How Sun Life’s C$1 Billion Tier 2 Debenture Issue Will Impact Sun Life Financial (TSX:SLF) Investors

Reviewed by Sasha Jovanovic

- In early December 2025, Sun Life Financial Inc. issued C$1 billion of Series 2025-2 subordinated unsecured 4.56% fixed/floating debentures due 2040 in Canada, structured as callable, Tier 2-eligible, unsecured corporate bonds priced at 99.928% of par.

- The company plans to use the proceeds for general corporate purposes, including potential completion of its BentallGreenOak and Crescent Capital Group LP ownership, further subsidiary investments, debt repayment, and other growth initiatives, reinforcing its focus on expanding fee-based and asset management capabilities.

- We’ll examine how this C$1 billion Tier 2 debenture issuance to fund acquisitions and debt management affects Sun Life’s existing investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Sun Life Financial Investment Narrative Recap

To own Sun Life Financial, you need to believe in its ability to grow fee-based and health-focused earnings while managing U.S. Dental and asset management headwinds. The new C$1.0 billion Tier 2 debenture issue modestly reinforces capital flexibility, but does not materially change the near term story, where Medicaid-related Dental pressures and MFS flow trends remain key swing factors.

The most relevant recent announcement is Sun Life’s ongoing discussion of potential acquisitions and “tuck in” deals in asset management and Asian distribution. The planned use of debenture proceeds for possible completion of BentallGreenOak and Crescent Capital Group LP ownership ties directly into that focus on expanding SLC Management, which is one of the main drivers in the current catalyst narrative around building more stable, fee-based earnings.

Yet even with this added capital flexibility, Sun Life’s reliance on U.S. Medicaid pricing still leaves investors exposed to shifts in...

Read the full narrative on Sun Life Financial (it's free!)

Sun Life Financial's narrative projects CA$49.3 billion revenue and CA$4.5 billion earnings by 2028. This requires 13.0% yearly revenue growth and about a CA$1.3 billion earnings increase from CA$3.2 billion today.

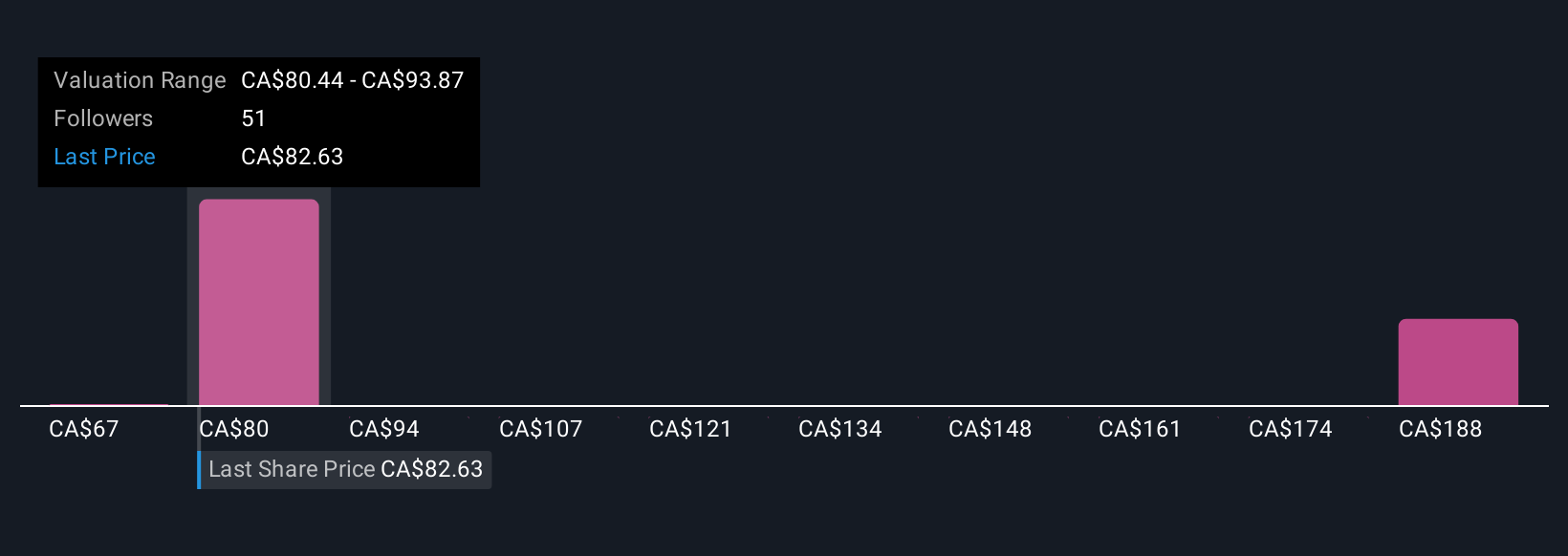

Uncover how Sun Life Financial's forecasts yield a CA$90.93 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community currently estimate Sun Life’s fair value between C$90.93 and C$206.05, reflecting very different growth expectations. When you weigh those views against the continued risk around U.S. Dental earnings and Medicaid funding, it becomes clear why exploring several perspectives can matter for your own conclusions.

Explore 3 other fair value estimates on Sun Life Financial - why the stock might be worth just CA$90.93!

Build Your Own Sun Life Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sun Life Financial research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sun Life Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sun Life Financial's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026