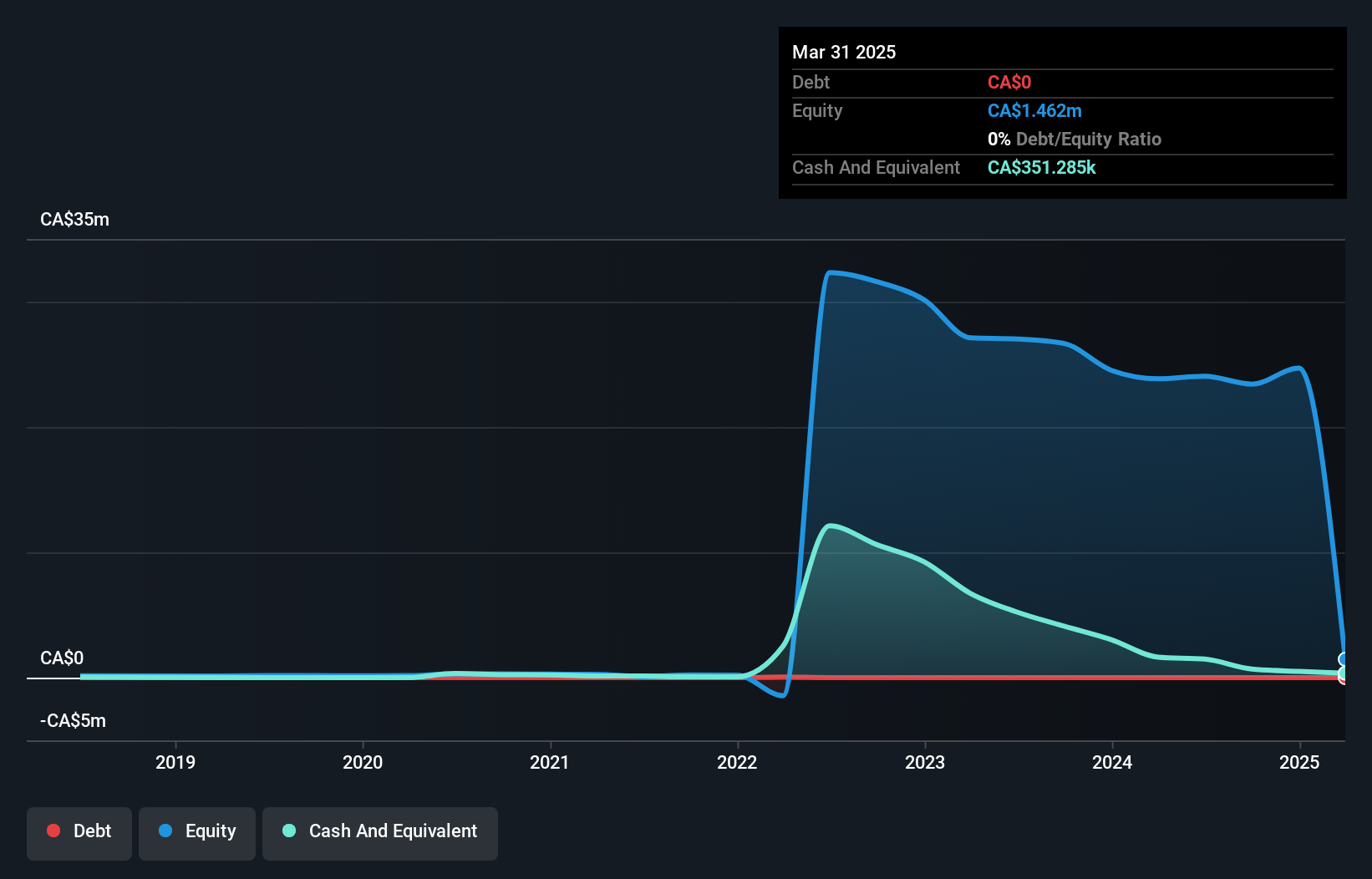

Kraken Energy Corp., with a market cap of CA$2.69 million, is pre-revenue and has experienced significant volatility in its share price recently. The company reported a reduced net loss of CA$4.25 million for the year ended June 30, 2024, compared to the previous year's larger loss. Shareholders have faced dilution over the past year, and Kraken's cash runway is less than a year if current cash flow trends continue. Recent leadership changes include Brian Goss as Interim CEO, bringing over 20 years of mining industry experience which could influence future strategic directions for this exploration-focused entity.

- Get an in-depth perspective on Kraken Energy's performance by reading our balance sheet health report here.

- Explore historical data to track Kraken Energy's performance over time in our past results report.

VR Resources (TSXV:VRR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: VR Resources Ltd. is a junior exploration company focused on acquiring, evaluating, and exploring mineral properties in the United States and Canada, with a market cap of CA$4.22 million.

Operations: No revenue segments have been reported for this junior exploration company.

Market Cap: CA$4.22M

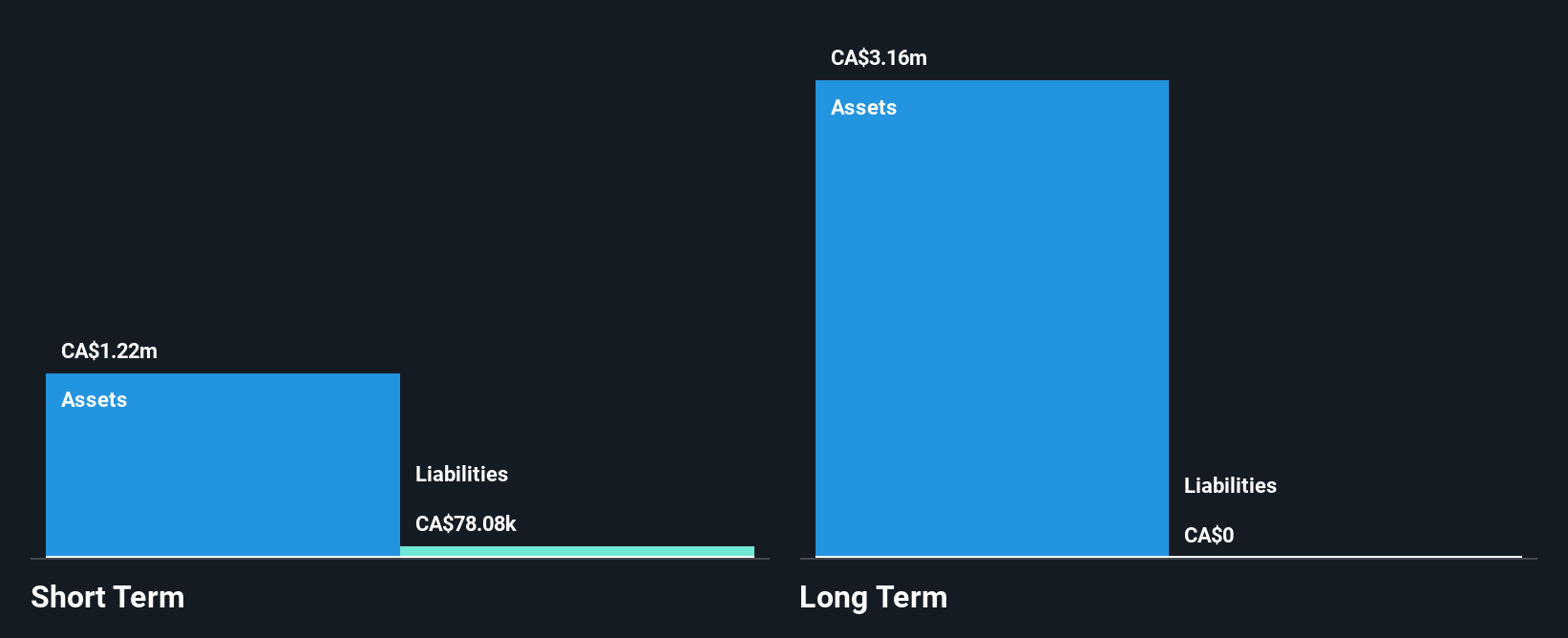

VR Resources Ltd., with a market cap of CA$4.22 million, is pre-revenue and has shown share price volatility. The company recently announced geophysical surveys at its Empire and Silverback projects in Ontario, targeting copper-gold-nickel mineralization. Despite having no long-term liabilities and sufficient short-term assets to cover liabilities, VR Resources' management team is relatively new, averaging 1.5 years in tenure. Shareholders have experienced dilution over the past year, but recent capital raises aim to support ongoing exploration activities. The board's experience could provide stability as the company advances its exploration initiatives across acquired properties.

- Jump into the full analysis health report here for a deeper understanding of VR Resources.

- Gain insights into VR Resources' past trends and performance with our report on the company's historical track record.

Summing It All Up

- Investigate our full lineup of 963 TSX Penny Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraken Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:UUSA

Kraken Energy

Acquires and explores for mineral properties in North America.

Moderate with adequate balance sheet.

Market Insights

Community Narratives