If You Had Bought California Gold Mining (CNSX:CGM) Shares A Year Ago You'd Have Made 130%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's been a soft week for California Gold Mining Inc. (CNSX:CGM) shares, which are down 26%. But that doesn't detract from the splendid returns of the last year. We're very pleased to report the share price shot up 130% in that time. So some might not be surprised to see the price retrace some. The real question is whether the business is trending in the right direction.

View our latest analysis for California Gold Mining

California Gold Mining hasn't yet reported any revenue yet, so it's as much a business idea as an actual business. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, investors may be hoping that California Gold Mining finds some valuable resources, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). California Gold Mining has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

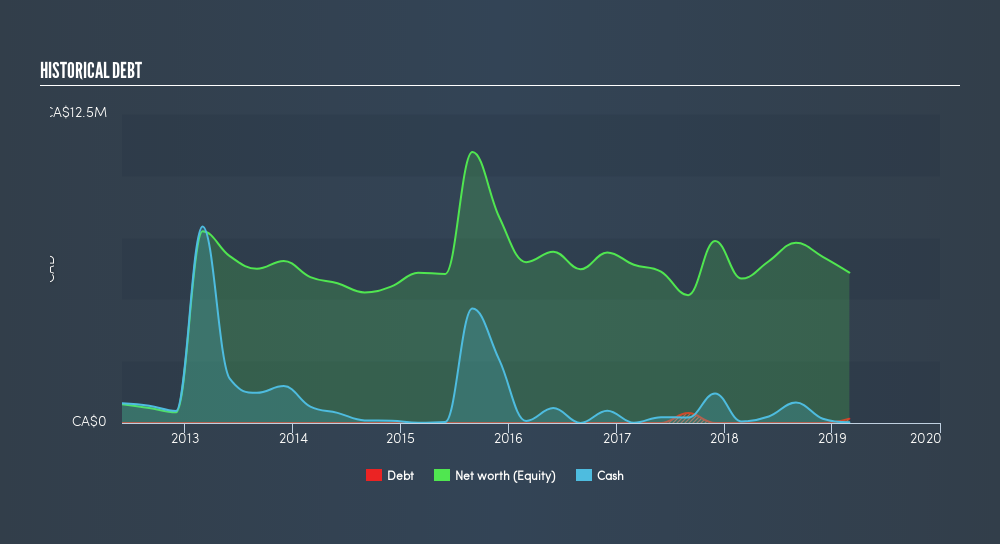

Our data indicates that California Gold Mining had net debt of CA$552,265 when it last reported in February 2019. That makes it extremely high risk, in our view. So we're surprised to see the stock up 130% in the last year, but we're happy for holders. It's clear more than a few people believe in the potential. The image below shows how California Gold Mining's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. One thing you can do is check if company insiders are buying shares. It's usually a positive if they have, as it may indicate they see value in the stock. You can click here to see if there are insiders buying.

A Different Perspective

We're pleased to report that California Gold Mining shareholders have received a total shareholder return of 130% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 1.6% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. You could get a better understanding of California Gold Mining's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges. We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Community Narratives