Sun Life Financial (TSX:SLF) Announces Leadership Changes to Drive Growth and Enhance Strategic Alliances

Reviewed by Simply Wall St

Sun Life Financial (TSX:SLF) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include a 4% increase in its common share dividend and significant growth in its Asian markets, juxtaposed against underperformance in the U.S. market and valuation concerns. In the discussion that follows, we will explore Sun Life's financial health, operational inefficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Unlock comprehensive insights into our analysis of Sun Life Financial stock here.

Strengths: Core Advantages Driving Sustained Success For Sun Life Financial

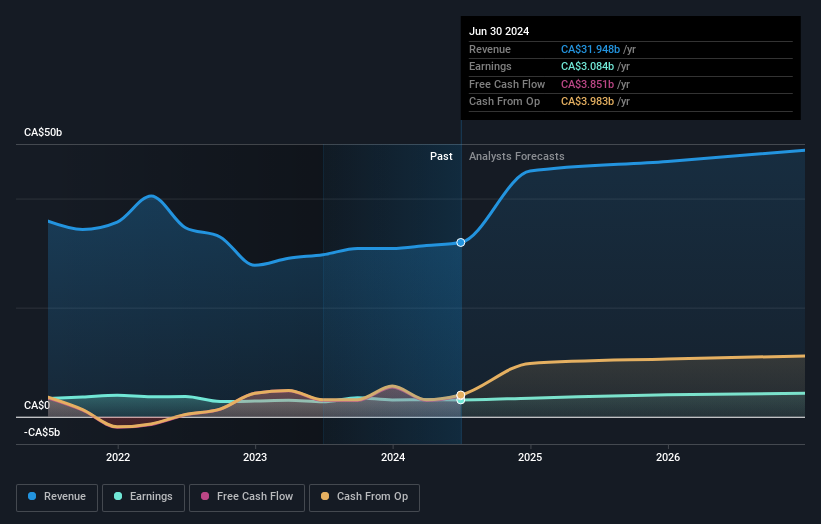

Sun Life Financial exhibits strong financial health, highlighted by a solid capital position with a LICAT ratio of 148%. The company's strategic initiatives, particularly in Asia, have driven significant growth, with individual protection underlying earnings in the region growing by 30%, driven by strong sales in Hong Kong and India. The company has also announced a 4% increase in its common share dividend, reflecting its commitment to returning value to shareholders. Furthermore, Sun Life's asset management business continues to thrive, with total company assets under management reaching an all-time high of $1.47 trillion, up 8% year-over-year. Client-centric innovations, such as the health navigator powered by PinnacleCare in the U.S., further enhance its competitive edge.

Weaknesses: Critical Issues Affecting Sun Life Financial's Performance and Areas For Growth

Sun Life Financial faces several challenges, particularly in the U.S. market, where it underperformed due to rising healthcare utilization rates and the end of the Public Health Emergency, which negatively impacted its dental business. The company's underlying net income of CAD 875 million and earnings per share of CAD 1.50 were modestly lower year-over-year by 2% and 1%, respectively. Additionally, Sun Life is considered expensive based on its Price-To-Earnings Ratio of 14.6x compared to the peer average of 12.9x and the North American Insurance industry average of 14x. Despite trading below the estimated fair value of CAD 184.37, the target price remains lower than the current share price, indicating potential overvaluation concerns.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Sun Life Financial has several opportunities for growth, particularly in expanding its market presence in Asia, with India being a significant growth market. The company's innovative health solutions, such as the diabetes care program launched through the Lumino Health pharmacy app, demonstrate its commitment to leveraging technology for client benefit. Strategic investments, including the sale of a 6.3% ownership interest in an asset management JV, unlocked a CAD 98 million pretax gain, providing additional capital for growth initiatives. Sustainability initiatives, such as completing Ontario's first all-electric net zero carbon industrial building, further enhance Sun Life's market positioning and appeal to environmentally conscious investors.

Threats: Key Risks and Challenges That Could Impact Sun Life Financial's Success

Sun Life Financial faces several external threats, including regulatory challenges such as the impending global minimum tax, expected to impact the company by 1% to 2%. The competitive environment in the dental market presents another challenge, with the repricing process for DentaQuest expected to take the rest of the year. Economic factors, particularly rising interest rates, pose a headwind for fundraising in the real estate sector. These factors could potentially impact Sun Life's growth and market share, necessitating strategic adjustments to mitigate these risks.

Conclusion

Sun Life Financial's strong capital position and strategic growth in Asia, coupled with its thriving asset management business, underscore its solid foundation and potential for future growth. However, challenges in the U.S. market, modest declines in net income and earnings per share, and its higher Price-To-Earnings Ratio compared to peers and industry averages highlight areas for improvement. The company's innovative health solutions and sustainability initiatives present significant opportunities, but external threats such as regulatory changes and economic factors require careful navigation. Overall, while Sun Life Financial is trading below its estimated fair value, its higher Price-To-Earnings Ratio suggests a need for balanced growth strategies to enhance shareholder value and maintain competitive performance.

Key Takeaways

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

If you're looking to trade Sun Life Financial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives