Sun Life Financial (TSE:SLF) Has Re-Affirmed Its Dividend Of CA$0.55

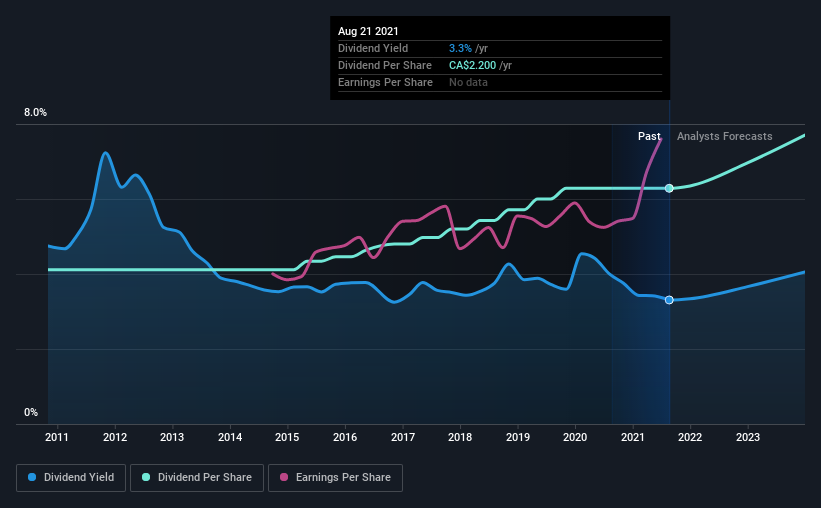

Sun Life Financial Inc.'s (TSE:SLF) investors are due to receive a payment of CA$0.55 per share on 29th of September. This payment means that the dividend yield will be 3.3%, which is around the industry average.

View our latest analysis for Sun Life Financial

Sun Life Financial's Dividend Is Well Covered By Earnings

We aren't too impressed by dividend yields unless they can be sustained over time. However, prior to this announcement, Sun Life Financial's dividend was comfortably covered by both cash flow and earnings. This means that most of its earnings are being retained to grow the business.

The next year is set to see EPS grow by 6.4%. Assuming the dividend continues along recent trends, we think the payout ratio could be 39% by next year, which is in a pretty sustainable range.

Sun Life Financial Has A Solid Track Record

The company has an extended history of paying stable dividends. The dividend has gone from CA$1.44 in 2011 to the most recent annual payment of CA$2.20. This implies that the company grew its distributions at a yearly rate of about 4.3% over that duration. Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think makes this a fairly attractive offer.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Sun Life Financial has impressed us by growing EPS at 11% per year over the past five years. Sun Life Financial definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

We Really Like Sun Life Financial's Dividend

In summary, it is good to see that the dividend is staying consistent, and we don't think there is any reason to suspect this might change over the medium term. Earnings are easily covering distributions, and the company is generating plenty of cash. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 12 analysts we track are forecasting for Sun Life Financial for free with public analyst estimates for the company. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion