Here's Why We Think Sun Life Financial (TSE:SLF) Is Well Worth Watching

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Sun Life Financial (TSE:SLF), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Sun Life Financial

Sun Life Financial's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Sun Life Financial has managed to grow EPS by 17% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Sun Life Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Unfortunately, Sun Life Financial's revenue dropped 18% last year, but the silver lining is that EBIT margins improved from 7.8% to 14%. That falls short of ideal.

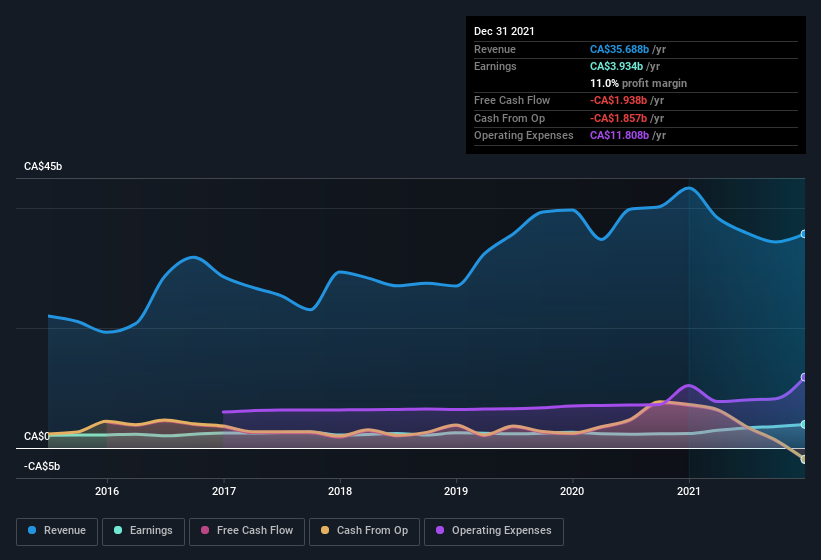

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Sun Life Financial's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Sun Life Financial Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's a pleasure to note that insiders spent CA$1.6m buying Sun Life Financial shares, over the last year, without reporting any share sales whatsoever. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. We also note that it was the , Ingrid Johnson, who made the biggest single acquisition, paying CA$1.5m for shares at about CA$71.01 each.

Does Sun Life Financial Deserve A Spot On Your Watchlist?

For growth investors like me, Sun Life Financial's raw rate of earnings growth is a beacon in the night. The growth rate whets my appetite for research, and the insider buying only increases my interest in the stock. To put it succinctly; Sun Life Financial is a strong candidate for your watchlist. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Sun Life Financial that you should be aware of.

The good news is that Sun Life Financial is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives