For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like NexgenRx (CVE:NXG). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out the opportunities and risks within the CA Insurance industry.

How Fast Is NexgenRx Growing Its Earnings Per Share?

Over the last three years, NexgenRx has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, NexgenRx's EPS shot from CA$0.028 to CA$0.05, over the last year. It's not often a company can achieve year-on-year growth of 78%.

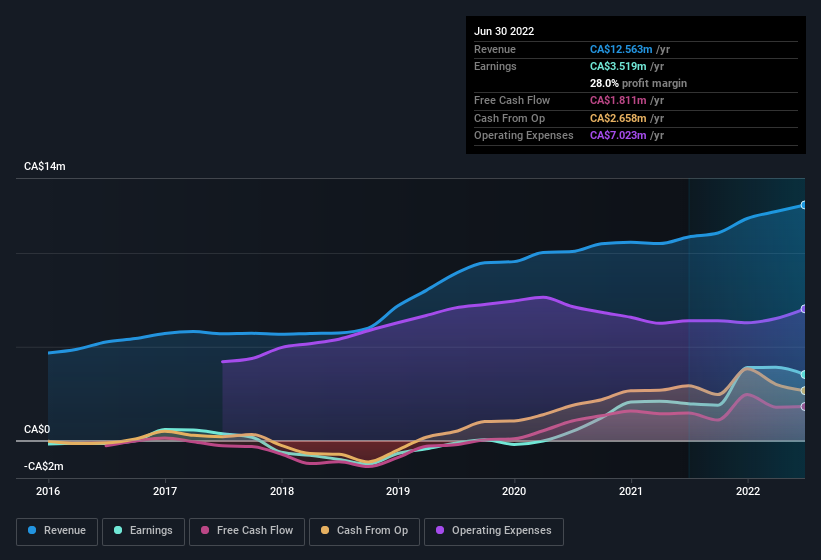

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. NexgenRx maintained stable EBIT margins over the last year, all while growing revenue 16% to CA$13m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since NexgenRx is no giant, with a market capitalisation of CA$21m, you should definitely check its cash and debt before getting too excited about its prospects.

Are NexgenRx Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

A great takeaway for shareholders is that company insiders within NexgenRx have collectively spent CA$21k acquiring shares in the company. While this investment may be modest, it is great considering the lack of insider selling. It is also worth noting that it was company insider Paul Crossett who made the biggest single purchase, worth CA$9.0k, paying CA$0.36 per share.

On top of the insider buying, we can also see that NexgenRx insiders own a large chunk of the company. Actually, with 37% of the company to their names, insiders are profoundly invested in the business. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Valued at only CA$21m NexgenRx is really small for a listed company. So this large proportion of shares owned by insiders only amounts to CA$7.8m. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Does NexgenRx Deserve A Spot On Your Watchlist?

NexgenRx's earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe NexgenRx deserves timely attention. However, before you get too excited we've discovered 3 warning signs for NexgenRx (1 makes us a bit uncomfortable!) that you should be aware of.

The good news is that NexgenRx is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NexgenRx might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:NXG

NexgenRx

NexgenRx Inc. administers, adjudicates, and pays drug, dental, and other extended health-care claims for the beneficiaries of health benefit plans underwritten by its customers in Canada.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion